- 2024 year-end: BENEFITS

Accommodations

Report objectives

This report aims to summarize the present metrics for our disability programs, assess the landscape of disability claim administration and litigation, and benchmark our patterns against comparable industry research.

data parameters

Our practice team uses JURIS claims data to perform comparative analyses informed by their expertise and analytics. The data in this report is based on the calendar year, January through December, for each reporting year.Certain client data is excluded from book of business metrics to avoid overrepresentation of a single client.

Key observations

Leave request trends

From 2023 to 2024, accommodations saw a slight increase of 1.8%.

| • | Incident rates rose by 3.3%, moving from 5.48 to 5.65. |

| • | The healthcare, manufacturing, services and transportation industries experienced slight increases, while retail dropped by 2.1%. Wholesale trade saw the most significant decline, with new volumes decreasing by 16% in 2024 compared to 2023. |

Request types

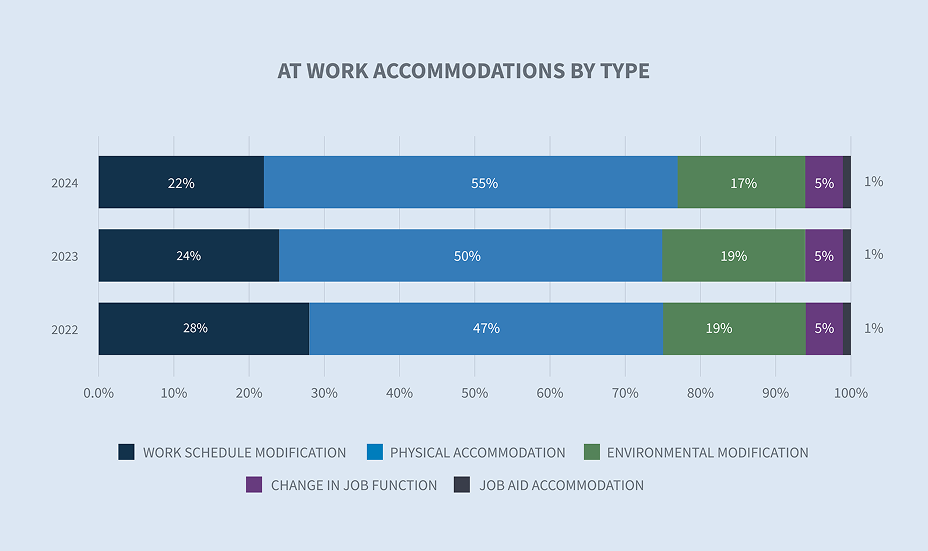

At-work request types increased by 21% from 2023 to 2024, rising from 28% to 34% of total requests.

| • | Leave of absence accommodations decreased by 10%. |

| • | Physical accommodations continue to dominate at-work request types, making up 55% in 2024 and showing steady year-over-year growth. |

Environmental modifications

In 2024, new claims for environmental modifications at work have decreased by 10%.

| • | However, the category of environmental modifications has seen a steady increase in closed claims, rising by 34.7% from 35.4% in 2023 to 47.7% in 2024. We expect this upward trend to continue. |

| • | Other accommodation subcategories within environmental modifications are trending downwards. |

| • | Industries with the highest increase in work-from-home accommodations include healthcare (up by 15.5% from 2023 to 2024) and finance (up by 74%, from 19.9% in 2023 to 34.7% in 2024). |

This trend suggests a growing recognition of the benefits of ergonomic and environmental adjustments, particularly in remote work settings. Industries such as healthcare and finance have seen notable increases in work-from-home accommodations, reflecting broader shifts towards flexible work arrangements.

With more employees returning to the office, there may be a renewed demand for physical and environmental modifications to accommodate various needs within the workplace.

The ERM Sustainability Institute’s 2024 Trends Report highlights the increasing importance of sustainability and ergonomic adjustments in the workplace, driven by the shift towards remote work and flexible arrangements. For more insights, you can refer to the Tunley Environmental 2024 Sustainability Report.

Durations

Overall, durations have shown a slight upward trend, increasing from 124 days in 2023 to 124.3 in 2024.

| • | When broken down by at-work accommodations, the duration decreased 8.5 days in 2023 to 251.5 in 2024. |

| • | Continuous leave of absence accommodations also decreased from 80.3 days in 2023 to 79.2 in 2024. |

| • | Intermittent leave of absence accommodations increased by 5.1%, rising from 17.2 days in 2023 to 18.1 in 2024. |

| • | Durations by industry show that finance, healthcare, services and wholesale trade have all seen increases in 2024. |

| • Finance increased from 199.5 days to 214.3 | |

| • Healthcare went from 145.3 days to 163.8 | |

| • Services went from 121 days to 134.3 | |

| • Wholesale trade increased from 129.6 days to 211.4 | |

| • | Long-term accommodation types have increased by 18.9% from 2023 to 2024. |

| • | Most age groups show durations trending down, with the 55+ age group increasing by 2% from 2023. |

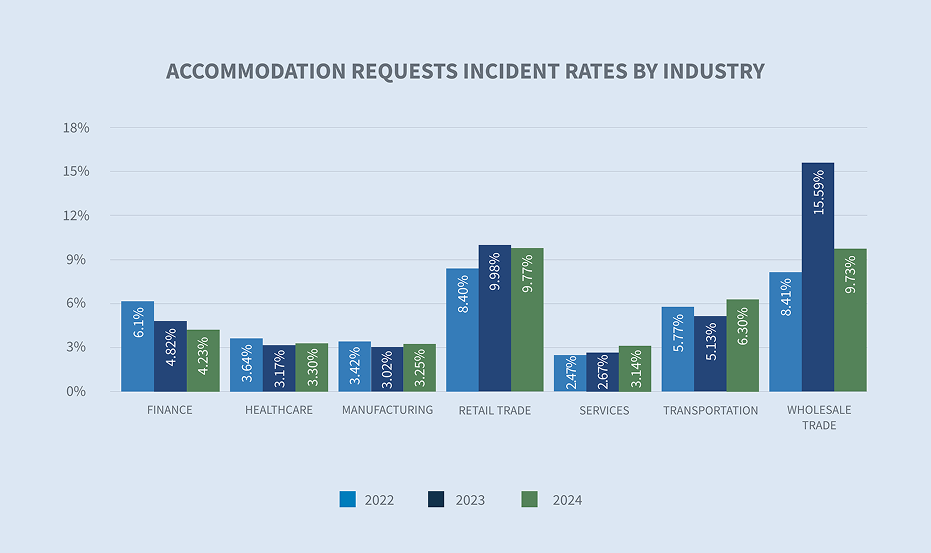

Incident rates

The accommodation incident rate remained consistent between 2022 and 2024, with slight increases year over year. In the wholesale trade industry, there was a dramatic shift in the incident rate from 2023 to 2024, decreasing about 20%. Wholesale volumes also had a 16% decrease from 2023 to 2024. Other industries remained relatively stable and consistent. Data suggests that a more aggressive return to work strategy among the wholesale industry group as they prepared for other industries to follow suit may have led to the spike in 2023 and the return to a more normal incident rate in 2024.

Accommodation requests by types

Leave of absence remains the top accommodation request. However, in 2024, we started to see an increase in at work requests followed by a subsequent drop in leave of absence requests. We are seeing a greater number of companies shift from a hybrid model to full return to office, which indicates that this trend may continue in 2025.

Physical accommodation requests increased 5% from 2023 to 2024. This is directly in relation to employers requiring more employees to return to the office. The most commonly requested physical accommodation dealt with lifting followed by requests for standing. Environmental accommodation and work schedule modifications were each down 2% year over year with work from home being almost 50% of the environmental modification requests. This trend was observed in 2023 as companies began their return to work or hybrid approaches. Increased break requests lead all work schedule modifications, which is again being attributed to return to office.

Accommodation requests by subtype

For accommodations requesting leave, the trend for allowing intermittent leave as an accommodation has continued to grow at almost 2% year over year since 2022. We anticipate this trend to continue as more and more employers become comfortable using intermittent leave as a short-term accommodation to assist their employees.

Work from home accommodations by age

New accommodation requests have shown slight increases of 4–5% for the 35-45 age group and above. Meanwhile, requests from the 25–35 and under 25 age groups have been trending down slightly. New accommodation requests from employees with 3–5 years of service or more increased slightly from 2023 to 2024 and account for 54% of the request types. This aligns with US data indicating that older individuals and those with disabilities are more likely to request workplace accommodations. The U.S. Office of Personnel Management also highlights that reasonable accommodations, including modifications to job duties, flexible work schedules and telework options, are often requested by employees with disabilities. A report from the Journal of Occupational Rehabilitation highlights these similar findings using data from 2019 and 2021 in relation to the COVID-19 pandemic.

Granted rate

Overall approval rates of accommodation requests continue to increase to an all-time high of 94.6% as employers are finding the majority of requests to be reasonable. While legal jeopardy continues to be a main driver, with the tight labor market and companies just now recovering from the great resignation, we expect that employers may continue to approve at this higher rate.

Future considerations

Working from home

Before the pandemic, the consensus in the courts was that it was at the discretion of the employer to decide if physical presence in the office was an essential function of most jobs and if remote work was not a reasonable accommodation. Now, the interactive dialog is paramount. After two years of teleworking, there will be questions about why employees with a disability cannot continue to do so as an accommodation. To justify hardship, an employer should be prepared to prove that although remote work was required during the shutdown, it was not effective (e.g., problems with technology, decreased productivity, lost sales, etc.).

The Equal Employment Opportunity Commission (EEOC) recently announced that it settled its first case related to an ADA accommodation for COVID-19 – and it involved work from home. Specifically, ISS Facility Services, Inc. (ISS), a workplace experience and facility management company, was ordered to pay $47,500 and provide other relief to settle a disability discrimination and retaliation lawsuit. The lawsuit alleged that an employee at ISS requested an accommodation to work remotely two days per week and be allowed frequent breaks while working on site due to her pulmonary condition, which placed her at a greater risk of contracting COVID-19. Although ISS allowed other employees in her position to work from home, it denied her request and soon after terminated her employment. While the agency’s announcement does not detail whether ISS engaged in a robust interactive dialogue, the events lead to a reasonable conclusion that ISS did not.

Litigation trends

In 2019, for the first time in the history of the ADA, disability charges were filed more frequently than any other type (e.g., race, color, religion, sex, national origin or age). Race had been the most common type of suit since statistics were kept. In 2021, that trend continued, and the gap between disability charges and other charges widened. Since then, the gap is sustaining.

This speaks to a couple of things:

| 1. | The requirement to interactively dialogue. The swift increase in claims has occurred in the 13 years since the ADA was amended in 2008, and of course, it was in those amendments that Congress made clear that employers had to interactively dialogue with employees and find reasonable accommodations for them should they have an impairment. |

| 2. | Employees becoming more and more familiar with their rights under the law. |

Aided by claims related to COVID-19, we believe that the trend will continue and the gap between disability litigation and everything else will remain steady or increase. While musculoskeletal, mental health and neurological disabilities are still the most cited impairments, it is thought that long COVID may become the most cited disability as we are starting to see more claims from long-haul COVID emerge.

Loper decision

The 2024 Loper decision is already having an impact as dozens of lawsuits have been filed challenging multiple regulatory interpretations. While this doesn’t undo past rulings, it is opening the door to allow past precedents to be re-evaluated. While benefits plans governed under the Employee Retirement Income Security Act have not been directly challenged, we do expect challenges to chip away at various regulatory agencies’ final rules such as the Mental Health Parity and Addiction Equity Act and others.

Political climate

With the change in administrations, we are already seeing the dramatic impact the Trump administration is having on the regulatory environment. The newly created Department of Government Efficiency (DOGE) has already impacted multiple regulatory agencies including the Department of Labor and EEOC. As of this article, over 40 lawsuits have been filed as a result of decisions by DOGE and executive orders., We anticipate the federal instability will lead to greater regulation at the state level, which will cause even more confusion as the patchwork of state and local laws increase.