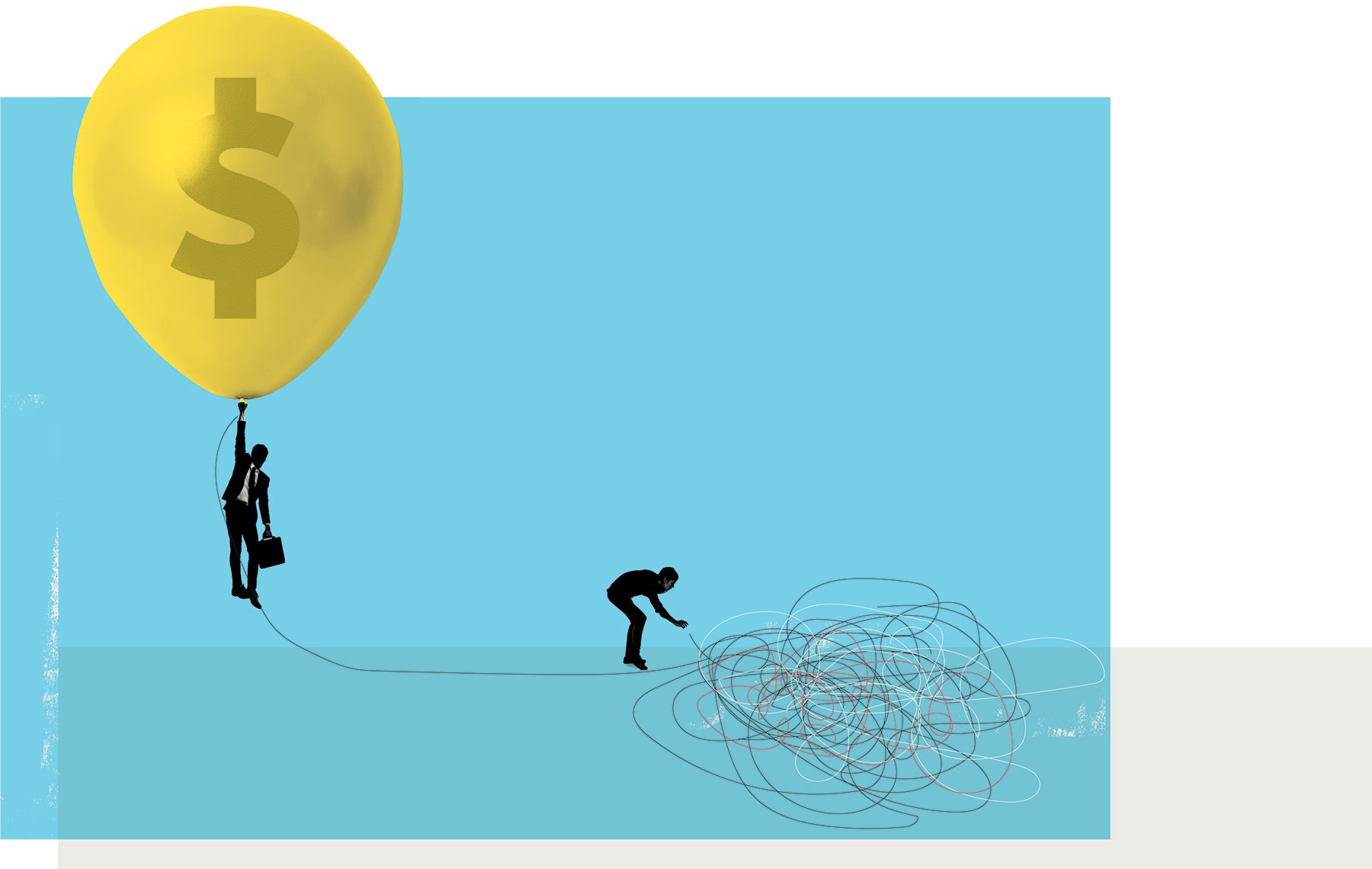

Conversations around severe weather events, rising inflation and lingering labor shortages and supply chain issues have become commonplace; because these trends affect our lives, our businesses — even our insurance. Rising claim complexity and severity doesn’t seem to be slowing down, and it’s important to explore the factors driving this trend and its potential implications for the property and liability claims sectors.

The impact of climate change

Globally, we’re seeing more extreme weather events and conditions, occurring more frequently — resulting in an unprecedented number of claims and a higher percentage of them involving significant complexity and severity.

The first half of 2023 saw elevated disaster losses, according to an Aon report, with the fifth-highest economic impact on record and the highest since 2011.The single costliest disaster was the February earthquakes in Turkey and Syria, although remaining insured losses were largely driven by severe convective storm activity in the U.S.

This year, close to a dozen insurance companies in Florida went bankrupt, while others restricted coverage due to increased hurricane losses and litigation costs. Insurers are declining to write policies in hurricane-prone areas of Louisiana; one stopped issuing new policies in California altogether. Another carrier reduced its coverage to homes along the East Coast at risk of flooding and those in western states at risk of burning.

Other contributing factors

The human drive to build bigger and better is fueling innovation in sophisticated building design and the use of new technologies and materials in construction. But stretching the bounds of aesthetic and technological precedents also leads to greater risk and more complex claims against the companies behind the work when something goes wrong. Whether it be traditional materials used in new ways or complex features like retractable roofs, the more companies deviate from standard procedures, the more risk they assume.

Labor shortages in the construction market coupled with wage inflation, high demand for projects and the steadily rising costs of materials are all contributing to higher repair and replacement costs. Increases have been exceptionally high for the goods and services that drive personal insurance claims.

Inflation is further driving up costs. McKinsey and Company estimated that inflation alone increased U.S. property and casualty insurance loss costs over historical levels by $30 billion in 2021.

In our increasingly litigious society, according to Sedgwick’s book of business, litigated claims account for as much as 50% or more of the total amount paid on all claims. According to a Carlton Fields survey, class action spending has increased for eight consecutive years due to two major drivers: claims are getting larger, and more companies are facing such lawsuits.

Preparing for and mitigating claims: best practices

Because litigation is one of the primary cost drivers in liability claims, we recommend that companies always lead with litigation avoidance. But if necessary, having the right partner with a strong management process for legal spend can ensure attorneys are maintaining each individual case and billing according to agreed-upon guidelines. Robust attorney oversight is vital as well.

It’s important to have partnerships, policies and emergency plans in place in advance of a catastrophe to minimize business interruptions and expedite restoration and resolution. These plans should be current, tested regularly, and reflect industry best practices for disasters like hurricanes while aligning with your carrier’s specific terms. Ensure your partners possess both technical expertise and a service-minded, empathetic-led approach.

To counter climate change-related challenges, sustainable construction practices — such as designing for sustainability and energy efficiency and selecting locally sourced, renewable and recyclable materials — have emerged as a proactive way to reduce the building industry’s adverse impact on the environment. By using water-efficient fixtures, rainwater harvesting techniques, and adopting waste reduction and recycling practices, companies can conserve and decrease waste output.

Looking forward

As we continue to face the reality of managing larger and more complex claims, insurers must keep an eye on trends and adapt strategies accordingly. Establishing the right partnerships, preparing in advance, and employing proactive mitigation and litigation practices are all critical to fulfilling our commitment to taking care of the people we serve.

Some of these ideas were featured in issue 22 of Sedgwick’s edge magazine.