By Luke Evans, business development manager

The struggle to source semiconductors is disrupting automotive supply chains, delaying production and deflating car sales.

With the current chip shortage expected to last until 2023, automotive manufacturers face a long and challenging road ahead.

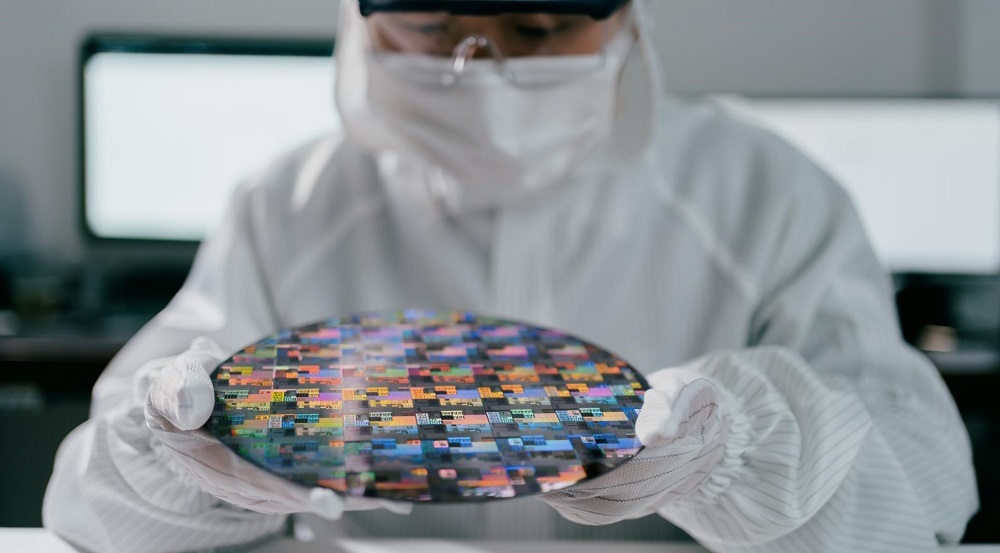

Building modern cars without chips is impossible. The average car has 1400 semiconductors — controlling everything from airbags and infotainment, to steering, fuel economy and advanced driver assistance. In fact, 37% of the demand for semiconductors in Europe comes from auto OEMs.

During 2021, car makers fought to obtain enough chips to support vehicle production.

Escalating demand and pandemic-related operational slowdowns seriously stymied semiconductor supplies — creating a worldwide shortage that is estimated to have cost the global automotive industry $210 billion in revenue during 2021. Consequently, European car output dropped 23%, down five million units from 2019, according to the European Automobile Manufacturers’ Association (ACEA).

Looking forward, advances in battery management systems and heightened demand for connected vehicles and Advanced Driver Assistance Systems (ADAS) will put even more pressure on chip supply chains — which may take a further year to bounce back from the current shortfalls.

Auto-OEMs are not alone in their desperation for components.

Every sector is seeking to secure chips. Even big tech brands are facing chip short falls. Apple, for instance, expects it to account for more than $6 billion in missed sales this holiday season. The EU makes only 10% of the world’s semiconductors and relies on American or Asian suppliers to fulfill its needs. In 2020, automobiles were Europe’s third largest export product, yet the European automotive industry continues to source 60-70% of chips from China and Taiwan.

Can the EU take the driving seat to boost supply?

With so much at stake, both the EU and private sector firms are taking positive steps to ease the chip shortage and implement long-term safeguards by increasing European production capacity. In September 2021, EU lawmakers proposed the European Chips Act (ECA) to help unify and boost industrial output and manufacturing capability in the semiconductor industry. Meanwhile, chip manufacturers such as Intel and Bosch are planning to increase capital expenditure and expand their European operations. The plan is to double European chip production by 2030.

New developments will take time to pay off.

With such an emphasis on the reliance of technology, scarcity of chips and supply chain disruptions, the likelihood of a safety event is high. Our latest recall index report shows that automotive alerts for Q3 2021 — although less than Q2 — are still 14% above the quarterly average of the past 15 years.

If you’re involved in automotive production, you should anticipate some fallout and be prepared for issues arising from quality, faults and compromised supply. That includes supplementing your crisis management programme with an end-to-end product recall plan. Similarly, existing plans should be re-assessed and tested to ensure that they are ready to meet new semiconductor shortfalls and risks as they arise.

To learn more about the rise and fall of recall trends and to acquire knowledge about how to plan for one, download the latest edition of our 2021 European recall index report.

Tags: Auto, automotive, Brand protection, chip shortage, European recall index, Evolving risks + Response, international, Manufacturing, recall trends, Resilience + Readiness, supply, Supply chain disruptions, Vehicle