900+

corporations write Sedgwick into their insurance policies

As the industry’s trusted partner for commercial claims, our adjusters help businesses and insurance companies handle every type of loss using the most advanced AI technology.

When a commercial property loss occurs, businesses turn to Sedgwick to help make things right again. With the largest network of loss adjusting professionals in the world, we can effectively manage commercial property claims across all lines and industries. And with our advanced AI-enabled claims technology, our adjusters deliver fast, accurate loss assessments to minimize business interruption at the lowest possible cost.

corporations write Sedgwick into their insurance policies

technical and business expertise in every major industry

years of experience per adjuster on average

No matter the size or complexity of your loss, our adjusters can expertly handle your claim and reach a fair settlement. Plus, with our proprietary Lightning tool, you get to experience some of the fastest response and cycle times around. Our unmatched expertise — backed by our industry-leading technology — is why so many organizations trust our property professionals to manage their commercial insurance claims.

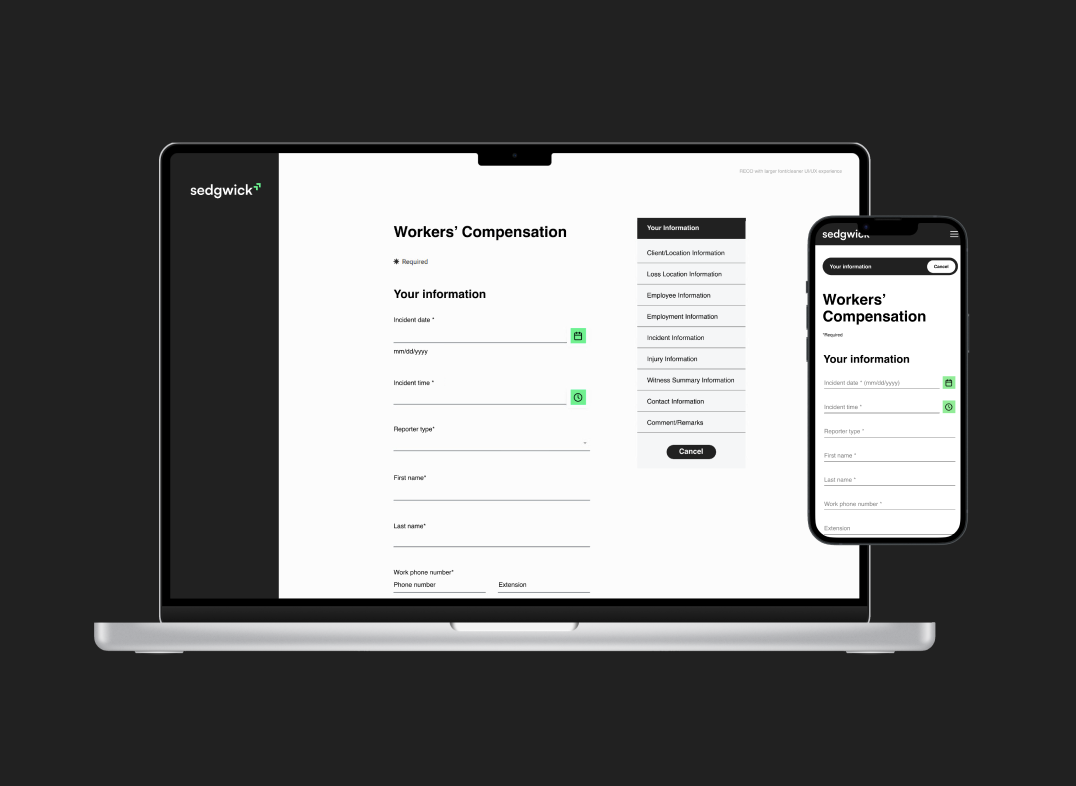

With our suite of proprietary claims technology, we ensure the claims experience feels seamless for everyone involved — and that includes you and your customers.

With our flexible intake platform, smart.ly, your customers can easily file insurance claims and submit related documents. These details are then quickly assessed and validated using our external data sources, allowing us to offer a settlement as soon as possible.

Through our easy-to-use information hub, viaOne, you always have a complete view into your claims portfolio. There, you can access real-time data and get the insights you need to make smarter decisions for your program.

We understand that recovering from a loss in the commercial space comes with unique challenges. To support your needs throughout the entire claims process, we also provide specialized expertise in the following areas:

When there’s a major loss, our team can expertly manage the claims process and get your business back on track as soon as possible. With advanced technical skills and specialists in every industry, we’ve been trusted to handle some of the world’s largest and most complex commercial claims.

After a loss occurs, our team can investigate the cause and help you understand the full financial impact. Whether we’re assessing a business interruption, cyber incident, corporate crime or something else, we can measure any loss to ensure even the most complex claims are accurately and fairly resolved.

When a commercial property is damaged, our professionals can step in to help manage the repair process. Using our independent construction expertise, we can offer technical advice, validate claims and keep your costs in check — all things that help drive the best possible outcome for your project.

Whether it’s a high-deductible, self-insured retention or captive insurance program, our best-in-class team can expertly manage your business’s claims and payments. We can help manage cash, provide and analyze reporting data, and lead subrogation efforts to protect your capital and risk management spend.

From tariffs and labor shortages to the rise of AI, property claims are being disrupted like never before. Download our report to get the clarity and confidence to navigate what’s happening now, and learn how Sedgwick helps you stay ahead.

Thought leadership • Regulatory updates • New solutions • News and developments