- 2024 year-end: PROPERTY

Property loss adjusting

Report objectives

This report aims to summarize the present metrics for our U.S. property programs, assess the current landscape of the property claims market, and benchmark our patterns against comparable industry research.

Unlike workers’ compensation, motor liability or general liability, property is not a monolithic product line. U.S. property consists of property loss adjusting and specialty services. Property loss adjusting contains five distinct product lines: catastrophe (CAT), high frequency low severity (HFLS), middle market, large loss and third-party administrator. Each of these has its distinct market, clients, competitors, pricing and service requirements. The specialty services division encompasses our forensic advisors/accountants, EFI Global (forensic engineering, environmental and fire experts), contents evaluators and building consultants. Sedgwick repair solutions, our direct repair network and temporary housing are also significant and growing segments of U.S. property.

data parameters

Our practice team uses claims data to perform comparative analyses informed by their expertise and analytics. This report is based on data for U.S. claims only, though it is important to note Canada and Latin America are also significant pieces of our property Americas business.

Key observations

Comparing the second half of 2024 to the first half, the level of new claims assignments was similar. This was primarily driven by the lack of significantly impactful catastrophe events. This ongoing stable period resulted in lower pending claims inventories due to the ability to focus on aged claims.

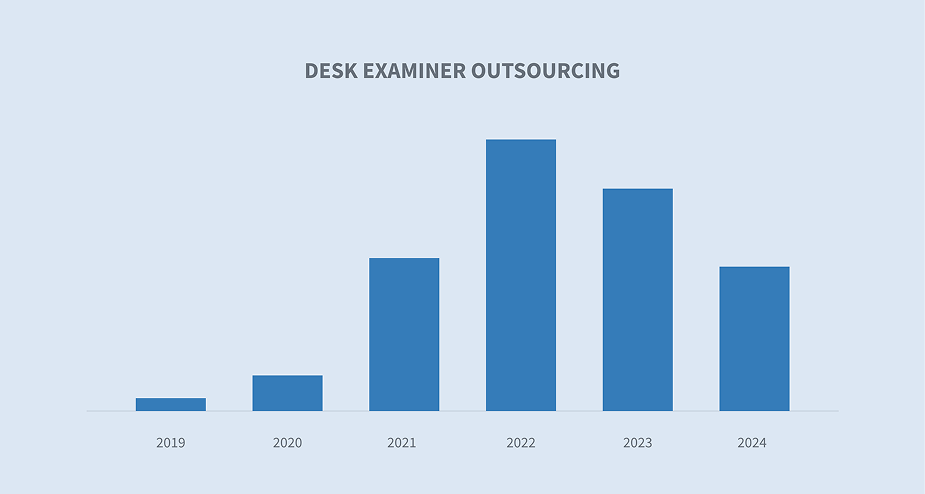

The trend of desk examiner outsourcing has become a business option for carriers throughout the market.

Gross loss average and gross loss totals across our loss adjusting book of business continue to trend upward.

Cycle time averages across our loss adjusting book of business trended down slightly during 2022, driven primarily by an influx of personal lines claims resulting from catastrophic losses, but have stabilized over 2023 and 2024.

Catastrophe events over one billion dollars in the U.S. continue to grow in frequency. However, the year-over-year volatility in the severity of dollars in total also continues, making preparation for catastrophes a challenge.

New assignments and pending claims volume

New assignment volume and pending assignment volume trends provide a broad-scale benchmark for comparison.

Although the overall new assignment data was relatively consistent, it shows a drop between the first and second half of 2023. This was primarily driven by catastrophe activity not reaching industry expectations or historical levels. Overall, our loss adjusting new assignment counts in 2024 leveled off into a steady pattern of daily claims after dropping from highs in 2022 and the first half of 2023. This was reinforced by pending claims inventory data, which remained steady from the second half of 2023 through 2024.

Desk examiner outsourcing

A noticeable trend in the marketplace is the change in how carriers are approaching the desk examiner role. Prior to the COVID pandemic, the traditional role of the independent property adjuster was primarily a field resource. Carriers generally engage independent adjusters in one of three ways:

| 1. | To support or fill gaps in coverage on their teams |

| 2. | To be their field staff if they chose not to have adjusters in the field |

| 3. | To support only in times of surge or catastrophe |

The labor challenges presented by COVID drove carriers to look to independent adjusters to serve as desk examiners, a role that traditionally was not outsourced. We identified this change and worked with multiple top carriers to develop tailored workflows and processes to fit their needs, focusing on the top two types of support above.

As we continued to see an increased demand, we invested significant time and capital into developing services specifically dedicated to this market. By leveraging our technology and full suite of damage capture solutions, carriers can outsource part or all of their desk examiner roles. Our services and ability to scale quickly can help drive efficiencies and cost savings. Several carriers have determined that outsourcing all or part of their desk functions has proven favorable.

Gross loss trends

Our team and our clients reference gross loss trends as a leading indicator for short- and long-term exposure. The next two charts show the average gross loss and the total gross loss across all our property loss adjusting business. From 2021 to 2024, a key trend was the significant increase in average costs per claim. This was expected due to supply chain issues and other economic impacts caused by COVID and the overall inflationary market. Note, Sedgwick’s expertise in the large loss market drove the 2023 increase as a small percentage of substantial losses skewed the overall metric.

Cycle time trends across all lines

The cycle time trend, which is the time from file open to close, provides carriers and companies in the claims space a performance benchmark to compare against the market. The chart below reflects cycle times across our full book of property loss adjusting business. This includes personal lines claims with gross losses in the thousands to large commercial claims with gross losses in the tens of millions. The expectation for cycle times varies greatly between the size of claims, but on average, the trend from year to year should be comparable. What stands out from this data are two things:

| 1. | Losses received in 2021 were still being impacted by the Covid pandemic and the challenges this posed, caused primarily in the sourcing of materials and the challenges in reaching settlements caused by the supply chain challenges driving up costs, particularly in the commercial market. This was offset somewhat in 2022 by the high volume of personal catastrophe claims in 2022. |

| 2. | Cycle time trends across our book of business leveled off across 2023 and 2024 to a consistent level, with the overall number being within half a day. This indicates that there were no significant external market trends driving results year over year. |

Catastrophe

The overriding trend for catastrophe continued to be volatility. There is significant year-over-year disparity in volume and severity, which makes predicting and managing these events challenging for carriers. Weather patterns will remain unpredictable, but as the data below reflects, the one consistent trend is an overall upward growth in the count and severity of events.

NOAA provides an annual overview of billion-dollar weather and climate disasters. This shows how the number of billion-dollar events increased over time. There were 24–28 events in calendar years 2023 and 2024, which are the highest on record. The red line indicates the severity in dollars for each year.

Source: NOAA, National Centers for Environmental Information- Billion-Dollar Weather and Climate Disasters

The chart below reflects short-term volatility from year to year. This chart represents the red line from the graph above. In the last five years, the dollars of damage in the U.S. from year to year have varied significantly, which makes managing and preparing for catastrophes challenging. The unpredictable nature of the potential impact year over year, coupled with the long-term trend of overall severity increases attributable to climate change, requires claims leaders to be prepared and have a carefully planned strategy. These strategies should include:

| • | Strong data analytics outlining potential catastrophe scenarios overlaid against policies in force (PIF). |

| • | Key partnerships in place with workflows and processes tested and confirmed |

| • | A constant review of new technologies to improve efficiency |

| • | A worst-case scenario “break glass if needed” plan |

Future considerations

Service delivery

The claims industry continues to look for new and improved ways to deliver services. Along with many insurance carriers, we are focused on new delivery models like desk examiner outsourcing or implementing technologies like AI into key areas of the claims workflow process to drive improvements in efficiency, outcomes and customer experience.

Catastrophe planning

This area remains a key consideration. The volume of billion-dollar events driven by climate change is undeniable based on the data. But the volatility year over year remains a challenge. As a result, catastrophe planning for any claims-focused operation is critical.

Future staffing

Although not highlighted in our data, staffing is a critical consideration as we look ahead in the industry. In the years to come, there will be fewer claims adjusters with the experience to handle large losses. Sedgwick’s property team is working to solve this challenge with our protégé programme. We identify talented young adjusters early in their careers and pair them with our executive and senior general adjusters. The goal of this programme is to escalate their exposure to the complicated world of large loss commercial claims handling, readying the next generation of adjusters.

Industry concerns

| • | Climate change impact on surge claim events |

| • | Emerging technologies (automation/AI) |

| • | Wage pressure |

| • | Volume labor (catastrophe) |

| • | Graduating talent |