Our viaOne suite gives clients full visibility into every aspect of the claims we handle on their behalf. With this secure platform, they have real-time access to their data. Thanks to enhanced dashboards and visualisation tools, users can determine the path and depth of the data they see — from an aggregate, graphical view down to the individual claim level. The core capabilities of viaOne are designed to make it easy for clients to track and analyse key claims metrics, run standard and custom reports, set alerts and more.

An easy-to-use information hub.

One-of-a-kind applications

The viaOne suite of applications provides comprehensive, on-demand, actionable claims information and reports —

all in one place.

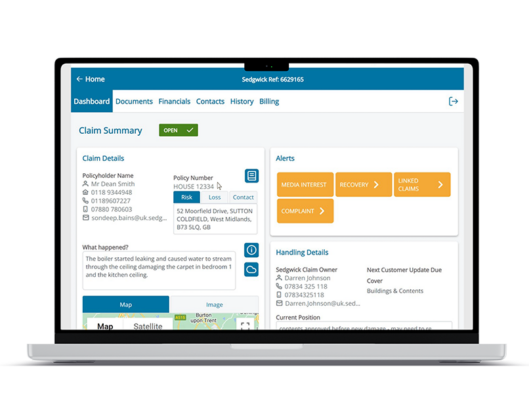

Dashboards

In viaOne, visual dashboards deliver data how and when you need it.

To enhance their data experience, clients can select from a series of dashboards containing tables, charts and graphs about meaningful claim and risk information. They have quick access to key metrics, interactive data discovery visualisation and more.

With more corporates taking larger deductibles, self-insuring, and/or setting up captives to reduce their cost of risk, viaOne features tools that allow them to view aggregate erosion across different policy years and groups. Using a simple gauge-like user interface, viaOne allows corporates to easily and quickly monitor critical information on a daily basis from a single dashboard.

View

Users can see all claim correspondence in an electronic format and conveniently search for claims across their organisation. Additionally, they can view specific claims for detailed, real-time information, including notes, payments, reserves and status via easy-to-use tabs and screens. Users have full visibility into every aspect of their claims and can even add notes and documents to files.

Alerts

With our alerts module, claim events matching certain criteria can be easily and consistently communicated using near-real-time or aggregated daily alerts. Clients can create triggers based on a variety of factors, such as reserve changes, large losses, litigation and vulnerable customer criteria. Alerts can be configured for clients with large deductible, self-insured and/or captive programs as they approach 75% of their aggregate and/or when they breach their aggregate.

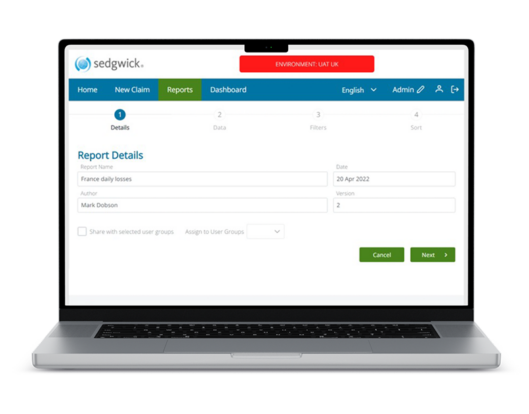

Reports

ViaOne has a dedicated self-service reporting module that allows customers to build their own reports from a palette of more than 400 data objects covering all lines of business. Once built, the reports can be saved, amended, shared with other colleagues, and run at any time — allowing customers to get access to their data whenever they need it.

Advanced analytics and risk insight

Organisations need details on claim trends and performance to make informed business decisions.

With viaOne’s risk insight, corporate customers can view the causes of risks within their business in a single dashboard. Covering property, liability and motor claims, the 10 configurable widgets provide a unique insight into corporate risks. The tool is configured for each organisation, allowing customers to drill down into claims spending and volume at different levels within their business. The incident and cause analysis provide details of the root cause of claims, giving corporates key data on how to reduce their claims spend. Risk insight is an essential tool to help corporates reduce their total cost of risk.

Self-service reporting

Full visibility into every aspect of the claim

Enhanced dashboards and visualisation tools

Easily and quickly monitor critical information from a single dashboard

Covering property, liability and motor claims

Easy-to-use information hub

Track and analyse key claims metrics, run standard and custom reports, set alerts and more.

Sign up to get more from Sedgwick

Thought leadership • Regulatory updates • New solutions • News and developments