August 21, 2024

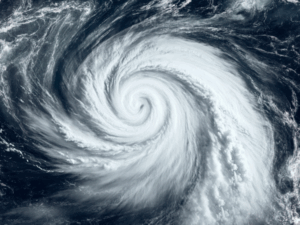

Category 5 hurricanes and high-magnitude earthquakes consistently draw broad and sustained public attention. But the smaller catastrophes (CATs), or secondary perils — a town flooding during a storm, a tornado hitting a small rural town — often go overlooked, despite being equally as insidious, causing loss of life, and upending entire communities. Regionalized events may also draw a lackluster response in comparison to major CATs, despite the severe impacts to human lives and property.

Meanwhile, with vast technological advancements, we now have access to digital tools that automate, streamline and simplify each step of the claims process. However, we find ourselves at an impasse: how do we integrate all the powerful tools at our disposal and ignite the use of these digital assets — to perform claim work in a timelier, more accurate way — while still centering an empathetic approach; to take care of people quicker in an unsettled environment? As the prevalence of secondary losses continue to rise, this question may be more consequential.

Microevents on the rise

The alarming rise of Earth’s air and ocean temperatures has long been shifting weather patterns and has, indeed, led to an increased frequency and intensity of extreme weather events, according to a 2021 Intergovernmental Panel on Climate Change (IPCC) report. Climate change is causing record-breaking heat waves on land and in the ocean, severe floods and drenching rains, extreme wildfires and years-long droughts, and widespread flooding during hurricanes — all of which are becoming increasingly prevalent and severe.

In the 20-year period between 2000 and 2019, climate-related disasters jumped 83% compared to the previous two decades, according to a report published by the United Nations Office for Disaster Risk Reduction (UNDRR). The past 20 years have also seen the number of major floods more than double, while the incidence of storms rose more than 28%. These trends are expected to continue and inflict further damage onto the planet’s infrastructure, ecosystems and social systems.

Meanwhile, secondary loss incidences have tracked upward in step with climate change impacts. A Swiss Re Group analysis reported that in 2020, secondary perils caused $57.4 billion, or 71% of all worldwide insured losses resulting from natural catastrophes (with the main drivers being severe convective storms and wildfires). Secondary weather perils are now approaching loss levels on par with moderate hurricane events.

Implications for insurers, claimants

This has staggering implications for policyholders, carriers and the insurance industry at large. The rising prevalence of small-scale CATs has forced a reckoning: carriers have long been disproportionately focused on primarily perils compared with secondary perils. Now, an imbalance has taken shape, and more focus is now required on the latter. A renewed focus is necessary, too, for strikes, riots and civil commotion coverage — a risk type also on the rise.

In response to incurring losses, many insurers have reassessed catastrophe risks and applied that to their budgets to protect their bottom lines. Some are significantly raising deductibles and re-underwriting specific exposures in vulnerable regions, while others have ceased coverage in areas altogether. Higher reinsurance rates, in turn, can increase the premiums that insurers charge their policyholders.

With the increase of wind and hail events, carriers are decreasing the number of concentrated properties and raising deductibles to reduce exposure. With higher deductibles comes decreased demand on field resources as fewer claims are presented. This creates a void of resources when a microevent impacts a community as the cost to deploy may outweigh the volume of losses assigned. The cascade of events when a community is hit with a tornado, hailstorm or flood may result in fewer resources available and longer wait times which decrease customer satisfaction considerably.

Technology’s role in CAT response

If adjusters have the know-how and access to the right leading edge-technologies, it can infuse accuracy and efficiency into the claim process and lead to better outcomes for customers. This can be particularly crucial in CAT management, as catastrophe adjusting can be complex and time-laden, and property destruction can risk human resources and prevent adjusters from safely accessing the loss site.

Digital tools continue to advance and have become integral to this profession. Following a catastrophe, Sedgwick uses technology like satellite imagery, drones and 3D modeling to conduct “virtual video tours,” where adjusters perform remote, in-depth damage assessments without leaving their desk.

Our proprietary apps enable on-site staff to upload videos, photos and reports directly into the claim file. Sedgwick also utilizes a geo-location system that displays assignment locations to streamline deployment, and video chat capabilities enable real-time collaboration and the seamless exchange of information to speed up the loss resolution and payment process.

Technology, labor market challenges

Still, there are barriers preventing technologies from working as efficiently as possible. Protecting claimants’ private data sets and loss history is one obvious concern. Sensitive data — from social security numbers to detailed homeowner information — must not be shared through unsecure channels where fraudsters lurk. Until further data security strides are made to ensure fortified protection of customers’ sensitive information, each asset will function as a piece-meal tool, rather than as one streamlined, highly efficient toolkit.

Add to that the claim industry’s labor problem. As older professionals retire at an astonishing rate, there is not nearly enough incoming younger talent to fill those deficits. It also prevents the natural transfer of technical knowledge from industry veterans, further straining talent development. The current staffing shortage creates foundational challenges for maintaining adequate resources to respond sufficiently.

But these challenges introduce opportunities for the industry to address the talent gap, technology integration barriers and data security vulnerabilities. Sedgwick’s team remains adaptable in the everchanging risk landscape so that we can continue to take care of the people who need it most when disaster hits.

Learn more > Explore our global CAT solutions brochure and visit the CAT resource center for the latest.