650+

colleagues in Asia

As the global leader in loss adjusting, claims administration and benefits administration, it’s our business to help people navigate the unexpected. Sedgwick operates globally and provides services throughout Asia.

Sedgwick simplifies the claims process, helping reduce costs and risks. Our loss adjusting and risk management experts in Asia provide fast, specialized attention throughout the region. We integrate advanced technology and digital platforms to optimise claim and appraisal management, delivering a more agile and transparent experience.

We have served the Asia market for more than 100 years and continue to expand across the region. Our strong local knowledge, combined with our global expertise, offers a unique blend of stability, innovation and technical ability across a variety of disciplines.

colleagues in Asia

claims per year

countries in Asia

Sedgwick’s loss adjusting teams in Asia manage everything from domestic and SME claims to highly specialized and catastrophic losses. Our extensive local network ensures the right experts are deployed quickly and efficiently, wherever and whenever they’re needed. With offices across the region, we provide seamless support that meets both local and global regulatory requirements. We work with insurers, reinsurers, brokers, Lloyd’s syndicates, corporates and government bodies to deliver reliable claims management.

Sedgwick’s TPA/Claims Management team in Asia provides coordinated, account-managed solutions across all lines of business, supported by advanced technology and centralized management information. Our flexible approach ensures clients receive efficient, transparent claims handling tailored to their needs, with services that include:

Trusted solutions for complex claims in marine, energy, aviation and technical and special risks. Discover Sedgwick’s global specialty loss adjusting services for high-value claims across niche markets.

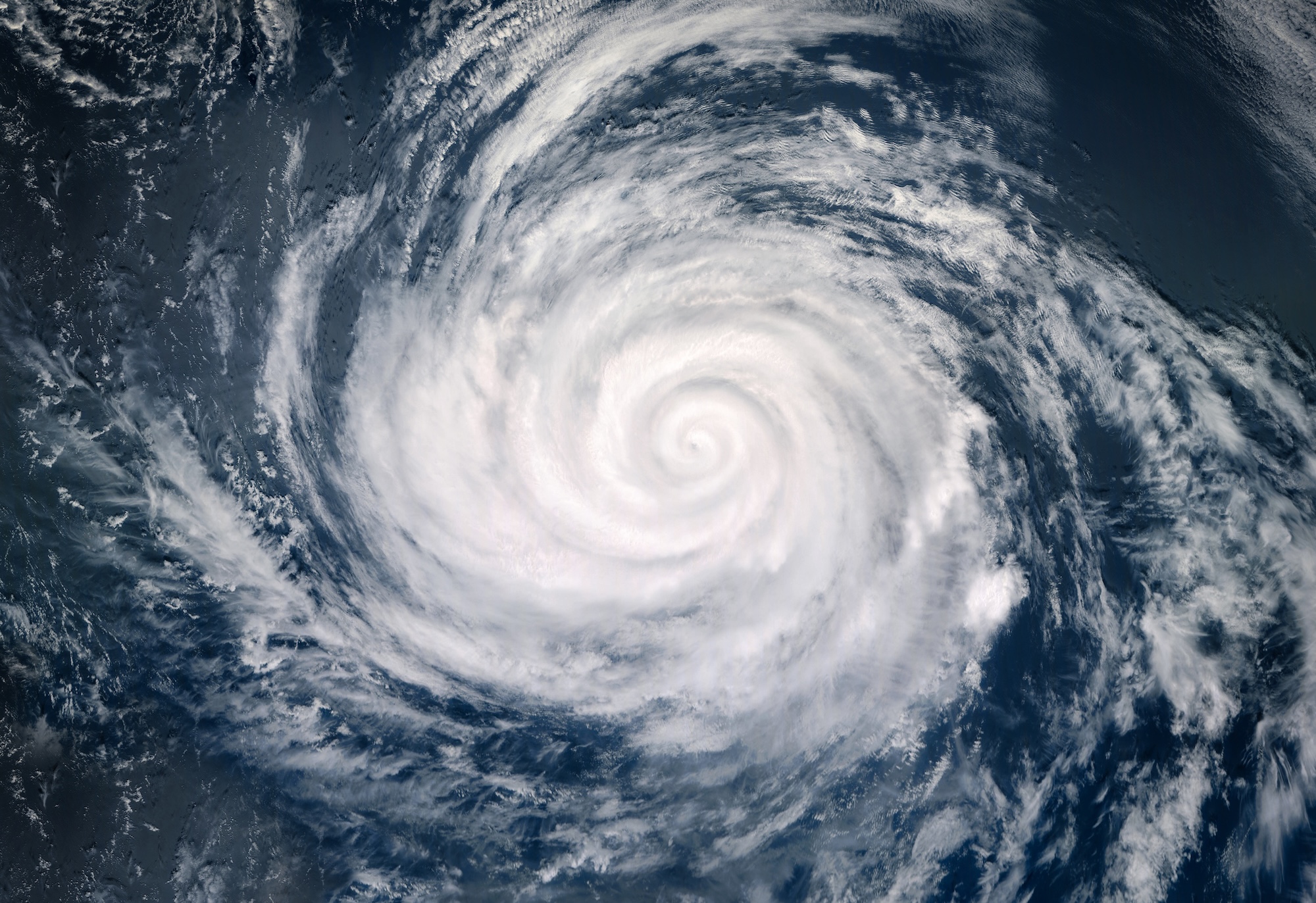

Regardless of size, scope or location, our catastrophe specialists mobilise quickly to assess and manage disaster-related claims. Our catastrophe response team works to accurately determine coverage and provide appropriate, insightful reporting and analysis throughout the life of the claim. We have specialists in virtually every industry sector and are ready to assist.

Sedgwick in Singapore stands at the forefront of risk, benefits and integrated business solutions in Asia, delivering expert support across property, marine, energy, and aviation risks.

With a dynamic leadership team and a commitment to innovation, Sedgwick continues to elevate the client experience through tailored solutions and technology-enabled services.

With strategic offices across the country and a legacy rooted in industry leadership, Sedgwick China provides tailored support across all classes of insurance claims — from property and casualty to complex business interruption and cyber risks. Backed by Sedgwick’s global network, the China team ensures proactive loss mitigation and rapid recovery, helping clients protect their reputation and return to business swiftly.

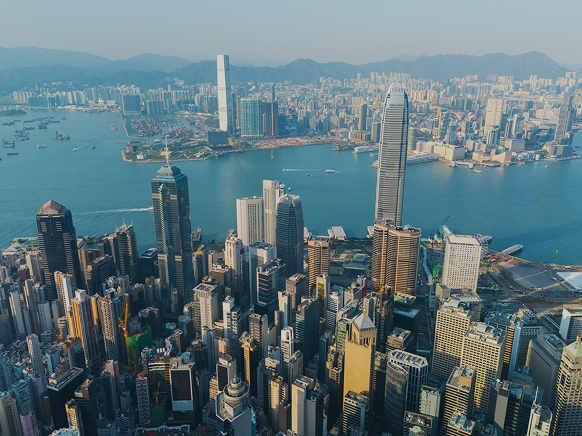

Sedgwick in Hong Kong delivers world-class claims management and loss adjusting services with a deep understanding of the local market. As Asia’s largest loss adjusting and risk management firm, Sedgwick combines global expertise with more than 30 years of experience in Hong Kong. From its headquarters in Causeway Bay, the team is committed to fast, efficient service and technical excellence — ensuring clients receive responsive, expert support when it matters most.

Sedgwick in Indonesia delivers global claims management excellence with deep local insight, offering tailored solutions across property, liability, marine, engineering, catastrophe response and more. As part of the world’s largest loss adjusting and third-party administration firm, Sedgwick Indonesia combines cutting-edge digital tools with a team of bilingual, highly qualified professionals to provide fast, consistent and proactive service.

With recent expansions in energy capabilities and a strong presence across Southeast Asia, Sedgwick Indonesia is uniquely positioned to support clients with complex claims and risk management needs — ensuring business continuity and peace of mind when it matters most.

Our team includes forensic accountants, engineers and industry specialists, providing fast, reliable support across sectors such as construction, marine, cyber, energy and product liability.

Operating 24/7, we help clients recover quickly from loss events while safeguarding their reputation.

Backed by Sedgwick’s global network, we offer proactive solutions and seamless service tailored to the Japanese market.

Sedgwick Korea delivers expert claims management and loss adjusting, combining local insight with global standards. Our team supports insurers, corporates and brokers with efficient, transparent solutions.

Our services include:

Sedgwick Malaysia provides comprehensive claims management across all major insurance lines, leveraging advanced technology and local expertise to deliver responsive, tailored solutions. We have 13 offices throughout the kingdom.

Our services include:

Sedgwick Taiwan offers specialist claims adjusting and risk management, ensuring efficient resolution and compliance with local and international standards.

Our services include:

Sedgwick Thailand combines deep sector knowledge with rapid response capabilities, supporting clients with end-to-end claims management and technical expertise.

Our services include:

Looking for local support? Use our Find an Expert tool to connect with industry professionals

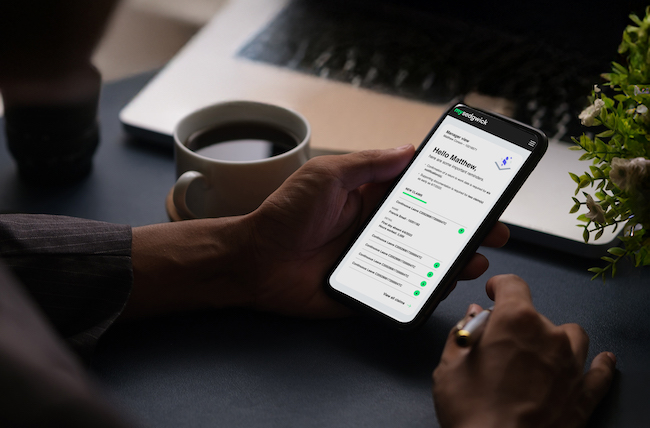

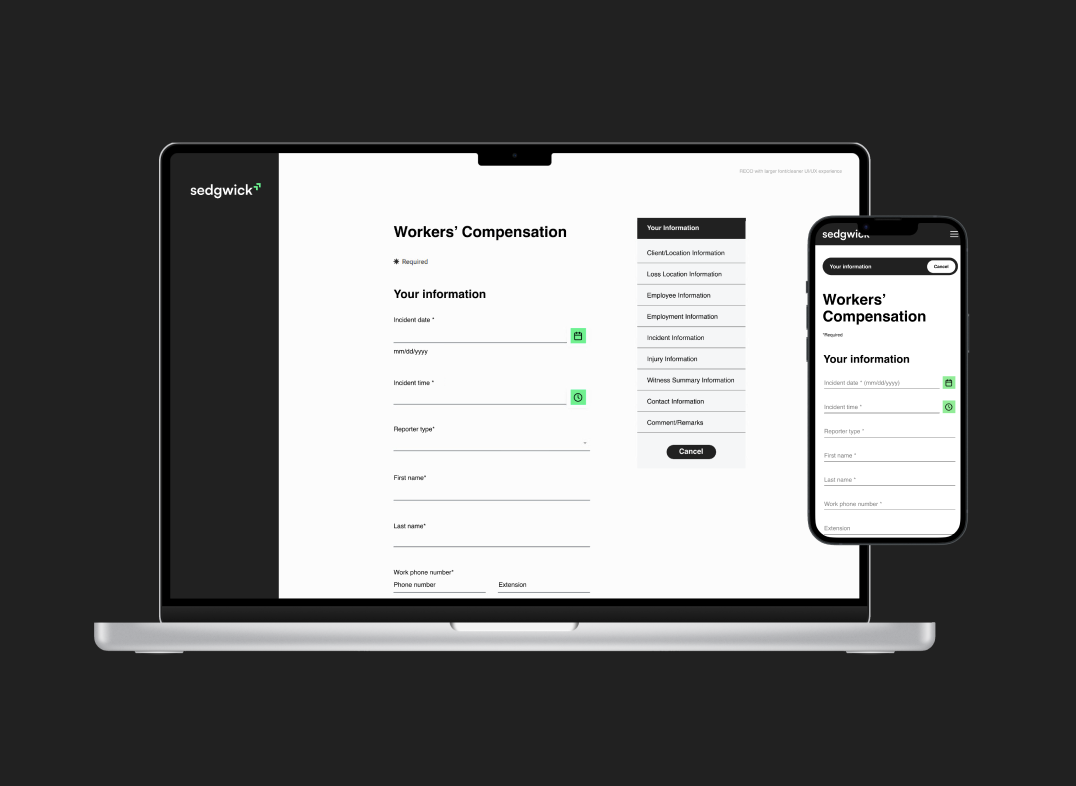

At Sedgwick, we’re always finding new ways to digitalise the claims journey and improve the experience for our clients, customers and colleagues. Our commitment to innovation is helping us lower service costs, reduce indemnity spend, enhance data insights and better serve our clients.

Allows our colleagues to easily manage international claims portfolios.

Updates customers with real-time claims and case information.

Streamlines and simplifies claim intake and reporting for customers.

Gives clients full visibility into every aspect of their claims.