Despite growing awareness and changes in technology, chip pans remain the most common cause of house fires in the UK, with around 12,000 cases every year, nearly 50 deaths and 4,600 injuries.

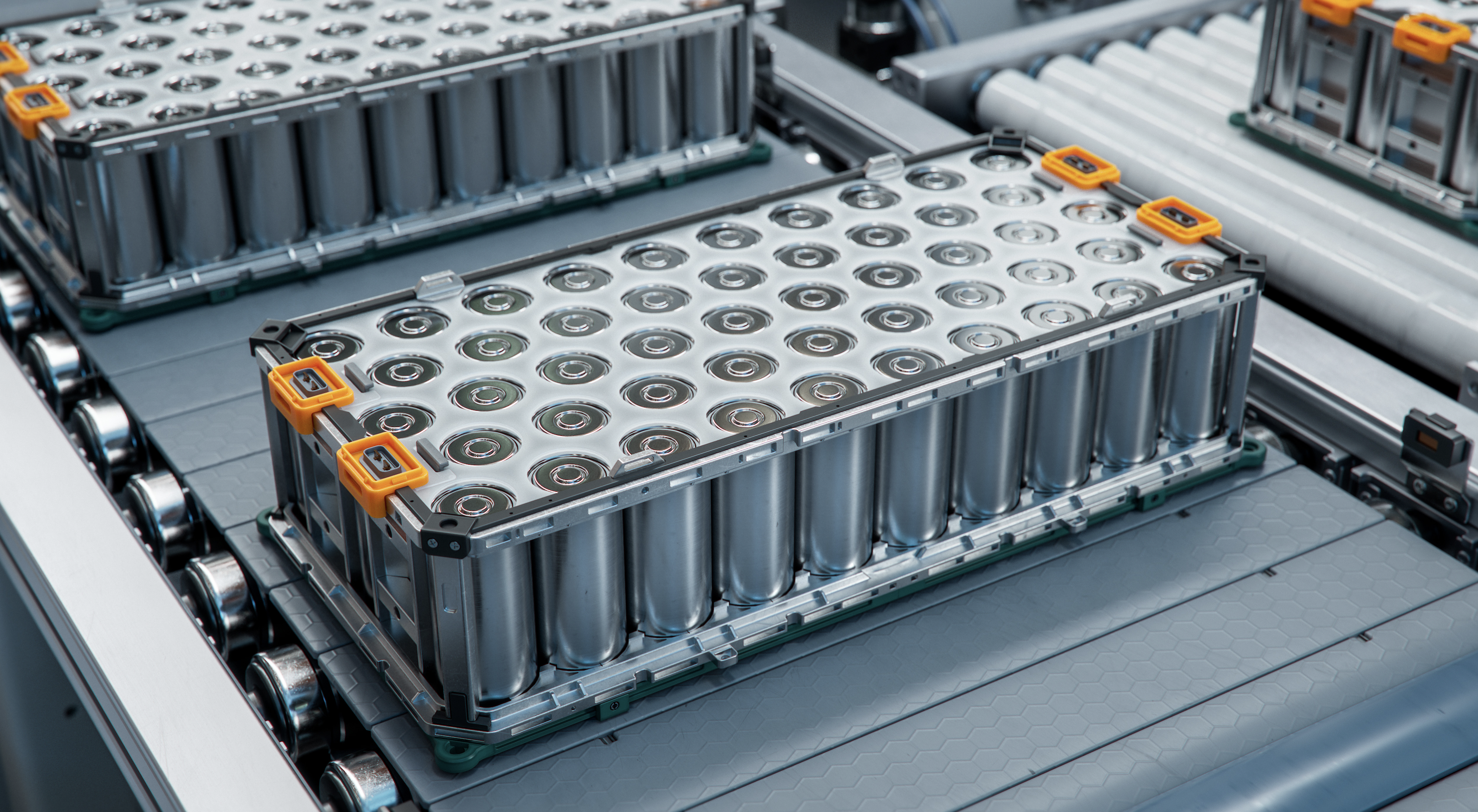

There is, however, a ‘new kid on the block’, set to rival the chip pan in the causation stakes. And the domestic insurance market isn’t the only one that needs to pay attention. Lithium-ion battery fires are on the rise for the commercial loss adjuster and given their widespread use in the modern world, have become a source of growing concern for both domestic and commercial underwriters.

Lithium-ion batteries aren’t just used in mobile telephones or electric vehicles (EVs), including e-bikes and e-scooters — they’re now prevalent in commercial vehicles, marine vessels, plant, machinery, battery, and banks and systems. These batteries are used in industries like manufacturing, construction, aerospace, telecommunications and leisure. Only now is society learning about the risks and hazards that come with these modern-day essential devices.

Risk examples

The London Fire Brigade saw a 60% rise in e-bike fires in 2023. In fact, in the first six months of 2023, the fire and rescue service reported 70 e-bike, 14 e-scooter and 35 other lithium-ion battery fires. While concerns aren’t quite comparable to the chip pan risks yet, numbers are increasing and heading in a worrying direction.

Sedgwick’s experts in the UK handled nearly 1,000 losses in 2023 where lithium-ion batteries have been at the heart of the cause, a 50% uplift from the year prior. The indemnity spend on these losses is now approaching £100m and this doesn’t take into account the lithium-ion battery marine cargo losses we’re handling in UK waters.

Identifying indemnity

How do these lithium-ion battery claims become so costly? Given their rechargeable nature, many instances occur when the device is unattended, which presents a greater opportunity for fire spread and resulting damage. These types of fires also burn at around 400 degrees Celsius and are very difficult to extinguish. With all this in mind, underwriters clearly have a lot to consider.

The causes of fires involving lithium-ion batteries

The energy storage density in batteries has increased exponentially, from lead acid, through nickel cadmium to lithium-ion. Batteries have become compact, lightweight and convenient. The increased capacity in a small footprint, combined with lower power electronics, has resulted in their widespread proliferation. As a result, nearly every household and commercial property is packed full of portable sources of energy which could fail incendively. This is particularly so in the modern era of universal charging connectors and after-market components. Batteries of all types have to be used in specific ways and this isn’t always properly understood by the end user.

Batteries fail for many reasons, the most common reasons being overcharging, misuse or defects. For example:

- Over-charging using an incompatible charger

- Mechanical or thermal damage through misuse

- Manufacturing defect, such as an internal short

Incompatibility of chargers and battery packs

At the cheaper end of the market, these devices are often inadequately matched with chargers, poorly manufactured and lack appropriate battery management systems which protect batteries from entering dangerous states. In addition, there are a number of lithium-ion battery chemistries, and the charging regime must match the chemistry. In situations where the correct charger has been used, fires have continued to occur because of the location of the device when being charged. For instance, mobile phones shouldn’t be charged on soft furnishings or tucked under a child’s pillow.

The dangers during charging and operation can be mitigated by the inclusion of battery management systems in devices and battery packs. Battery management systems can identify batteries which are problematic and either isolate the cell or shut down the battery pack before an incendive event. Battery management systems and other protective functions are often omitted from batteries and appliances at the cheaper end of the market.

Next steps for manufacturers

Major manufacturers of lithium-ion batteries are keenly aware of the fire risks and chemistries are being introduced where batteries reaching thermal runaway* release their energy more slowly and with an associated reduced peak energy. However, the energy density for these chemistries is lower and they are therefore less desirable for devices such as mobile phones where maximum energy density is required. The race for maximum density pushes battery tolerances to their limits and has resulted in high-profile handset recalls.

Chip pan fires were likely not a strong primary source of recoveries, but battery fires are something to become aware of. Our legal services division has seen a rise in the both the frequency and value of claims that relate to battery fires. These incidents tend to be fires that occur during the charging phase, which often happens at night and in a low traffic area leading to advanced stages of conflagration before the fire can be tackled.

Battery fires are always reviewed by Sedgwick for recovery prospects against the manufacturer, importer and seller. Niche avenues against repairers and credit providers can also be pursued. Due to the need for forensic advice, detailed evidence regarding ownership and use, and strong resistance from commercial sellers who investigate any suggestion of wider issues with batches of batteries, this area can be complex. Supply chains into the UK can be hard to ascertain with the importer often being culpable for products manufactured in other jurisdictions.

Obtaining forensic evidence early on can be the key to a recovery after fire damage. Modern payment methods are often online, so proof of purchase is usually easy to establish, but sellers are often difficult to contact and have limited funds if not insured. An active adjuster linked to quick forensic advice is key in this area.

More widely, underwriters will want to think about policy response and drafting with the heightened risk of substantial damage when multiple large batteries are placed near each other — or in locations when fires cannot be easily fought or contained. The domino effect of small fires into much larger and uncontainable ones is another example of the increasingly connected world we live in.

*One of the primary risks related to lithium-ion batteries. It is a phenomenon in which the lithium-ion cell enters an uncontrollable, self-heating state.

Learn more > Contact Scott Cameron, major and complex loss operations director, Sedgwick UK at [email protected].