Sedgwick brand protection releases latest European product recall index report

LONDON 1 June 2022 – Sedgwick brand protection have released the latest report into European product safety and recall, which reveals lingering concerns about supply chains and regulatory oversight across the five key industries surveyed.

According to the findings in the recall index report, while many countries and businesses eased pandemic-imposed restrictions to operations, there were lingering concerns about supply chains and regulatory oversight across the industries surveyed.

The recall index report reveals a decrease in overall product recalls activity in Europe by 2.4% in the first quarter of 2022, indicated by a decline in events within the pharmaceutical (28.0%), medical devices (17.3%), and food and beverage (10.3%) sectors. However, certain sectors such as automotive saw a significant rise in recall activity with an 155.1% increase, as well as consumer products including clothing (131.3%), toys (9.0%) and electronics (44.8%).

The recall index report takes an in-depth look at recall data and regulatory developments in the EU and UK, as well as product safety trends, insights and analysis to help business leaders mitigate risk to their operations and reputation as they navigate new trade rules under Brexit and ways the pandemic has changed the world.

To download the latest report, visit European product recall index report.

Q1 2022 recall highlights:

- The 227 automotive recalls in Q1 2022 represented an 155.1% increase compared to Q4 2021. This rise may be an indicator of regulatory oversight practices returning to normal or manufacturers finding challenges with new regulations. Consistent with previous quarters, “injuries” were the leading risk associated with automotive recalls, accounting for 175 recalls or 77.1% of notifications, however, this is slightly lower than their overall contribution over the past five years (82.3%). “Environmental” related incidents accounted for 4.8% of notifications, which is significant compared to their average accountability of 1.6% over the past five years.

- For food and beverage, the data collected showed a 10.3% drop in recalls to 1,202 in Q1 2022, compared to Q4 2021. Contamination “other” accounted for 630 recalls, more than half of all events for the quarter, with bacterial contamination, primarily from salmonella, being the second leading cause of recalls in this sector.

- Pharmaceutical recall activity across the EU and UK dropped 28.0% in Q1 2022, compared to the previous quarter, with 67 recalls recorded. The most common reason cited was “safety”, leading to 24 recalls, followed by “mislabelling” (15) and “failed specifications” (13).

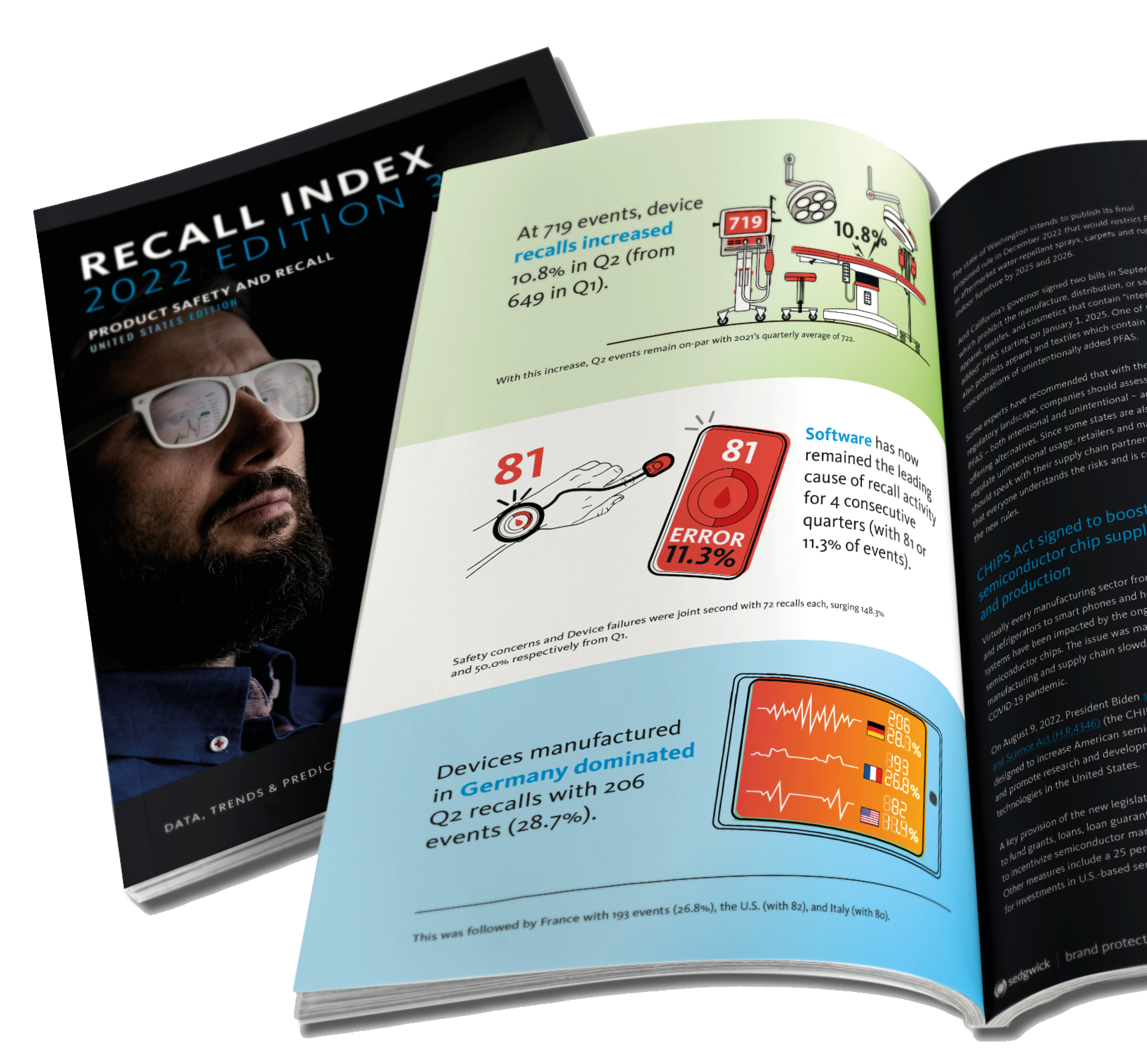

- The 649 medical device recalls in Q1 2022 saw an overall drop of 17.3% compared to Q4 2021. This is also lower than the 722 recalls from the same quarter last year. “Software issues” were the leading cause of medical device recalls, a trend that has been consistent for the past three quarters with 82 or 12.6% of events, replacing “quality.”

- Within the electronics sector, Q1 2022 activity saw a rise of 43.8% with 139 recall events recorded. This could be attributed to a sharp increase in electronic purchases over the holiday period. “Electric shock” accounted for 68 recalls and almost half (48.9%) of recalls in the sector. This recall cause also had a considerable 83.8% increase compared to the last quarter.

- Toy recalls rose in Q1 2022 to 181, up from 166 in Q4 2021. This represented a modest 9.0% increase. However, there was a 72.4% increase from Q1 2021. “Choking” was the most common cause of recall, with 47 events cited.

- Clothing recalls more than doubled from 32 recalls in Q1 2021 to 74 recalls in Q1 2022. This represents a 131.3% increase quarter-over-quarter. Children’s apparel, including infant and baby clothing, made up 68.9% of recalls in the quarter, with “choking” being cited as the main hazard, with 21 events.

“While many countries and businesses eased pandemic-imposed restrictions to operations, there were lingering concerns about supply chains and regulatory oversight and a significant rise in the number of recalls across a number of the five sectors assessed,” said Mark Buckingham, international product recall consultant at Sedgwick.

Buckingham added: “regulators in the UK and EU want to amend rules for a range of operations – from manufacturing to consumer protection to transportation. They are keen to support broader visions around the European Green Deal, the new Circular Economy Action Plan, the industrial strategy and other cross-sector initiatives. They also continue to work to find ways to update regulations to keep pace with changing technologies, including protecting against scams and anti-competitive behaviour from online marketplaces.”

Looking ahead further in 2022:

- Automotive – Automated vehicles (AVs) are receiving increased attention, particularly after the Law Commission of England & Wales and the Scottish Law Commission released the report, they have been compiling for the past three years around AV regulation recommendations.

- Food – The UK government continues its focus on food safety, supply chain reliability and ultimately, consumer protection. It is now requiring calorie and portion information on the majority of food sold at most “out of home” sellers including restaurants, buses, markets, and food delivery apps.

- Pharmaceutical – Regulators in the UK and the EU have increasingly been levying fines against companies that it feels are out of compliance regulations, particularly when their actions result in demonstrably higher drug prices for consumers and for the National Health Service (NHS). The UK is also creating its own processes for defining substances of very high concern (SVHCs) in the post-Brexit era.

- Medical devices – The medical device industry in the EU and the UK is facing a lot of new regulations, with some as a result of Brexit and the need for both jurisdictions to update their rules. Others are related to regulators wanting to be sure that guidelines are up to date with real world situations. However, delays by government authorities to share their findings are causing issues for manufacturers who will need to comply with the revised rules.

- Consumer products – electronics, toys, clothing – The sectors continue to face challenges from changes in the regulatory landscape. The European Commission took several steps in Q1 2022 that will impact safety, not only for electronics but across toys and clothing sectors. In electronics, the Commission also released a final report expressing its concerns about high barriers to entry, a lack of vertically integrated players and issues around data access and interoperability, among other things, in the consumer Internet of Things (IoT) marketplace. In clothing, sustainability remains an important topic as regulatory pressure is mounting for textile companies to drastically reduce their use of water and raw materials, whilst improving reuse and recycling processes and finally provide better working conditions.

Julie Ross, Sedgwick’s international business development director says: “Supply chain delays continues to be an issue alongside a range of other external factors, influencing how businesses operate. Having a recall plan in place helps to mitigate the impact and protect your brand when the worst happens. Working alongside a partner with the relevant expertise who can honour the business’ commitments to customers, supply chain partners, industry groups and regulators can save a significant amount in regulatory and litigation costs.”The recall index report is the industry’s leading research and analysis produced quarterly by Sedgwick’s experts in best practice product recall and remediation solutions. It is an essential reference for manufacturers and retailers seeking impartial and reliable perspective on past, present and future recall data and product safety trends.

For more information on Sedgwick brand protection, visit https://www.sedgwick.com/brandprotection

To download the latest report, visit European product recall index report.