- WINTER 2024:

- BENEFITS

Leave of absence

Report objectives

The objective of this report is to provide a broad view of our current metrics for our leave of absence programs and provide an overview of the current environment surrounding leave case administration. Our compliance and data analytics teams collaborated to configure TAMS data into a Sedgwick “state of the line” report intended to compare and contrast our trends with other relevant industry trends.

data parameters

Data is based on the calendar year, January through December, for each reporting year.

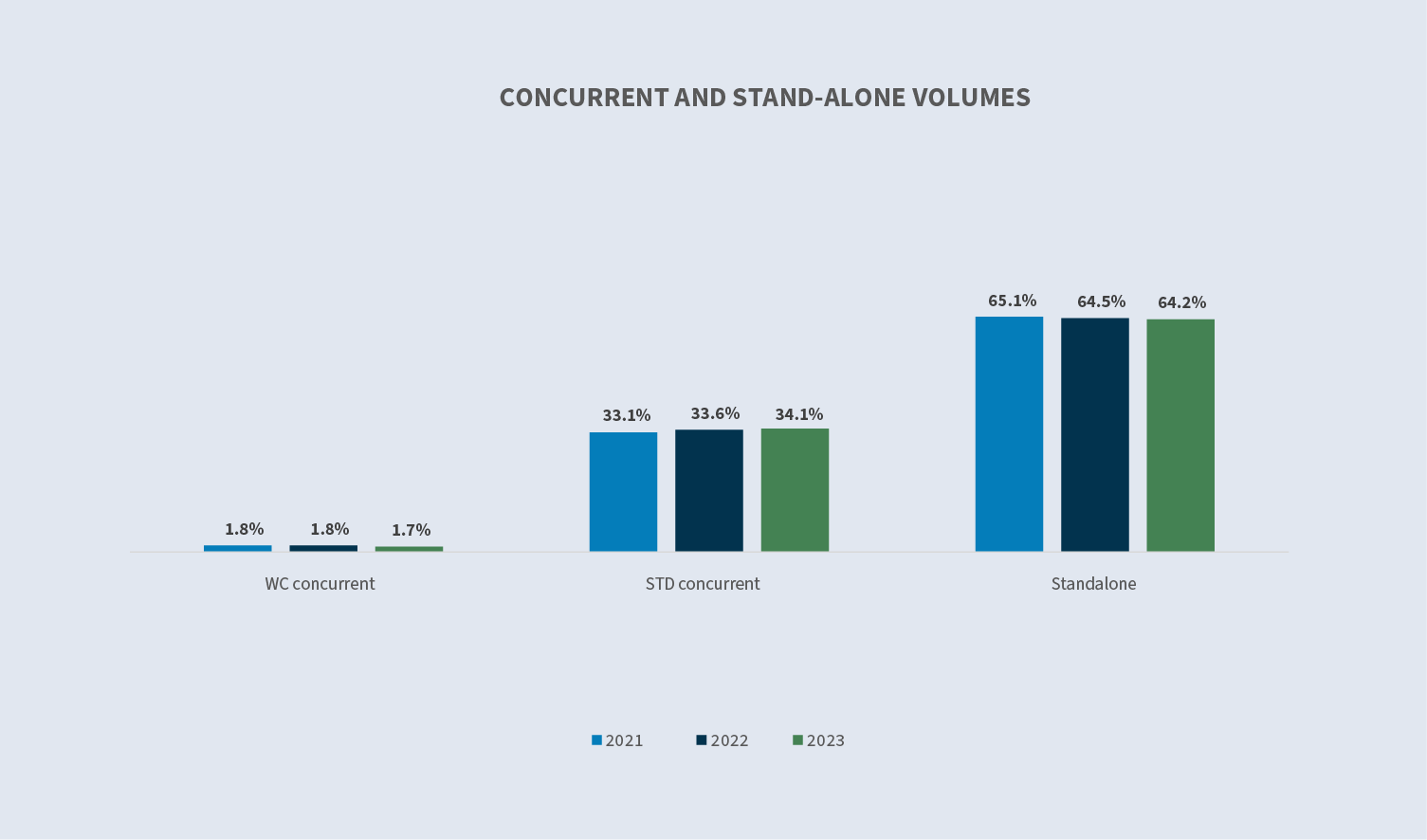

Unpaid leave data includes stand-alone cases only, meaning there is no concurrent disability claim. This is to avoid double-counting cases that are simply running in the background of a disability claim, while disability is the primary claim. Data on unpaid leave running concurrently with disability would mirror the disability report.

Key observations

Unpaid leave volumes decreased 2.3% in 2023, compared to the record-high in January 2022 caused by an unprecedented spike from COVID claims.

Volumes and incident rates quickly fell in 2022 and stabilized into 2023, leading to an overall incident rate decrease from 17.1% (2022) to 15.3% (2023). Excluding COVID leaves, the unpaid leave incident rate was 0.3% lower in 2023 compared to 2022.

The types of leaves being reported is shifting from “other” leave (which includes COVID personal leave policies) to employee medical and family leaves. Bereavement leaves are becoming more prevalent — accounting for 11.5% of company leaves, up from 5.5% in 2022.

Leave approval rates for FMLA continued to drop in 2023, continuing a three-year trend. In 2022, 68.4% of leaves were approved, which decreased to 67.4% in 2023. The increase in denials is primarily being driven by missing or incomplete certification and insufficient length of service.

Length of approved leave (LOAL) increased on continuous leaves by 13.8%, This is primarily driven by employee medical leaves, with a seven-day increase over 2022. Intermittent leave duration increased by 5% year-over-year. Intermittent usage was up equally for both employee medical and family leaves.

Paid leave volumes continue to increase. New claim volume in 2023 increased 1.6% compared to 2022, which increased 19.6% compared to 2021. The majority of the 2023 increase was driven by statutory leaves.

California Paid Family Leave (CAPFL) and New York Paid Family Leave (NYPFL) continue to make up most statutory paid leave claims, at 38.1% and 52.9% respectively. The incident rate for NYPFL rose 0.5% while the CAPFL incident rate remained flat year over year.

Unpaid leave

New case volumes

It is normal to see a slight increase of new case volumes in the first quarter of a new year, as plans that run on a calendar year may require a new case to be opened when the year rolls over. While there was a slight increase in January of 2023, the overall volumes stayed consistent, and no significant spikes were observed. Incident rates dropped in 2023, with continuous incident rates at 8.8% and Intermittent at 6.4%.

Unpaid leave incident rates spiked in 2020 at the onset of the pandemic. Over the last three years, incident rates slowly decreased. 2023 is more consistent with 2019, where the continuous incident rate was 8.2%.

New leaves by leave type

Due to the pandemic, COVID policies were generally identified as a company leave type rather than as an employee medical leave or family member leave policy. This category was historically around 12% of cases, yet increased when new COVID policies were introduced in 2020. In 2023, with the decrease in COVID, we have seen the number continue to decrease from 2022. This led to both employee medical and family leave volumes accounting for a larger percentage of all new leave cases. The distribution of leave types in 2023 was in line with data from 2019.

New leaves by case type

Intermittent employee medical leaves increased in 2023 compared to previous years, resulting in a 33% difference between intermittent and continues leave. Family leaves shifted slightly toward more intermittent leaves than continuous.

Other leaves, including any leave other than employee medical, family leave or military, are still dominated by personal leaves. However, over the past three years, personal leaves decreased by 16% as companies offer increased bereavement leave benefits.

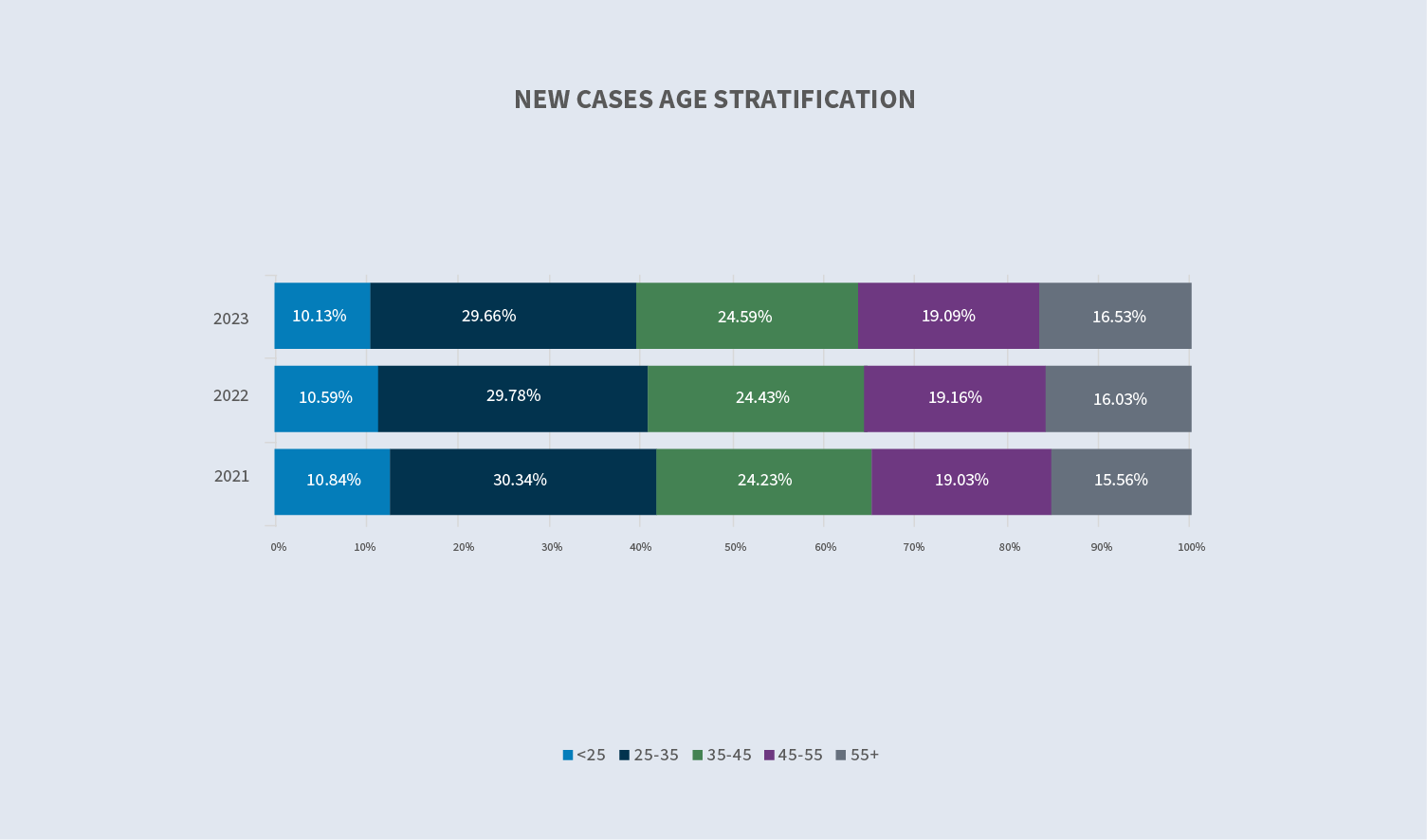

New leaves by age

The average age of claimants filing stand-alone leave has remained relatively constant over the past three years. There was a slight increase in claimants over 55 and slight increase in claimants under 25 in 2023, both shifts of less than 1%.

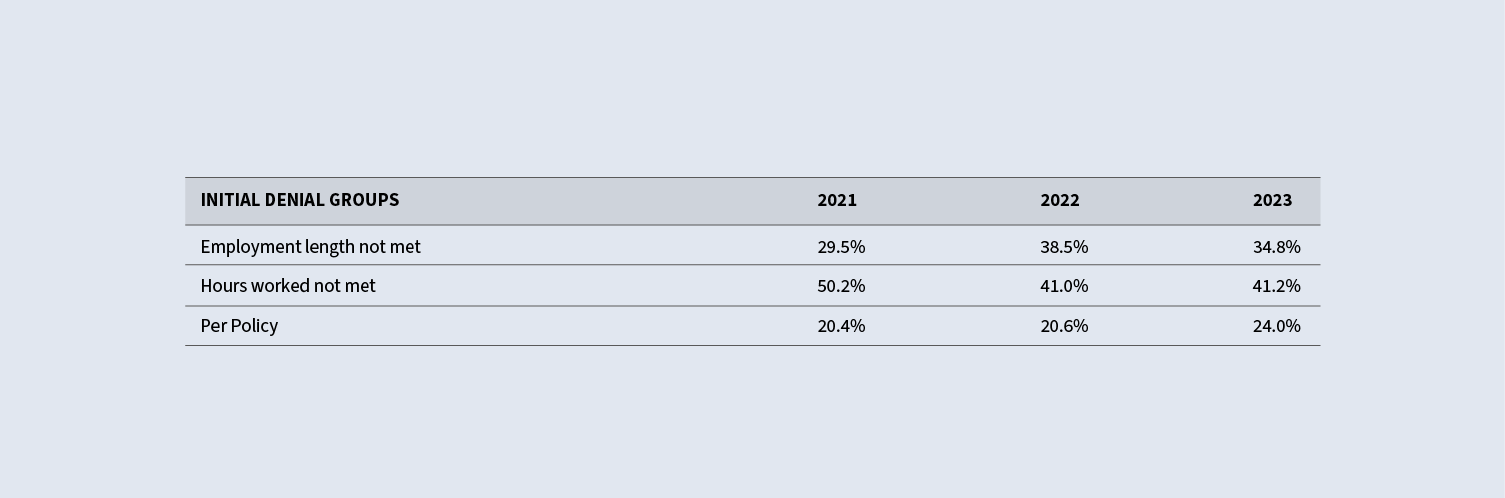

Leave denial reasons

The approval rate for FMLA cases has gone down each of the last three years. It was 68.9% in 2021, 66.5% in 2022 and 66.3% in 2023.

The most common reason for an initial leave denial was missing or incomplete certification; this is the same trend seen in disability claims. As claimants struggle with access to care or learning how to use telemedicine, the change of missing or providing incomplete certification increases.

There was a decrease in denials due to hours worked from over 50% in 2021 to only 41% in 2023. This decrease resulted from more employers adjusting their internal policies as well as an impact from the workforce realignment trend that occurred from 2021 through 2023.

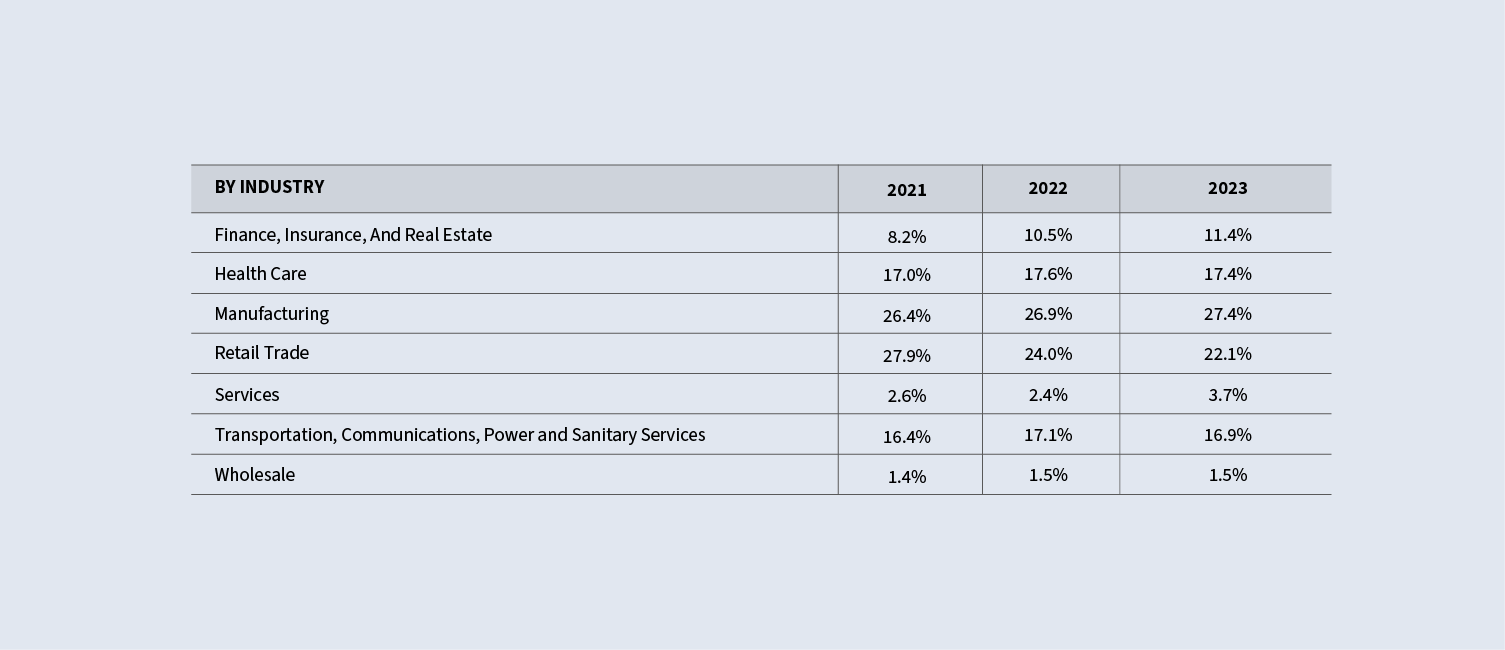

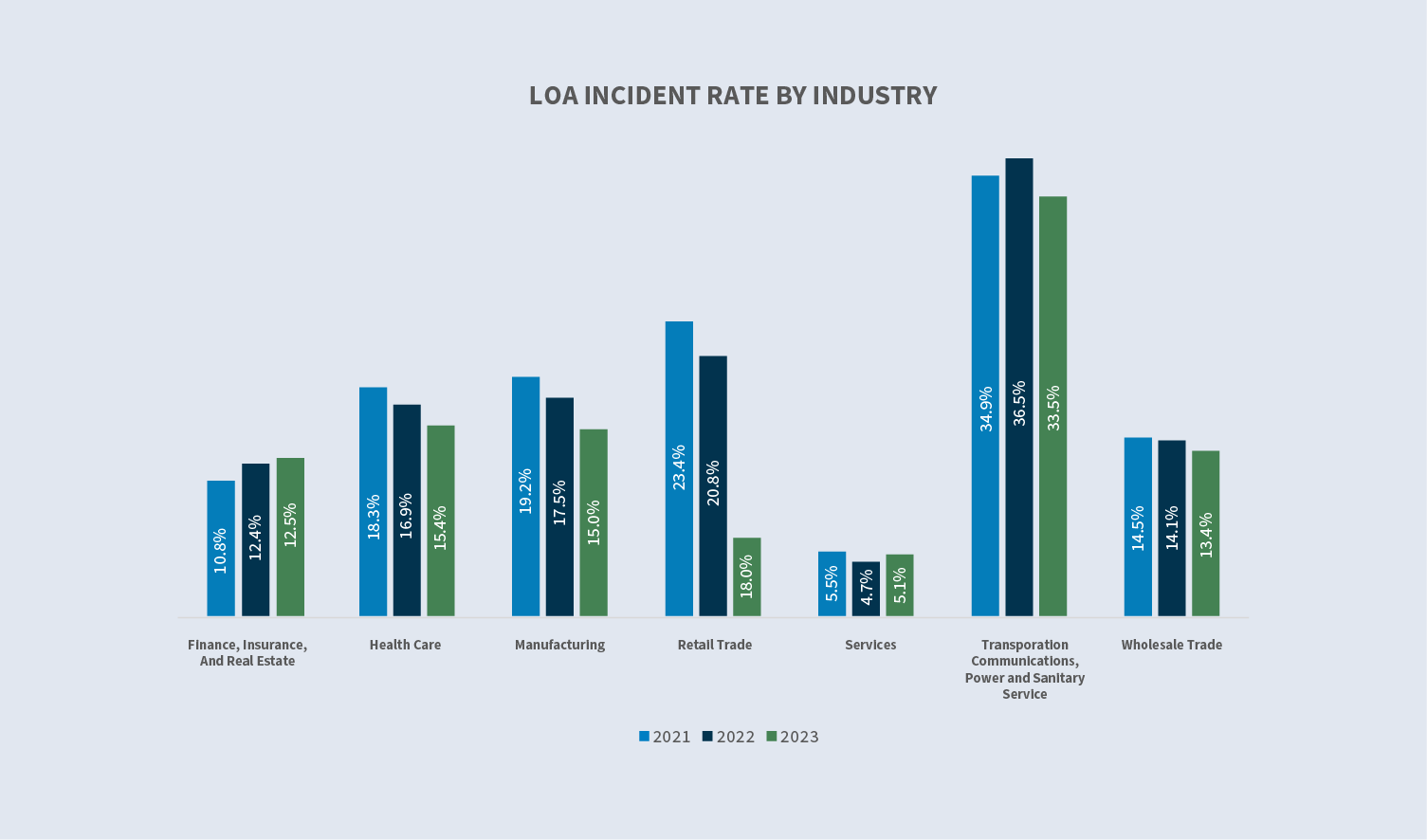

Industry trends

Stand-alone leave volumes are decreasing and stabilizing across every industry. This is primarily due to the decrease in COVID-related claims. Retail saw the largest decrease of 9.9% from 2022 resulting from a large decrease in COVID incident rate in the retail sector. The COVID incidence rate for retail was 4.2% in 2021 and dropped to 1.8% in 2022.

Leave incident rates are down in every industry except finance and services.

Paid leave

New claim volumes

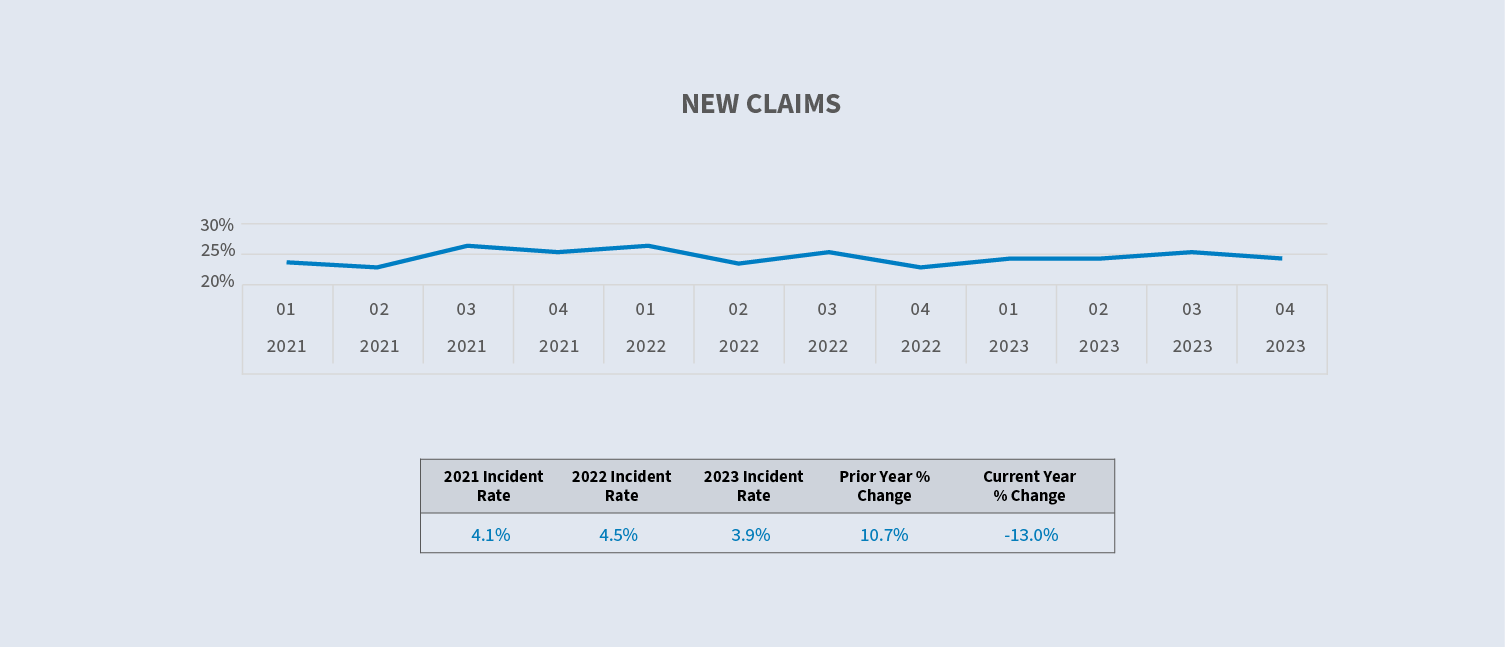

New paid leave claim volumes increased 19% in 2022 in comparison to 2021; however, it increased only slightly (by 1.6%) in 2023. Statutory paid leave volume increased 8.6%, with less than 1% of claims coming from newly implemented state leave benefits. There will likely be another rise in statutory paid leaves as multiple new states mandate paid leave.

Company paid leaves

Overall durations increased by 9.9% from 2022 to 2023, which was impacted by an increase in COVID-related claims. In the first quarter of 2022, there was a sharp increase in COVID-related leaves. This caused the average duration time to decrease since COVID-related leaves are usually less than 10 days in duration. The trend did not continue past the first quarter of 2022, and levels returned to normal.

Statutory paid leaves

Washington Paid Family Leave (WAPFL) was added in 2020 and Massachusetts Paid Family Leave (MAPFL) was added in 2021. The base of employee population in Washington is small; therefore, no significant impact to the overall paid leave numbers occurred from WAPFL. In 2022, we saw Connecticut Paid Family Leave (CTPFL) go live; however, similar to WAPFL, volumes are exceptionally low.

California durations decreased 4.2% and the average cost increased 1.8%. New York durations increased 3.8% and average cost increased 11.2%. As wages increased in 2023, the cost per claim also increased in these two states, where wages are significantly higher than the US average.

Future considerations

Expansion of paid leave policies

Paid leave provides financial support (and sometimes job protection) when a child or a personal or family care need requires an employee to take time away from work. Although there is currently a task force in Congress working on a bipartisan federal solution, it is not likely that a federal paid leave option will be passed based on Congress’ current make-up. Therefore, states continue to establish and expand paid leave programs.

Here is a list of recent implementations and expansions:

Washington Paid Family and Medical Leave (WA PFML): Effective Jan. 1, 2025, any interested party will have access to certain records and information related to an employee’s paid family or medical leave claim, including the type of leave being taken, the duration of the leave and whether the employee was approved for and paid benefits. This Washington amendment defines “interested party” as a current employer, a current employer’s third-party administrator or an employee.

California Paid Family Leave (PFL) and State Disability Insurance SDI: For PFL and SDI claims beginning on or after Jan. 1, 2025, individuals who earn 70% or less of the state average quarterly wage (SAWW) will receive a benefit of up to 90% of the average weekly wage (AWW). Individuals who earn more than 70% of the state average quarterly wage will receive a benefit of up to 63% of AWW.

Maryland has enacted a Family and Medical Leave Insurance Program on April 9, 2022, effective Jan. 1, 2026.

Delaware has enacted the Delaware Healthy Families Act on May 10, 2022, effective Jan. 1, 2026.

Minnesota has enacted a Paid Family and Medical Leave Act on May 25, 2023, effective Jan. 1, 2026.

Maine has enacted a Paid Family and Medical Leave Act on July 11, 2023, effective May 1, 2026.

New York’s governor has proposed an increase in New York disability benefits to match the paid family leave benefit for the first 12 weeks of medical leave. Eligible employees would receive 67% of their AWW, capped at 67% of the SAWW, once fully phased in after five years. As this is a proposal, there is no implementation date.

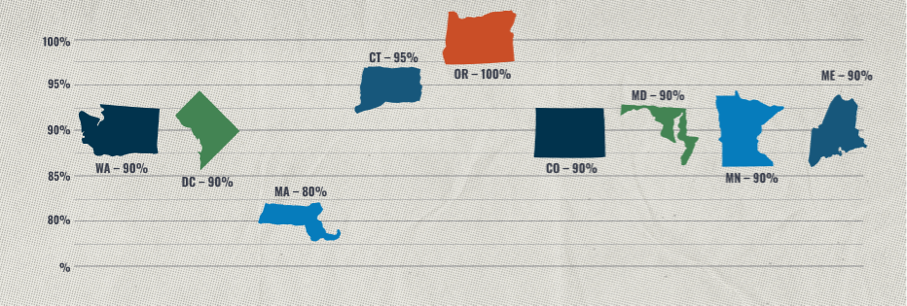

Recent state programs have implemented a two-part (and sometimes three-part) formula, providing a higher percentage of wage replacement to lower-wage workers. This was done in the hopes of supporting people who are more financially insecure. This trend started with Washington providing low-wage earners 90% of their earnings. Minnesota and Maryland will do the same when their benefits take effect in 2026.

States with the multi-part formula, and the percentage of wage replacement that they offer lower-wage earners:

Generally, the definition of family member has trended to be more inclusive. Recently enacted laws extend the definition of family member beyond parents, spouses and children to include grandparents, grandchildren, siblings, parents-in-law and domestic partners. More importantly and more generously, in six states, family also includes a person “to whom the worker is related to by blood or affinity.” The “blood or affinity” family member definitions are applicable in Washington PFML, New Jersey Family Leave Insurance (NJ FLI), Connecticut FMLA and Paid Leave, California Family Rights Act (CFRA), Paid Leave Oregon and Colorado FAMLI. Interestingly, both Maryland and Delaware have both chosen to not follow the trend of this expanded family member definition. Minnesota and Maine continue with the “blood or affinity” relationship as part of their PFML programs.

Upcoming implementations and likely new states

2023 was the first year that two states implemented plans simultaneously. Specifically, Oregon Paid Leave benefits began Sept. 3, 2023, and Colorado FAMLI benefits began Jan. 1. After that, we have our first triple implementation: Delaware, Maryland and Minnesota, which will all roll out on Jan. 1, 2026. Maine is slightly behind this first grouping, implementing on May 1, 2026. That means there will be four new paid family and medical leave programs going live in 2026. Employers know the challenge of implementing PFML in one state for their employees; however, having four states go live at the same time will create unique challenges.

We are also tracking states that are passing group insurance paid family leave programs which allows individual carriers to offer group insured benefits attached to group disability products. So far six states —Tennessee, Virginia, Florida, Texas, Alabama and Arkansas — have passed this model. It is expected that Kentucky, North Carolina, and Pennsylvania may add to this total, which is likely to be a challenge for employers. Carriers may have significantly different product offerings, unlike traditional PFML states, which have a standardized offering.

Bereavement

New bereavement leaves continue to be added by the states. Effective Jan. 1, Illinois added two new bereavement leaves to its existing leave programs. Employees may now be eligible to take up to two weeks (10 workdays) of unpaid leave under their existing Victims’ Economic Security and Safety Act (VESSA) under expanding qualifying events. Additionally, under the existing Illinois Family Bereavement Leave, employees who experience the loss of their child by suicide or homicide are now entitled to take up to 12 weeks (large employers) or six weeks (small employers) to take unpaid leave from work to grieve the loss of that child.

The non-FMLA or military leaves bucket included only 2.4% bereavement leaves in 2020; that number increased to 11.5% during 2023.

Safe leaves

Both Oregon and Colorado have included in their upcoming leave laws a provision that allows employees to take time off from work to address the immediate safety needs and impact of domestic violence and/or sexual assault. Minnesota’s Paid Family and Medical Leave program, which will provide benefits starting Jan. 1, 2026, will also include this leave reason. While not all paid family leaves have this provision, we anticipate that it will be more commonly discussed as a leave reason in the future as states consider rolling out leave laws.

Caregiver leave

Studies show that one-third of the workforce is a caregiver. Consider the “sandwich generation” concept, which is defined as adults who are caring for their children and aging parents simultaneously. As generations and the demographics of the U.S. workforce continue to change, so does an employee’s expectation of their employer’s role in providing leave and support.

Sabbatical leave

Once thought to be the province solely of educational institutions, sabbatical leave is becoming more common, especially as organizations deal with the “great resignation” following the pandemic. A sabbatical is an extended break from work that may be paid or unpaid and typically lasts from one month to one year. Sabbaticals provide time to rest, travel and learn new things. We expect that more clients may add this benefit.