We don’t just follow technology trends — we set them.

As the world’s leading risk and claims administration partner, we’re redefining what’s possible through unmatched investments in AI, data science and advanced technologies. Our mission is clear: to continuously reimagine claims handling, elevate the customer experience and deliver outcomes that exceed expectations.

Redefining AI: Amplifying expertise, not replacing it

With the strength of 33,000 dedicated colleagues around the globe, we bring unrivaled expertise to every interaction. But what truly sets us apart is our belief that technology should amplify the human touch — not replace it. That’s the heart of our approach to AI, which we call collaborative expertise. It’s about empowering our people with intelligent tools so they can focus on what matters most: delivering care, clarity and confidence to our clients and claimants.

We’re leading the way in many transformative areas, including:

Empowering adjusters at the desk level to make smarter decisions

With Sidekick Agent, we’ve taken collaborative expertise to another level. Our proprietary agentic AI tool delivers real-time, data-driven insights directly within the systems our colleagues use every day — helping them make faster, more informed decisions and meaningfully shape customer outcomes.

Triaging claims for industry-leading speed and accuracy

By integrating our smart.ly data portal with the generative AI capabilities of Sidekick, we’re accelerating low-complexity claims and intelligently routing others. This seamless orchestration ensures every claim is handled with the right level of attention — faster, smarter and more accurately than ever before.

Leveraging AI-driven clinical insight to deliver caring that counts

Our AI care guidance model scans medical bills, notes and documentation to flag workers’ compensation claims that may benefit from early clinical support. By spotting subtle risk patterns, it enables faster referrals to telephonic or field case management (TCM/FCM) — helping us deliver timely, high-quality care while reducing claim severity.

Setting the standard for claimant communication

We’re embedding AI-powered voice and chat tools into our service model to instantly handle routine inquiries — ensuring our care teams are free to focus on the moments that require empathy, expertise and human connection.

This is what leadership looks like: not just adopting new technologies, but using them to elevate people, improve lives and lead our industry forward with heart and purpose.

Digital experience

At the core of our digital experience are the market-facing platforms that support every aspect of the services we offer:

SIDEKICK AGENT

Transforming the claim journey with generative and agentic AI.

Our industry-first platform uses cutting-edge technology to supercharge our claims professionals.

Our award-winning Sidekick application offers our colleagues an expert edge in their daily work by providing AI-powered document summaries, routine task automation and real-time, data-driven guidance on key next steps of the claim life cycle. By delivering clear, timely insights at the desk level, Sidekick Agent prompts swift action and improves our claims handling accuracy.

- Real-time, data-driven guidance for our claims handlers

- Streamlines decision making

- Promotes service consistency

SMART.LY

Online intake and incident reporting.

Our flexible platform for managing a variety of scenarios can be implemented in a matter of hours, not days.

Our flexible, multilingual platform for the digital submission of claims information, smart.ly simplifies the intake and incident reporting process with AI-based tools, an embedded rules engine, intuitive scripting and digital triage capabilities. It leverages real-time system interactions to streamline the first notice of loss (FNOL) process and supports swift management of a broad spectrum of claim events. Connected application programming interfaces (APIs) allow smart.ly to instantly obtain and share information across multiple sources.

- Agile, efficient and clever

- Intelligent decision engine

- Rules-based structure and intuitive scripting

- Intake, fast track, automated processing and more

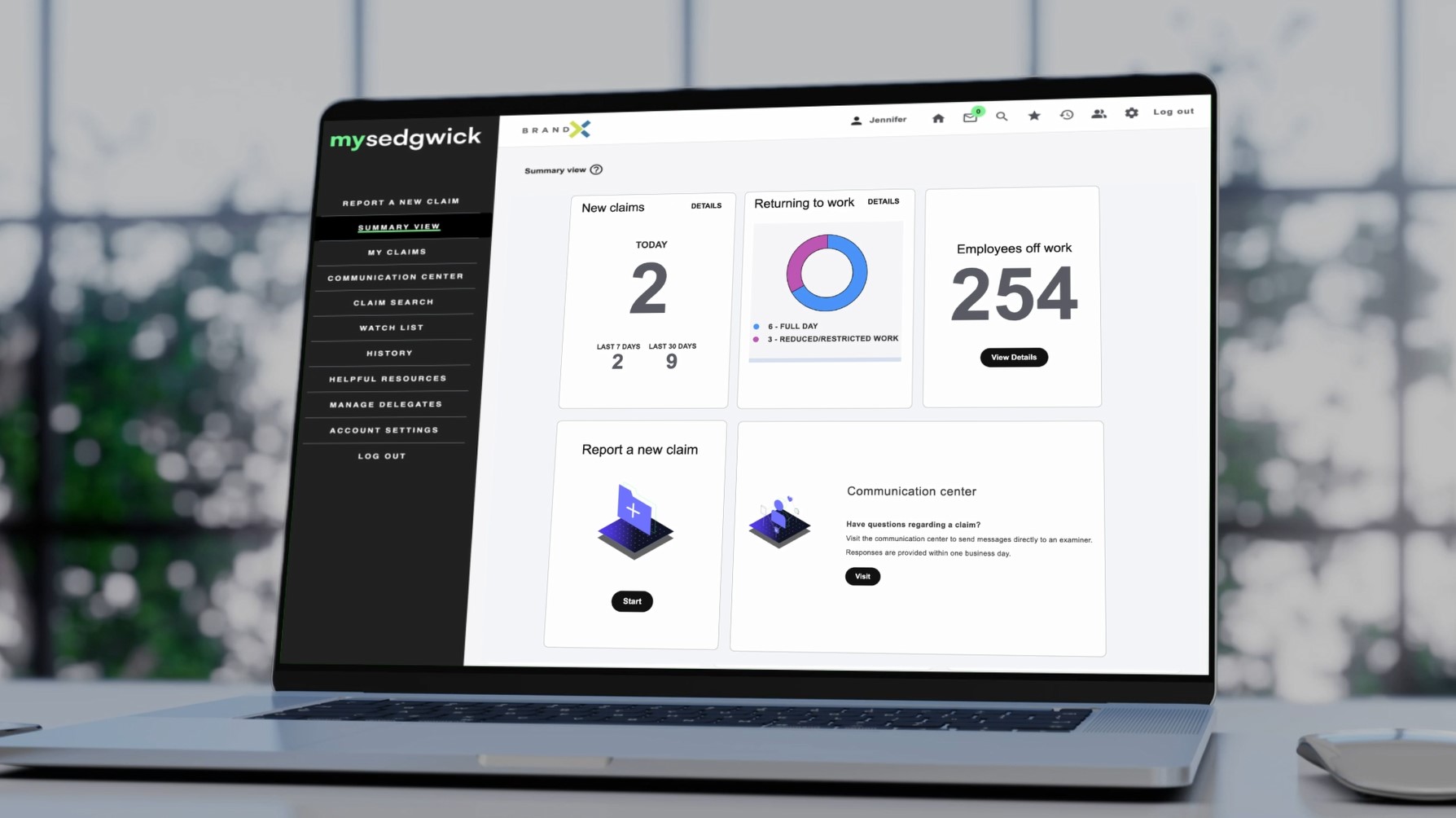

MYSEDGWICK

A virtual guide through the claims process.

Our self-service portal gives clients’ employees, policyholders and customers access to real-time claim information.

Our customer-centric self-service tool, mySedgwick offers convenient, secure online access to the latest claim updates. Users can view details about their claim, select their communication preferences, easily update information, engage with their assigned handling team and keep the process moving forward.

- Online access to real-time information

- Chronological activity stream for easy monitoring of claim progress

- Communicate directly with the assigned claims team

- User profiles tailored to relevant roles and preferences

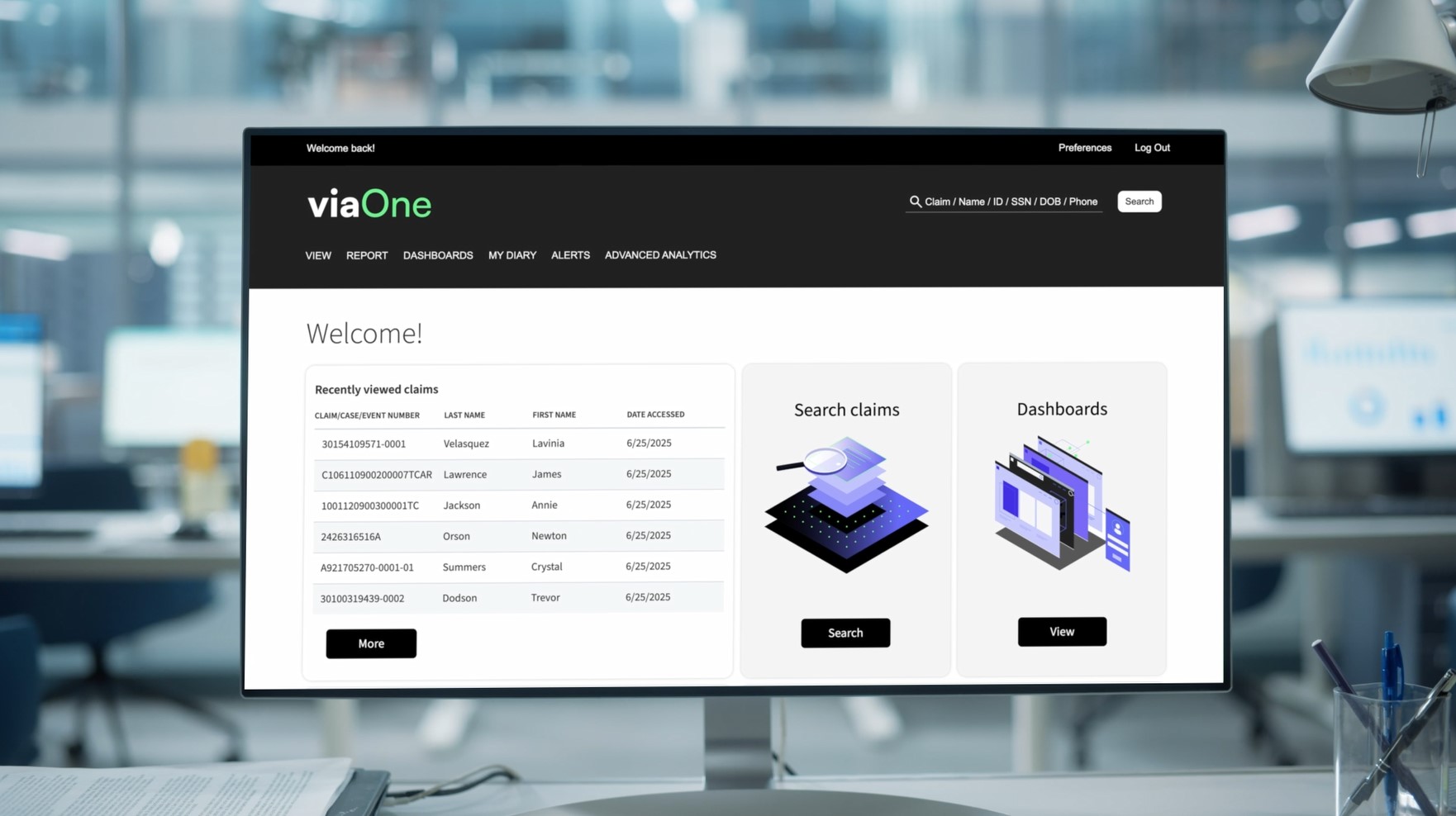

VIAONE

An easy-to-use information hub for

our clients.

On-demand claims data reporting.

Our viaOne digital platform gives clients full visibility into their claims portfolio with on-demand, actionable reports. Users determine the path and depth of the data they see. We’ve designed viaOne so it’s easy to track key claims metrics, run standard and custom reports, set alerts and more.

- Access to real-time data

- Track and analyze key metrics

- Customizable visual dashboards

SIDEKICK AGENT

Transforming the claim journey with generative and agentic AI.

Our industry-first platform uses cutting-edge technology to supercharge our claims professionals.

Our award-winning Sidekick application offers our colleagues an expert edge in their daily work by providing AI-powered document summaries, routine task automation and real-time, data-driven guidance on key next steps of the claim life cycle. By delivering clear, timely insights at the desk level, Sidekick Agent prompts swift action and improves our claims handling accuracy.

- Real-time, data-driven guidance for our claims handlers

- Streamlines decision making

- Promotes service consistency

SMART.LY

Online intake and incident reporting.

Our flexible platform for managing a variety of scenarios can be implemented in a matter of hours, not days.

Our flexible, multilingual platform for the digital submission of claims information, smart.ly simplifies the intake and incident reporting process with AI-based tools, an embedded rules engine, intuitive scripting and digital triage capabilities. It leverages real-time system interactions to streamline the first notice of loss (FNOL) process and supports swift management of a broad spectrum of claim events. Connected application programming interfaces (APIs) allow smart.ly to instantly obtain and share information across multiple sources.

- Agile, efficient and clever

- Intelligent decision engine

- Rules-based structure and intuitive scripting

- Intake, fast track, automated processing and more

MYSEDGWICK

A virtual guide through the claims process.

Our self-service portal gives clients’ employees, policyholders and customers access to real-time claim information.

Our customer-centric self-service tool, mySedgwick offers convenient, secure online access to the latest claim updates. Users can view details about their claim, select their communication preferences, easily update information, engage with their assigned handling team and keep the process moving forward.

- Online access to real-time information

- Chronological activity stream for easy monitoring of claim progress

- Communicate directly with the assigned claims team

- User profiles tailored to relevant roles and preferences

VIAONE

An easy-to-use information hub for our clients.

On-demand claims data reporting.

Our viaOne digital platform gives clients full visibility into their claims portfolio with on-demand, actionable reports. Users determine the path and depth of the data they see. We’ve designed viaOne so it’s easy to track key claims metrics, run standard and custom reports, set alerts and more.

- Access to real-time data

- Track and analyze key metrics

- Customizable visual dashboards

Sign up to get more from Sedgwick

Thought leadership • Regulatory updates • New solutions • News and developments

Australia

Australia  Canada

Canada  Denmark

Denmark  France

France  Ireland

Ireland  Netherlands

Netherlands  New Zealand

New Zealand  Norway

Norway  Spain and Portugal

Spain and Portugal  United Kingdom

United Kingdom  United States

United States