As high-net-worth (HNW) homeowners build increasingly large, high-spec basements, and severe weather events are causing frequent flooding occurrences, UK adjusters are watching a trend quietly take shape: water ingress and escape of water claims within high-value homes’ basements. These instances are more common than ever — and claim volumes, in addition to claim costs, are higher than ever.

The rise of mega-basements

For homeowners who want to expand their home’s footprint, London’s conservation-related urban planning rules require digging down rather than expanding upward. Consequently, over the past decade, we’ve seen a notable trend in HNW individuals — often categorised in the financial services industry as those who own liquid assets valued over £1million – building mega-basements in their homes.

According to a published research paper, Newcastle University researchers identified 7,328 basement developments that had been granted planning permission across Greater London between 2008 and late-2019. The total depth of those basements together adds up to an estimated 25,461 meters — nearly 16 miles — that’s been excavated underneath London since 2008.

These spaces often include swimming pools, cinemas, staff accommodation and a range of other amenities, laid out within — in some cases — multiple subterranean floors/stories. In addition to the obvious benefits of extra leisure space and maintaining reputations, this trend may be, in part, due to the substantial value a high-end basement creates. According to a recent Foxtons analysis, adding a basement to a London home boosts the property value by, on average, 54%, or £292,000 — even taking into account exorbitant construction, renovation and planning fees.

In prestigious boroughs this is true on an exponential scale. In Kensington and Chelsea, for example, a basement addition can add nearly £1.2 million to the value of the average home (accounting for construction costs), equating to a 96% increase in property value.

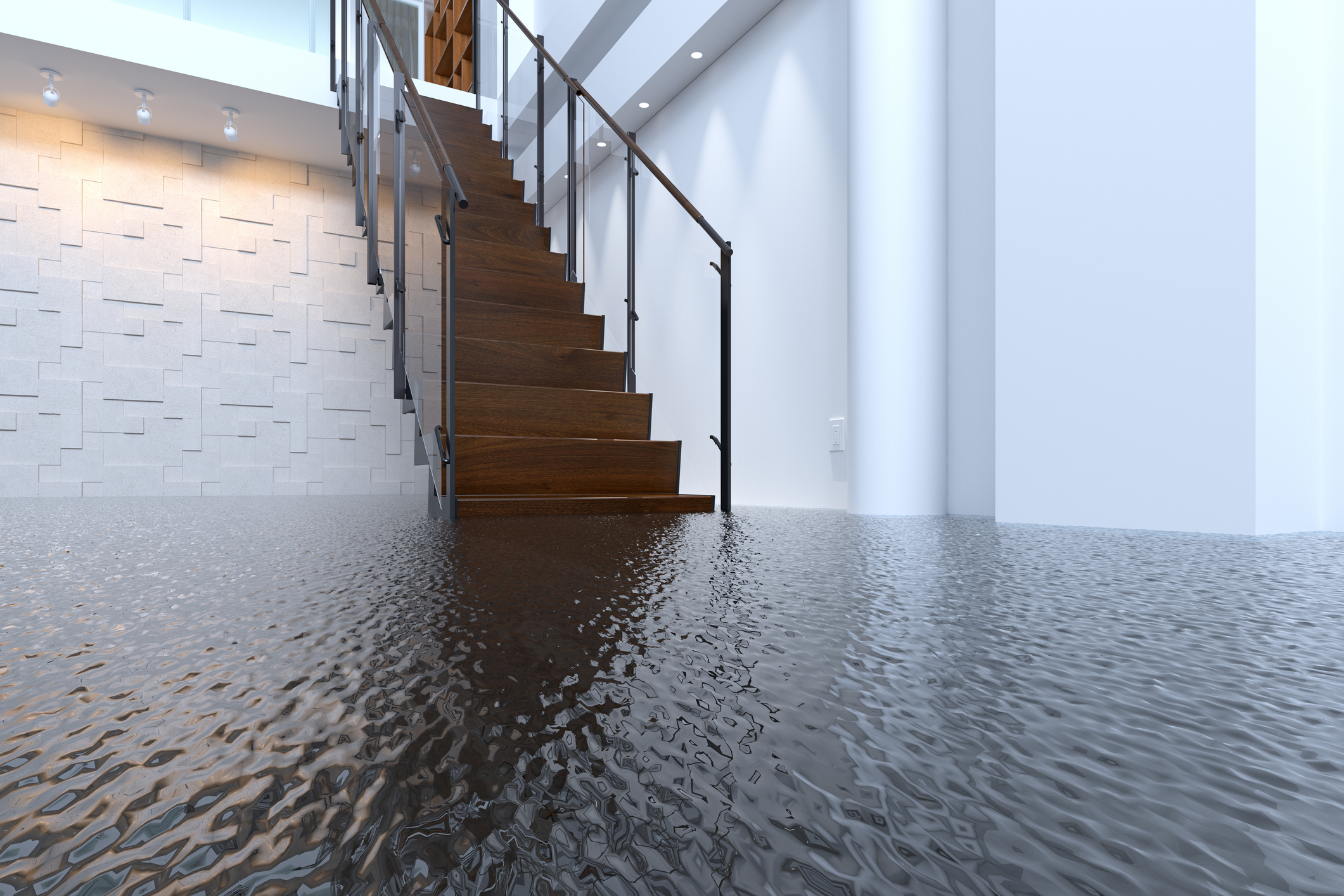

But now that basements are being built with more space, deeper below ground, and contain high-value possessions and luxurious home fittings, homeowners are at greater risk of water damage that involves heavy financial loss. Because a basement is below-ground-level, it is more vulnerable to flooding or water ingress than any other room. If a home’s basement is not properly waterproofed, water ingress will inevitably occur.

Rise in UK water damage claims

There are several categories of claims related to water damage. Escape of water (EoW) claims, which result from a burst pipe or water leak within a home, usually from a plumbing/heating system or appliance, are the leading cause of domestic insurance claims in the UK, accounting for more than a quarter of all claims, according to the Association of British Insurers (ABI).

EoW claims have become so common and a significant an issue within the market — in frequency, but particularly severity — that according to a Chartered Insurance Institute (CII) practice guide, its impact has adversely affected average cost trends over the past 5+ years. Not only are losses attributed to EoW increasing, but they’re also getting more expensive. In 2020, the average claim cost was £3,170, a 50% increase in cost from 2014. And a single burst pipe can cost nearly £9,000, according to ABI calculations.

Water ingress, on the other hand, is the penetration of external water into a structure, such as seepage through a wall due to poor waterproofing, or persistent dampness permeating through unnoticeable crevices after heavy rainfall. As moisture accumulates — much of the time unseen to the naked eye — it can recess within the structure, weaken the home’s fabric and deteriorate construction materials like reinforcements, according to Build Safe. A basement’s damp, low-level environment acts as an ideal incubator for mold and other biological hazards, which, aside from damaging surfaces can cause serious health issues.

The key to water ingress, same as for EoW, is catching it early; walls and ceilings left unchecked over time are vulnerable to increasingly severe damage. Common signs include damp patches and discoloration on walls and ceilings, in addition to mold growth, musty odors, or the bubbling/peeling of paint on walls or surfaces.

Policyholder implications

These concerning trends mean that homeowners need to be proactive in protecting their homes, particularly their basements. Just a miniscule pipe rupture, or small amount of moisture ingress can cause irreparable harm to the home’s structure, fittings or fixtures, and destroy valuable and sentimental possessions.

The best way to prevent both water ingress and EoW is through regularly planned home maintenance and continuous observation. Keep a keen eye on whether building materials appear to be deteriorating, whether there are cracks or visual changes to brickwork or stonework, and engage professionals to ensure pipes are intact, mortar isn’t cracked, gutters aren’t blocked, and plumbing is working as it should. Ensure basement waterproofing is airtight and up-to-date and encourage due diligence.

During the winter or severe cold fluctuations, the ABI suggests leaving your heat on for at least one hour per day while away from your home. Ask a friend or relative to visit your home on a near-daily basis to detect any issue as soon as possible. If the property is being left entirely unoccupied for any length of time, it’s best to shut down the water supply.

The role of adjusters

After notifying the insurance company, a loss adjuster will liaise with the policyholder to investigate the claim on behalf of the insurer. It is critical the loss adjuster responds promptly and conducts an on-site investigation to assess the damage in detail and pinpoint the source of the leak or water ingress.

He/she also must determine whether the damage is covered; while certain types of water damage is commonly covered under a home’s insurance policy, many circumstances are not routinely covered. A burst pipe or flooding, for example, potentially would be covered, while a rise in the water table, or gradual ingress of water may not be.

Several other questions remain: What are the policy limits and the terms and conditions that need to be adhered to? What will the method of repair be for the damaged surfaces, or is replacement the best, most cost-effective course of action? Is drying out the affected area more appropriate than stripping out the damage?

In essence, the adjuster should respond quickly, establish an effective process where everyone involved in the claims process has a clear understanding of their individual responsibilities, document evidence thoroughly, organise and allow essential remedial works and always uphold fair and empathetic treatment of the policyholder.

Learn more:

Read about Sedgwick UK’s repair solutions services such as water mitigation, water damage and mold restoration, and home emergency repairs.

Tags: basement, basement construction, Claims, Damage, flood, flooding, house, Housing, private clients, Property, Property claims, Property damage, Property loss, property owner, Restoring property, UK, United Kingdom, water, water damage