- WINTER 2024:

- CASUALTY

Workers’ compensation

Report objectives

The objective of this report is to provide a broad view of our current metrics for our workers’ compensation programs that is somewhat comparable to what is periodically released by research organizations and rating bureaus. For that comparative analysis, our business intelligence and workers’ compensation practice teams collaborate to configure JURIS claims data into a Sedgwick “state of the line” report intended to compare and contrast our trends with other relevant industry studies.

Available analysis from the following entities was utilized:

• National Council on Compensation Insurers (NCCI) research

• California Workers’ Compensation Insurance Rating Bureau (WCIRB) research

• Workers’ Compensation Research Institute (WCRI)

data parameters

For industry comparisons, the data is based on new claims for a rolling 12 months (referred to as CY) Jan. 1, 2023, through Dec. 31, 2023, for insured and self-insured claims in all states at five valuation points from 2019 to 2023. The impact of the COVID-19 pandemic and the economic recovery on workers’ compensation continues to be reflected in Sedgwick’s claims data.

Key observations

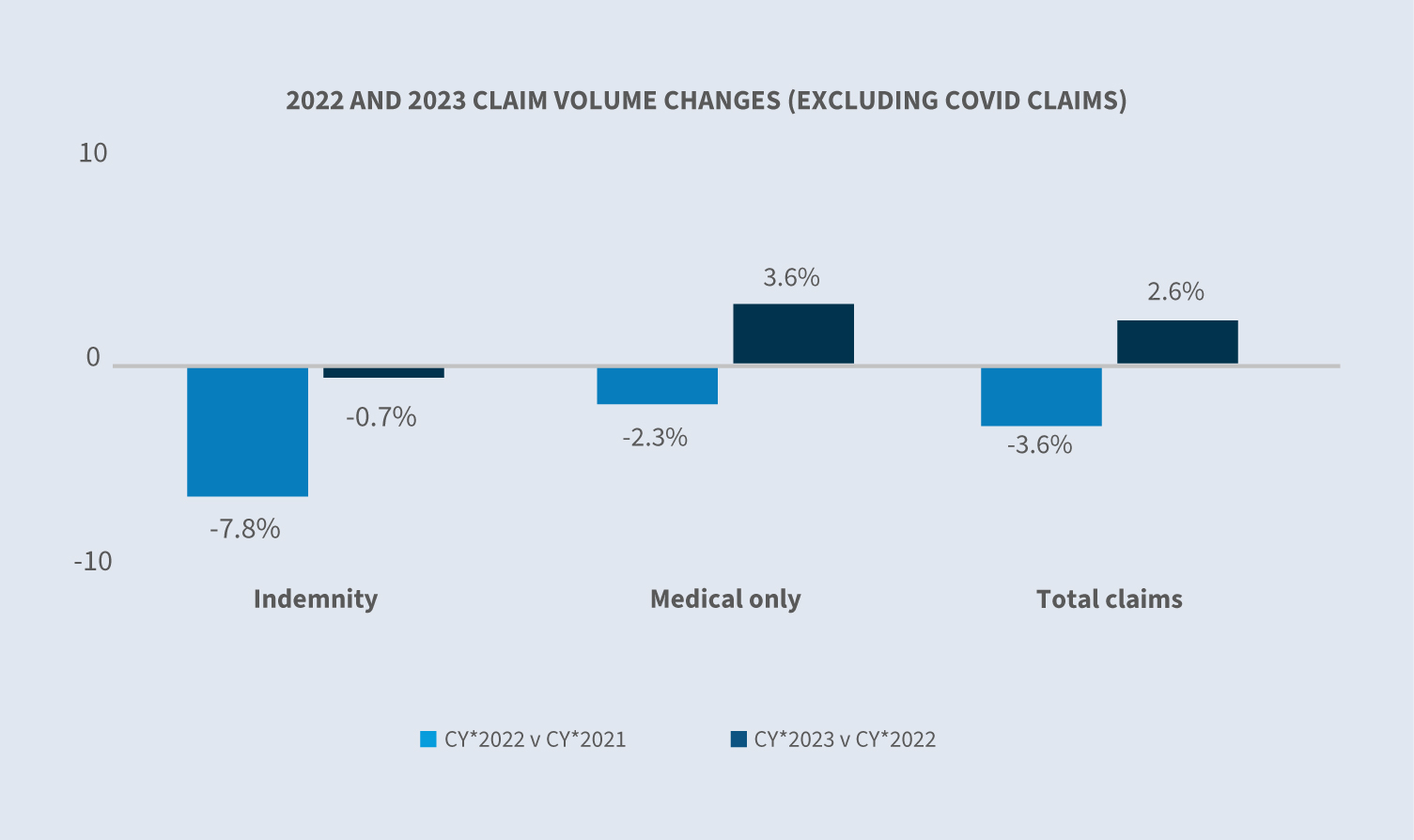

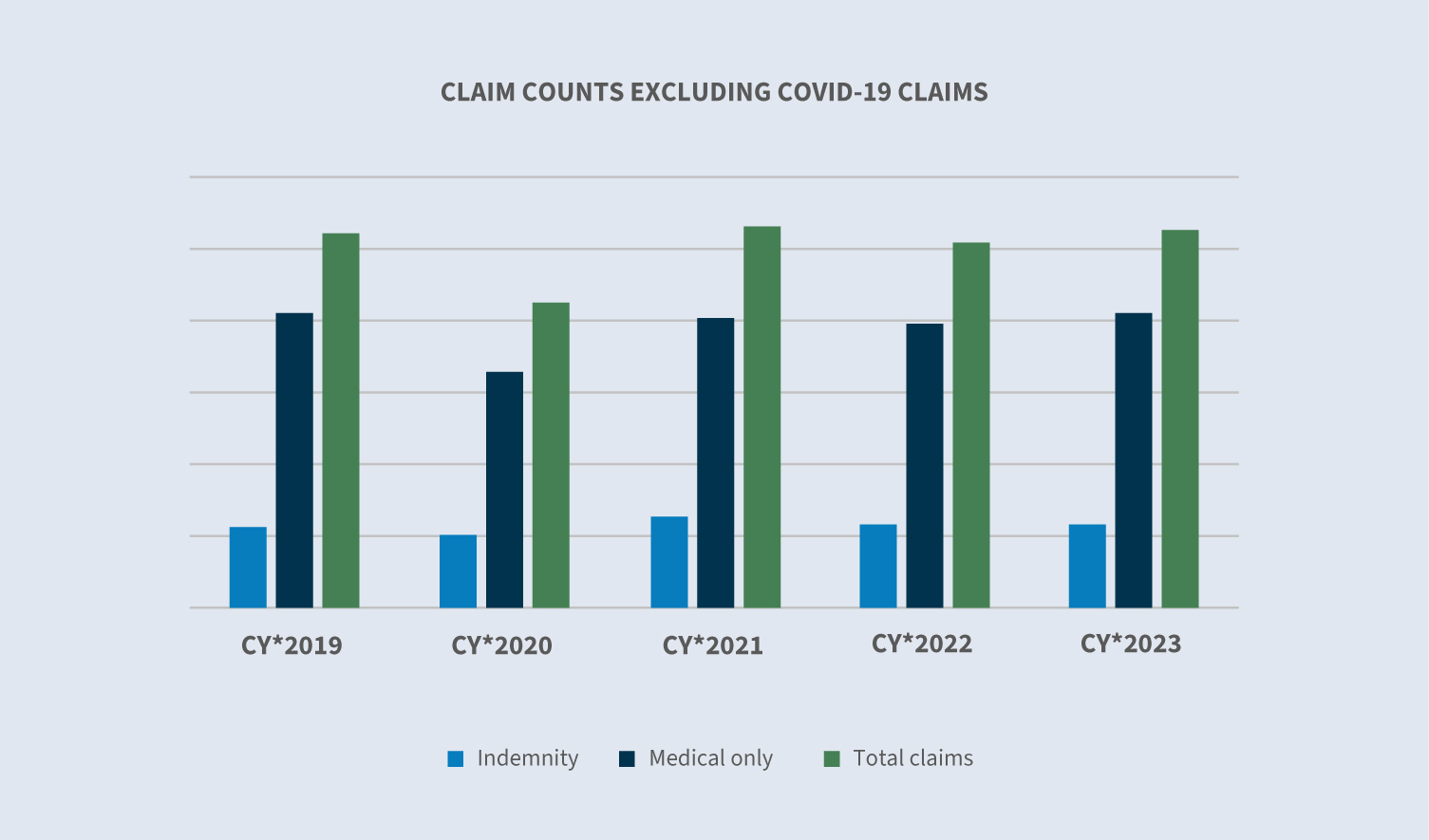

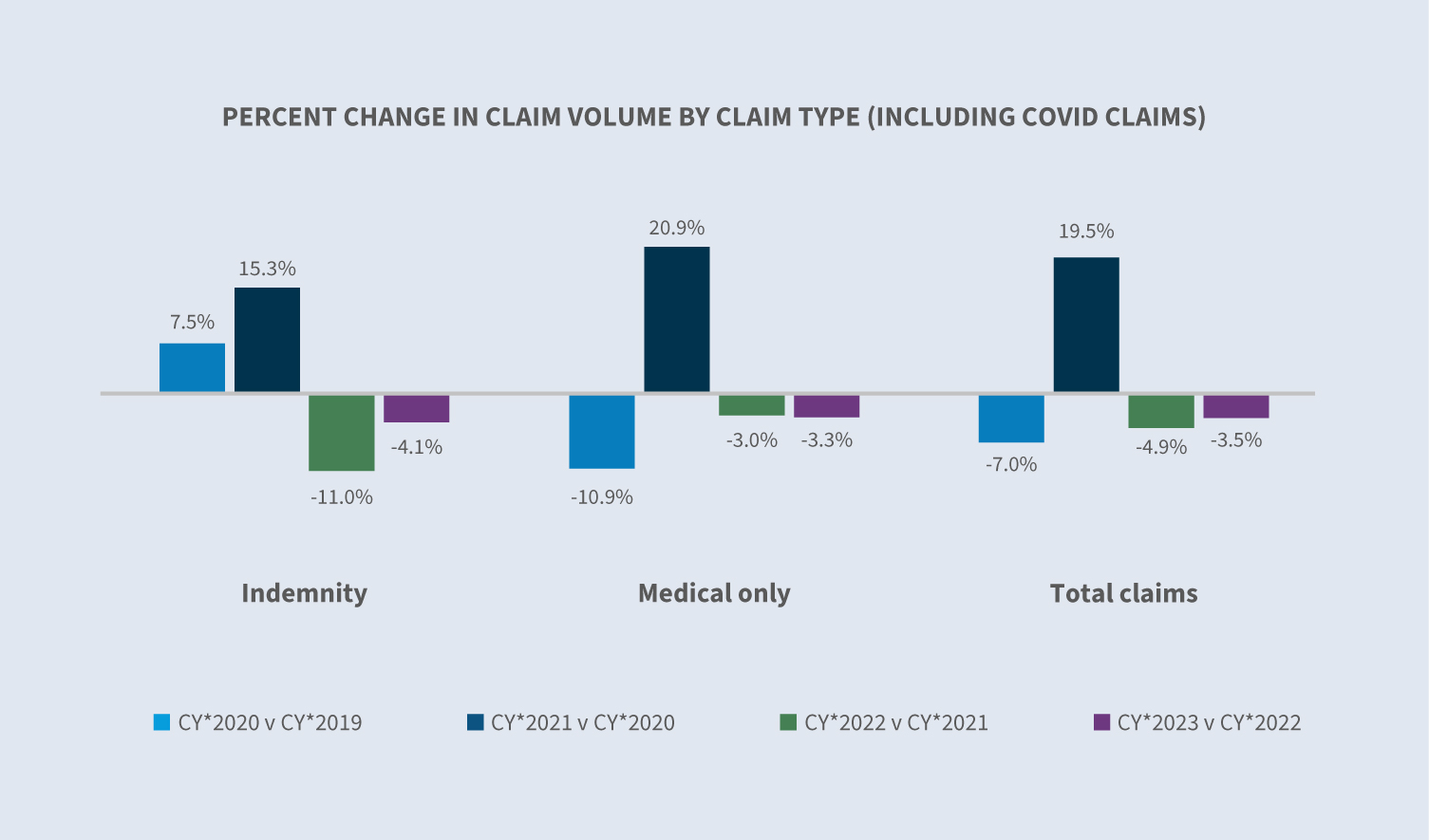

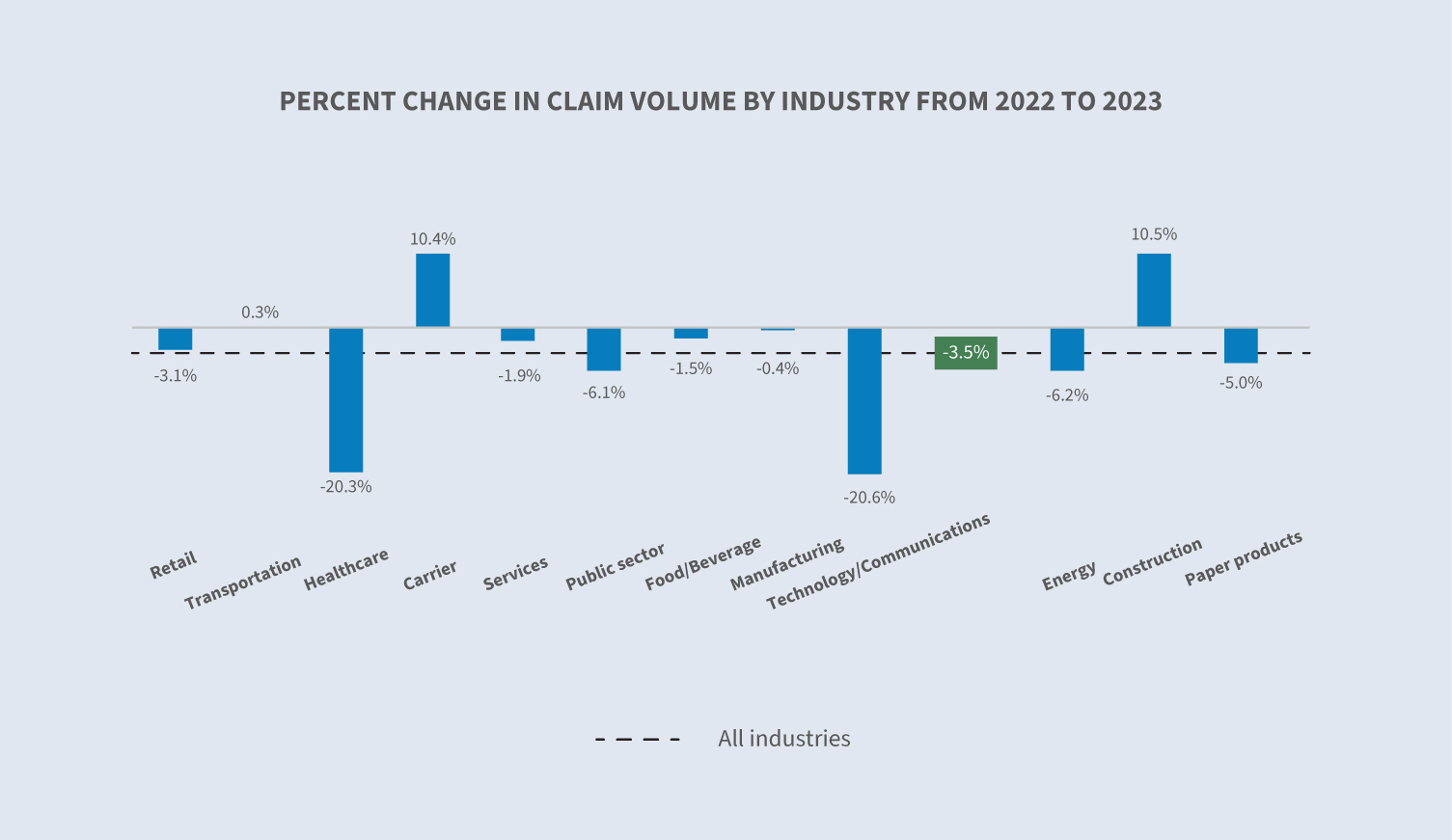

Workers’ compensation claim volume decreased 3.5% from 2022 to 2023; however, excluding COVID claims, volume (last significant spike occurred in early 2022) increased 2.6% from 2022 to 2023 and 1% from 2019.

COVID claims received in 2023 declined 85% when compared to 2022. The healthcare industry continued to have the largest share of COVID claims in 2023.

The average paid per indemnity claim increased 11.2% in 2023. Excluding COVID claims, the increase in the average paid per indemnity claim was 8%. This demonstrates the continuing but diminishing impact of COVID on workers’ compensation results.

Overall workers’ compensation claim closure and duration rates in 2023 were consistent with 2022 results.

Market

Workers’ compensation, the largest commercial line in the U.S., continues to have favorable results.

According to the 2023 Workers’ Compensation Financial Results Update published by the National Council on Compensation Insurance (NCCI) on Nov. 1, 2023, “The countrywide WC 2022 calendar year private carrier combined ratio is expected to be very similar to 2022, which would be a full decade of workers’ compensation calendar year combined ratios under 100%.”

(Combined ratio is a commonly cited measure of profitability for individual insurers and for the industry.)

A.M. Best’s Market Segment Report: Workers’ Compensation Remains a Profit Engine for U.S. Property/Casualty Insurance Industry notes the following trends:

“The segment, in which premiums are based on payroll levels, has benefited from the largest U.S. wage growth in over 25 years, coupled with strong job growth, which has helped increase its overall premium to pre-pandemic levels.”

“Medical and indemnity severity increased, but the magnitude of these increases was less than the increase in wages. The higher payroll exposure base for workers’ compensation insurance kept the increase in claim severity manageable.”

However, industry experts caution that inflation could disrupt this stable environment. Additionally, rate decreases in all states (except Washington) in 2023 may lead to margin compression and challenge carriers’ ability to retain profitability.

Claim volume

Calendar year 2023 reflected a 2.6% increase in claims counts when COVID claims were excluded. Not only have the number of COVID cases and fatalities decreased substantially, in 2023, workers’ compensation rebuttable presumptions expired in all states.

Looking ahead, the impact of COVID on workers’ compensation claims is expected to continue to dissipate.

Including COVID claims, there was an overall 3.5% decrease in total claim counts compared with 2022. According to the Bureau of Labor Statistics’ (BLS) TED: The Economics Daily report published Jan. 24, 2024, the economy added a net 2.7 million jobs in 2023, which is a significant slowdown from the 7.3 million jobs gained in 2021 and 4.8 million jobs gained in 2022.

From an industry-level perspective, the NCCI’s Economic Outlook for Q4 2023 highlights uneven employment growth with economic sectors accounting for over 80% of the net job growth for the year: education and healthcare; leisure and hospitality services; and government. Sedgwick’s claim counts only increased in 2023 for the carrier, construction and transportation industry groups.

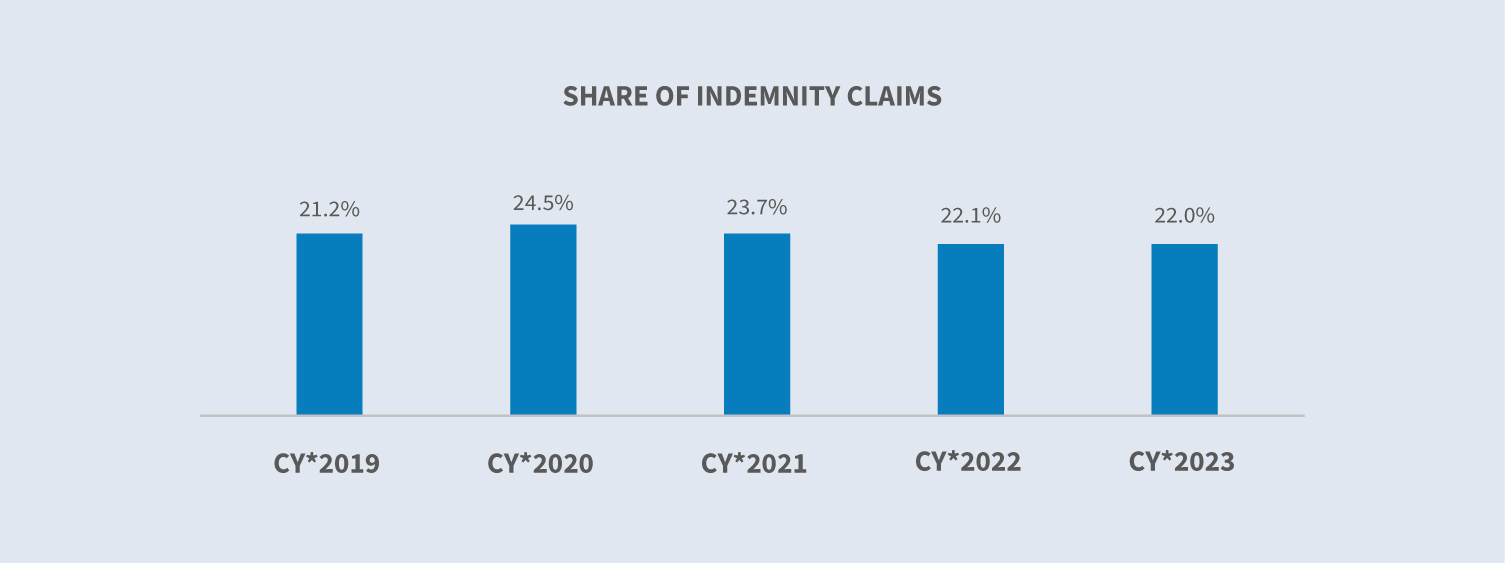

The share of indemnity claims versus medical-only claims held steady in 2023 compared to 2022. Indemnity claims previously hit a height of 24.5% in 2020.

Claim costs

Indemnity

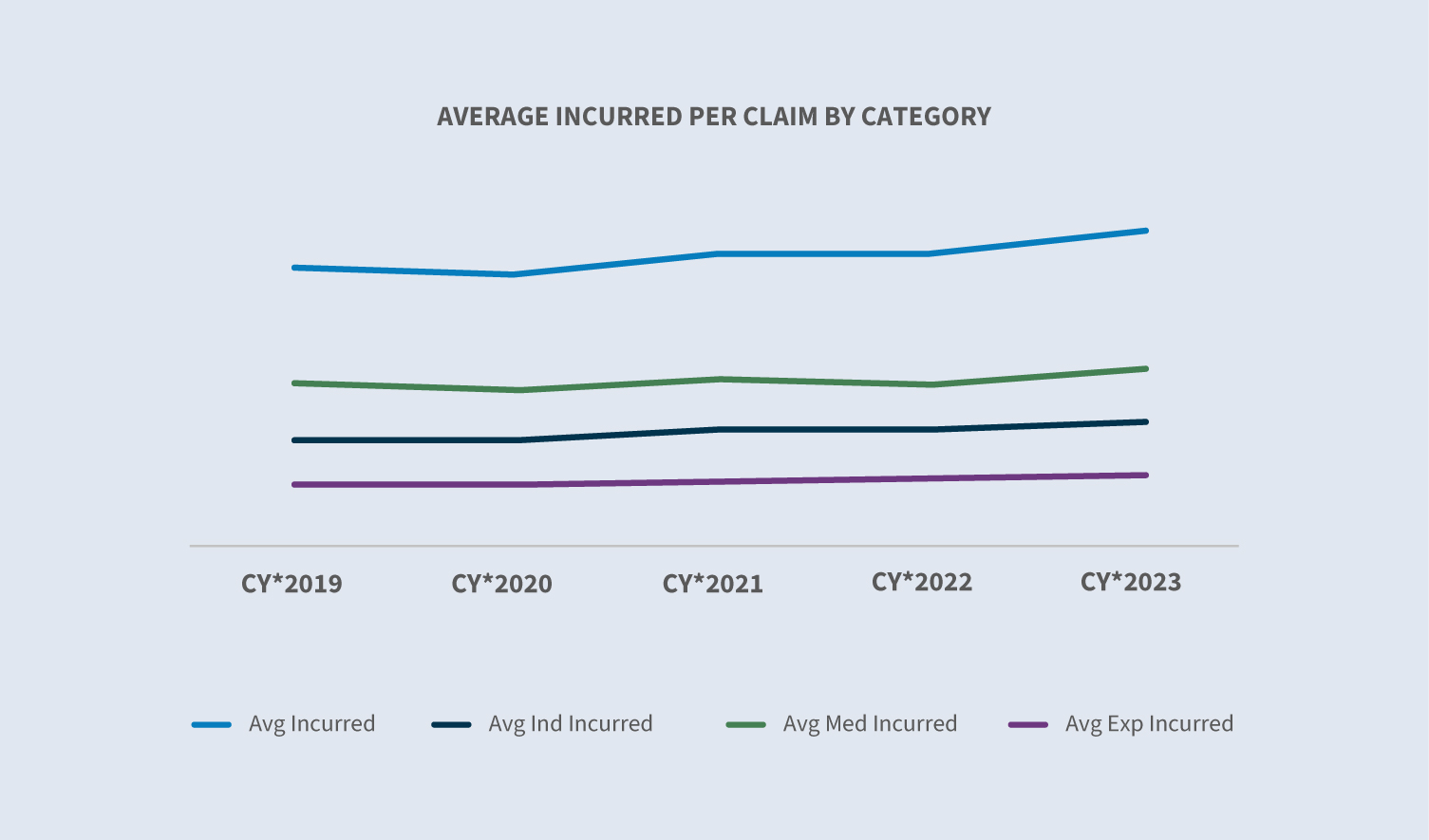

The average incurred increased 9% in 2023 compared to 2022 — driven by an increase of 10% in average medical incurred, 7% increase in average indemnity incurred and a 10% increase in average expense incurred.

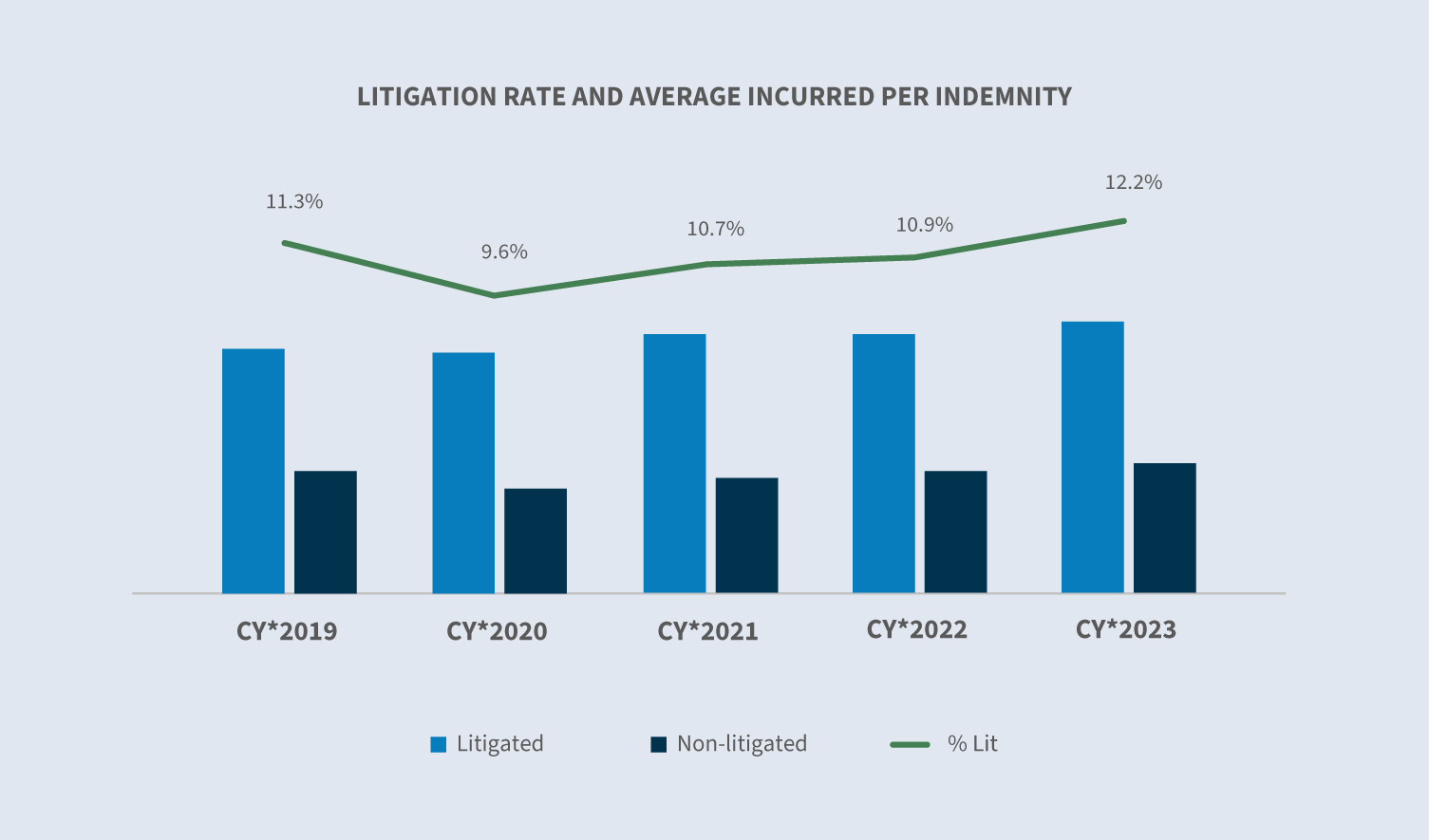

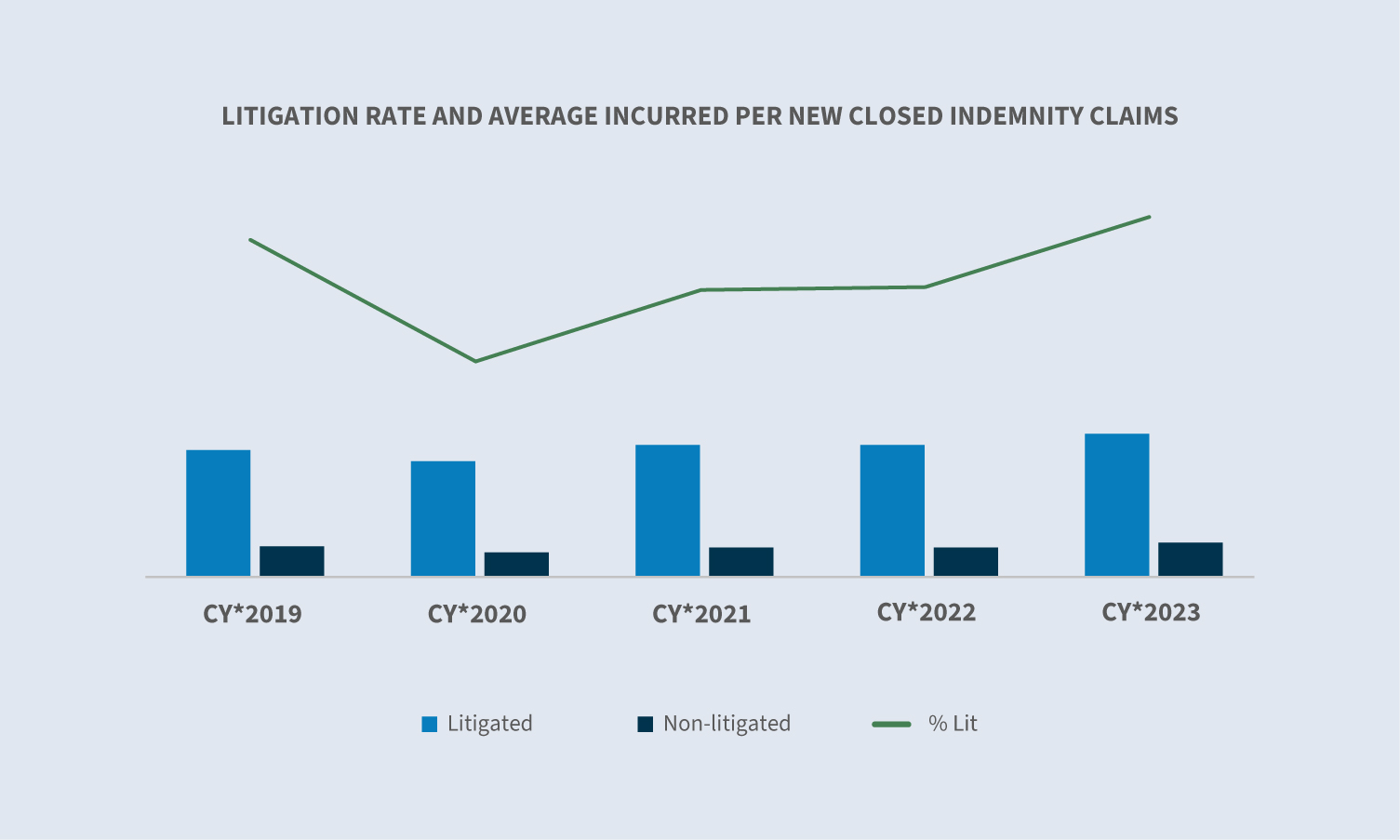

The litigation rate for indemnity claims increased from 10.9% in 2022 to 12.2% in 2023. The average incurred for litigated indemnity claims increased 3%, and the cost of litigated claims remains at over twice that of non-litigated claims.

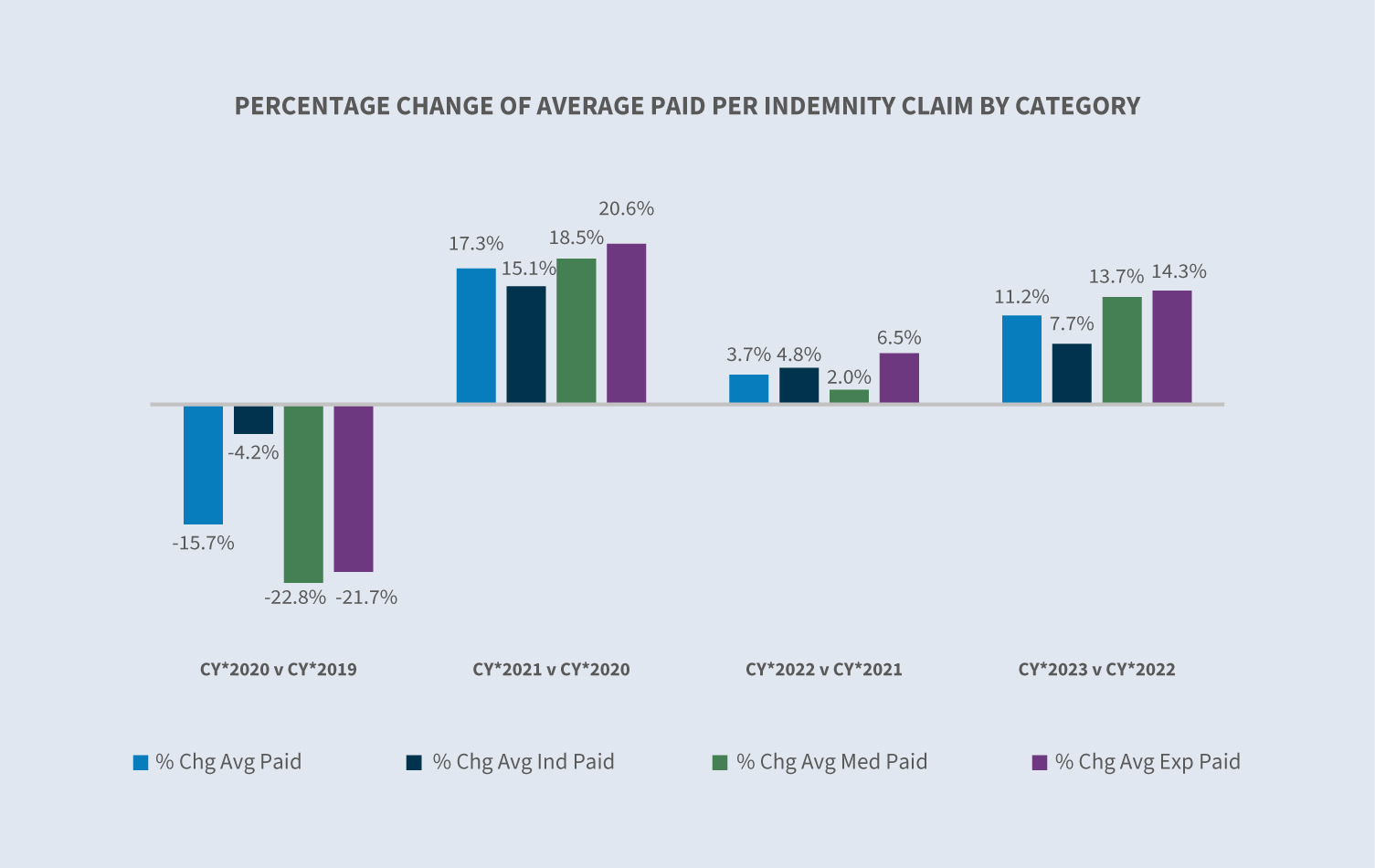

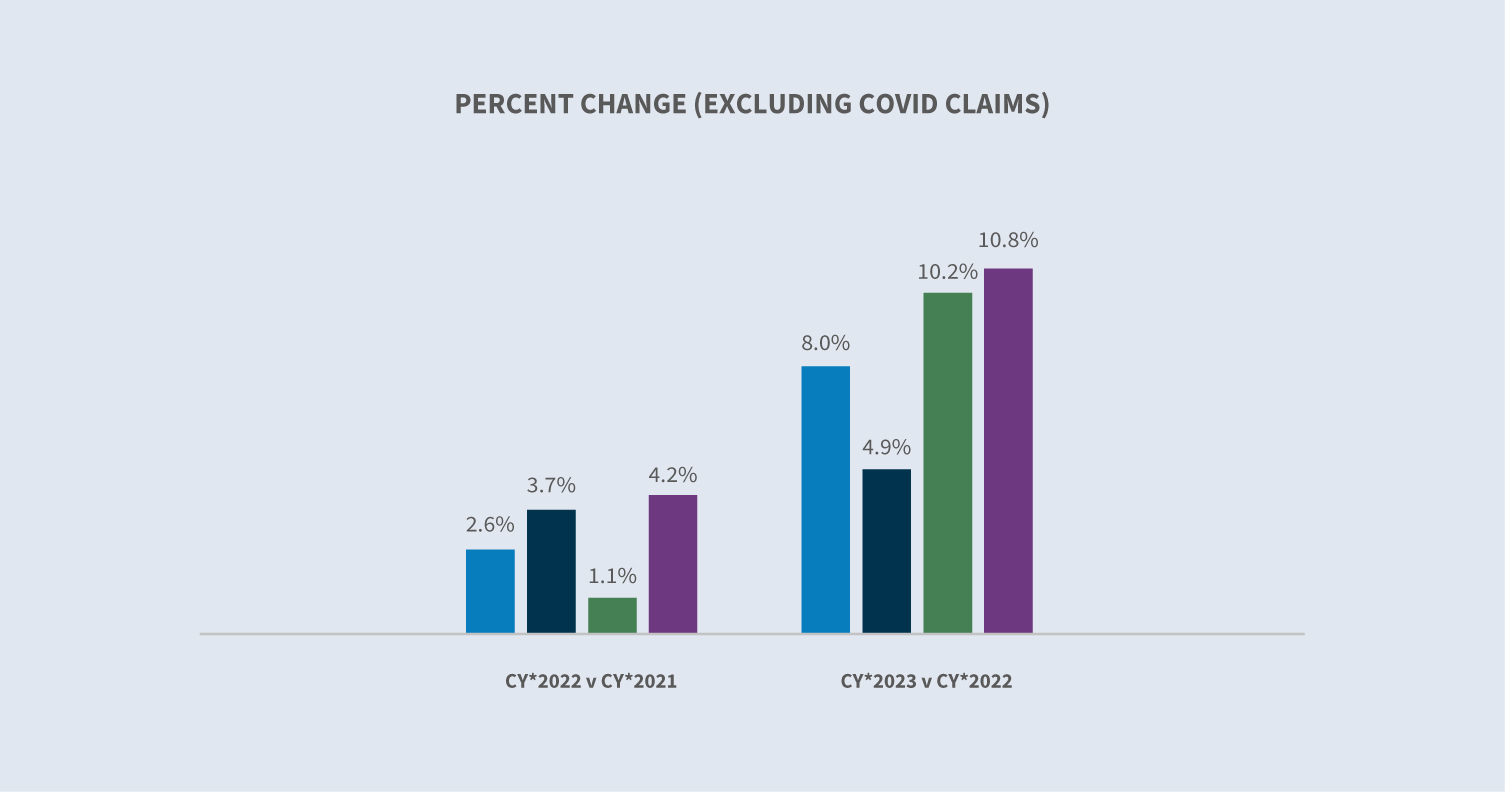

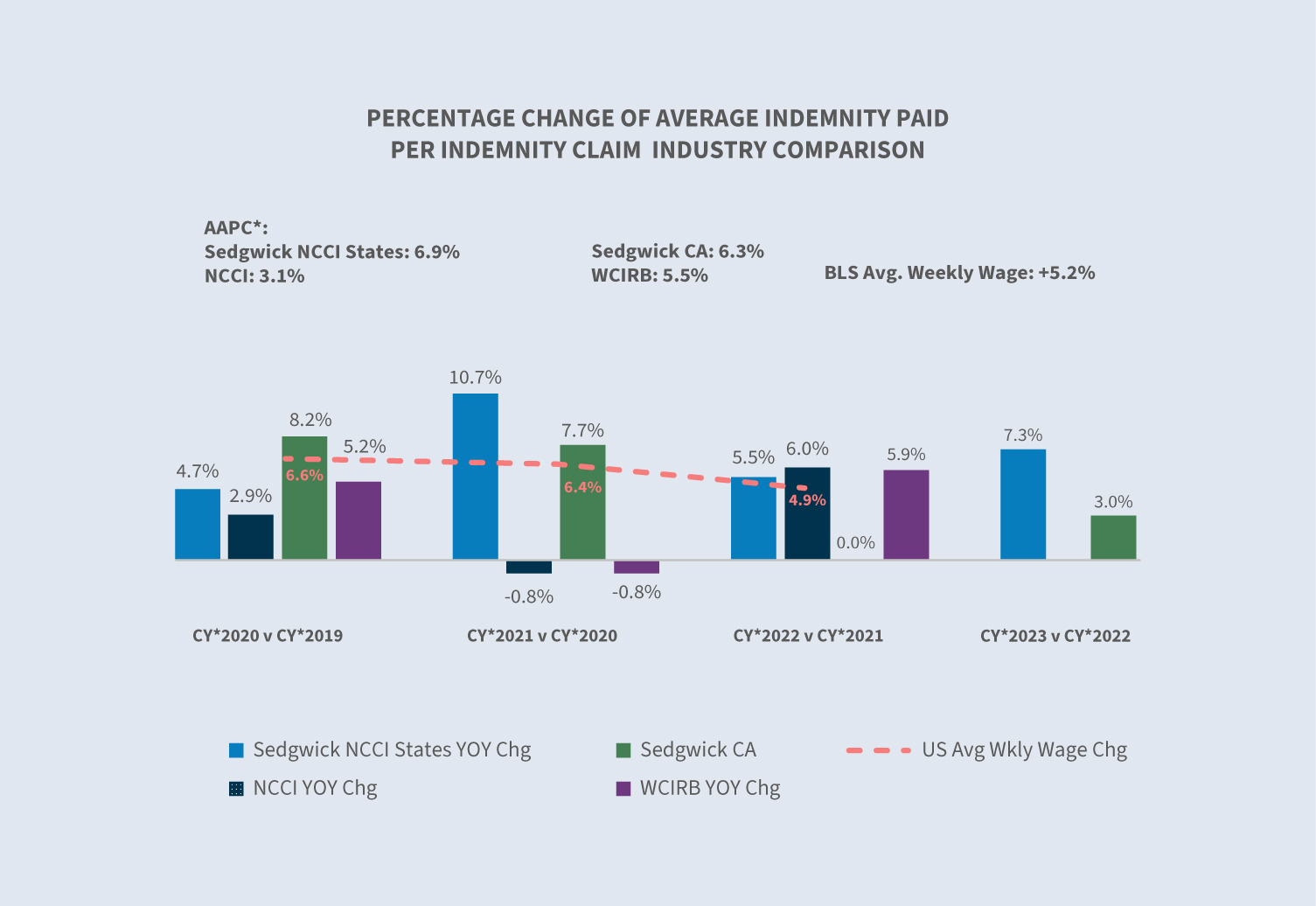

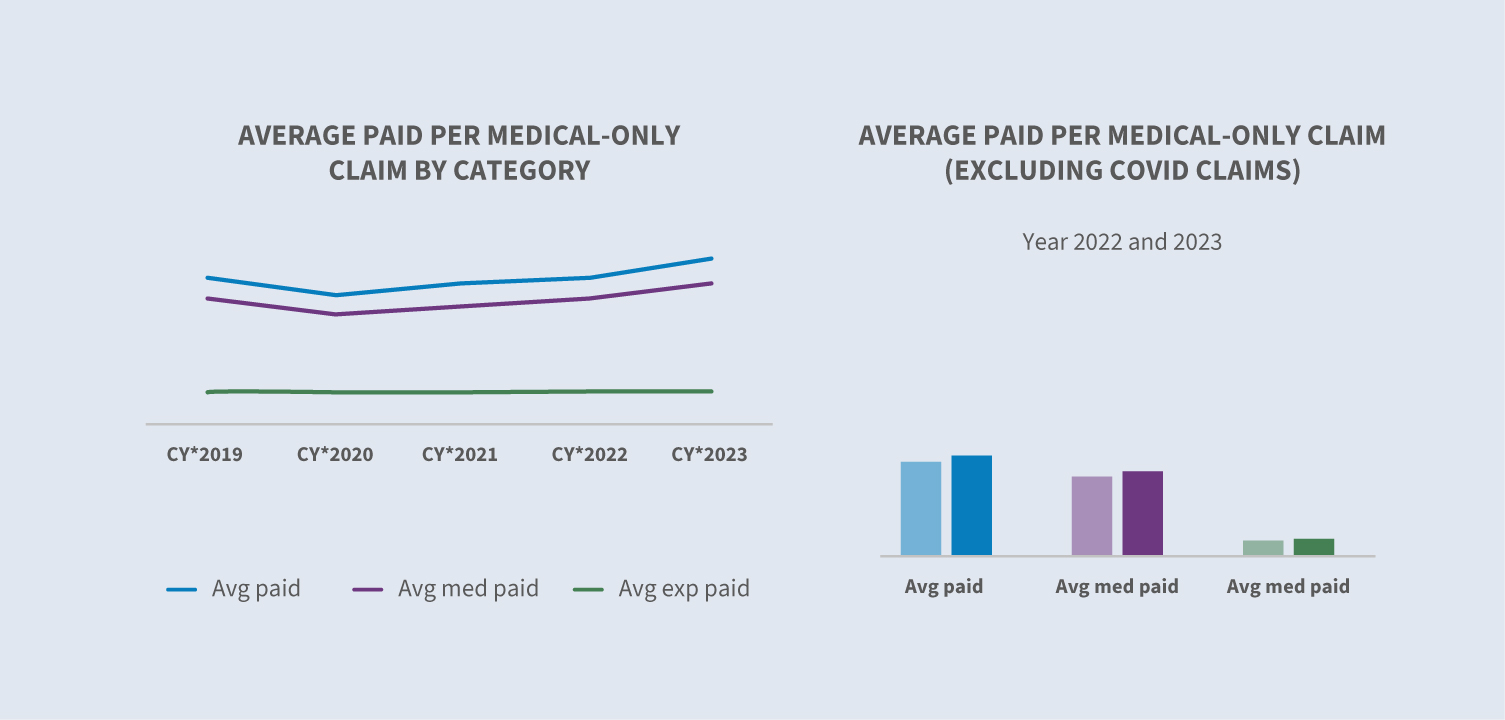

Compared to 2022, there was an 11.2% increase in the average paid per indemnity claim in 2023, including COVID claims.

Excluding COVID claims, the increase in the average paid per indemnity claim was 8% in 2023 versus 2022, reflecting that the average paid for COVID-19 claims continued to drive down the average paid per indemnity claims.

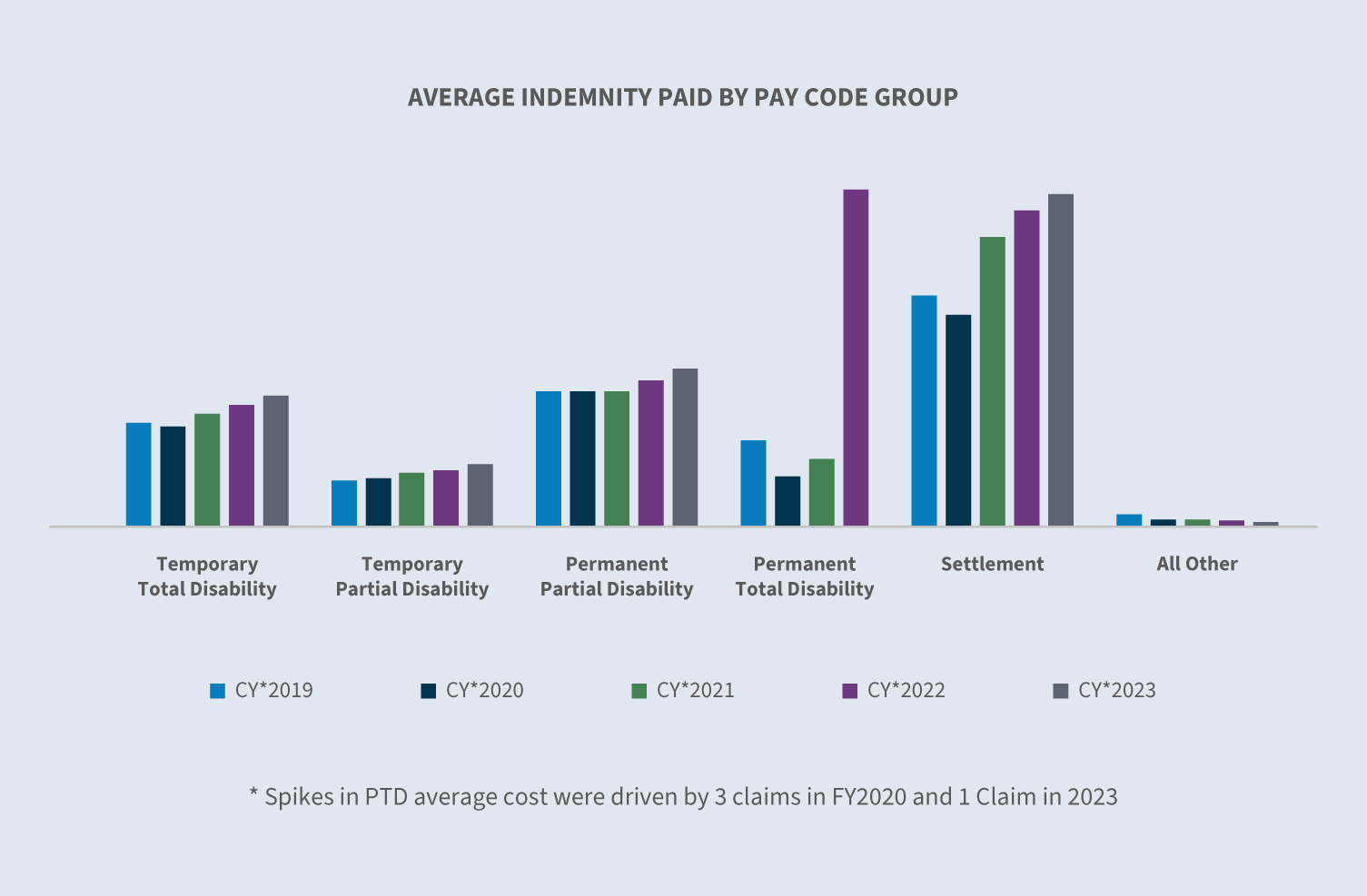

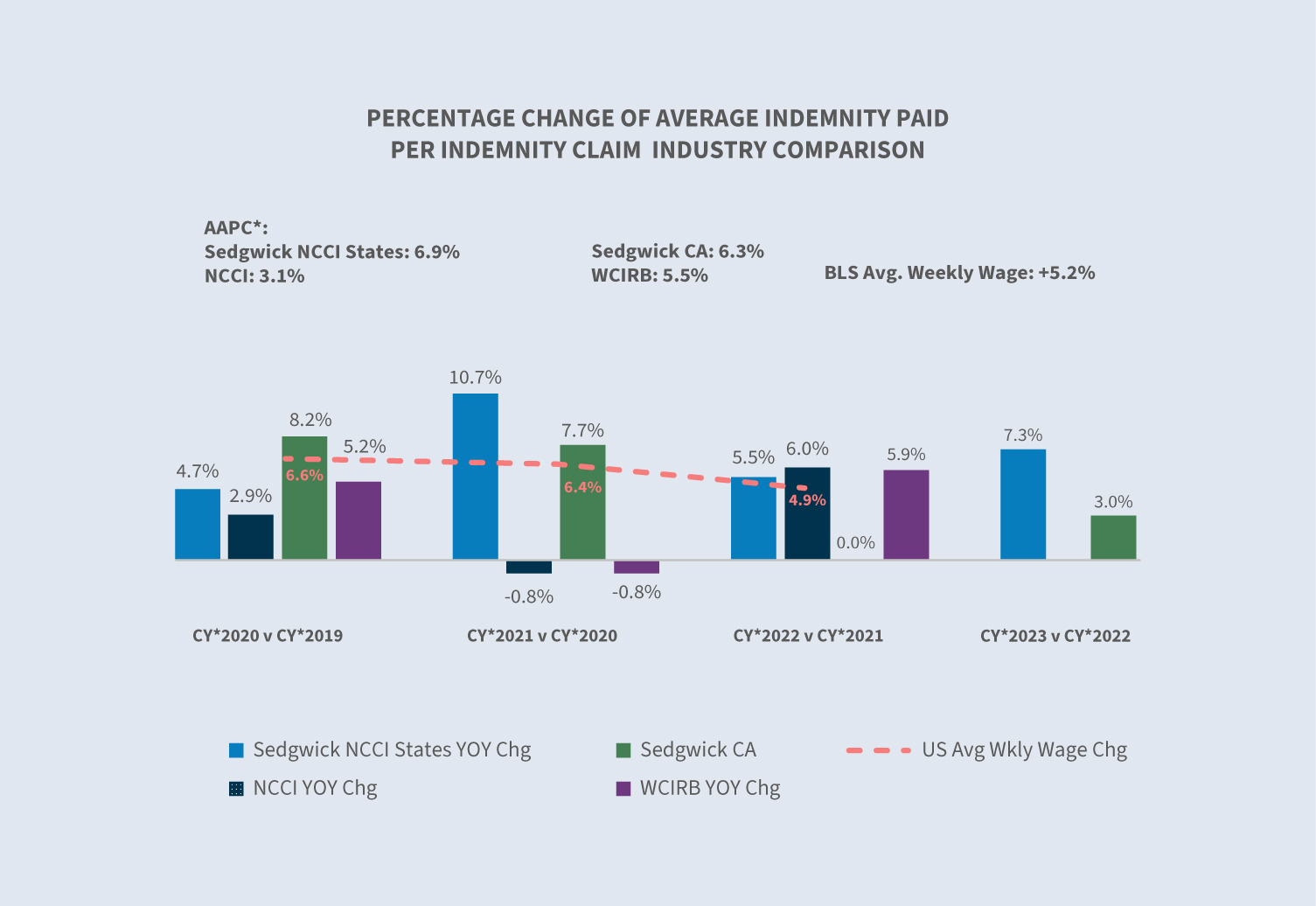

Indemnity benefit payments increased 7.7% per indemnity claim in 2023. The average indemnity paid in 2023 increased for all pay code groups, with temporary total disability (TTD) increasing by 7.6%.

The state filter of the average weekly wage (AWW) inflation tool allows comparisons of the AWW by state. According to the BLS Employment Cost Index issued Jan. 31, 2024, wages and salaries increased 4.2% for non-union workers and 5.4% for union workers during the 12-month period ending in December 2023. Another factor bolstering wages in 2023 was the minimum wage increases in 23 states due to inflation, legislation and ballot initiatives. In 2024, 22 states increased the minimum wage according to The Economic Policy Institute minimum wage tracker, raising pay for an estimated 9.9 million workers. Most states annually index their maximum indemnity benefit to the state average weekly wage (SAWW) to prevent inflation from eroding the level of the workers’ benefits.

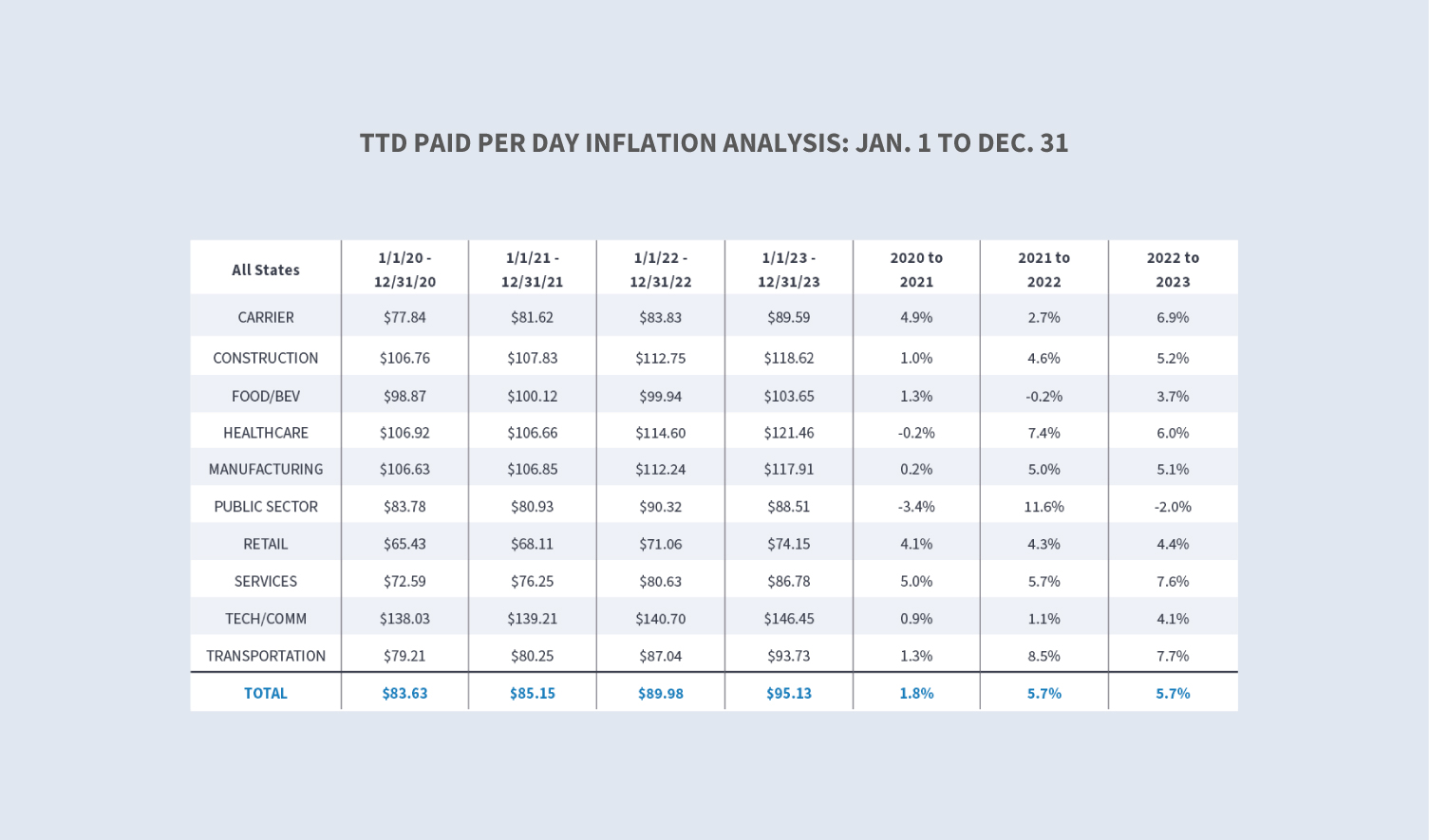

Our TTD paid per day inflation analysis indicated a 5.7% increase for 2023 compared to 2022. The transportation and services industries experienced the largest increases at 7.7% and 7.6%, respectively.

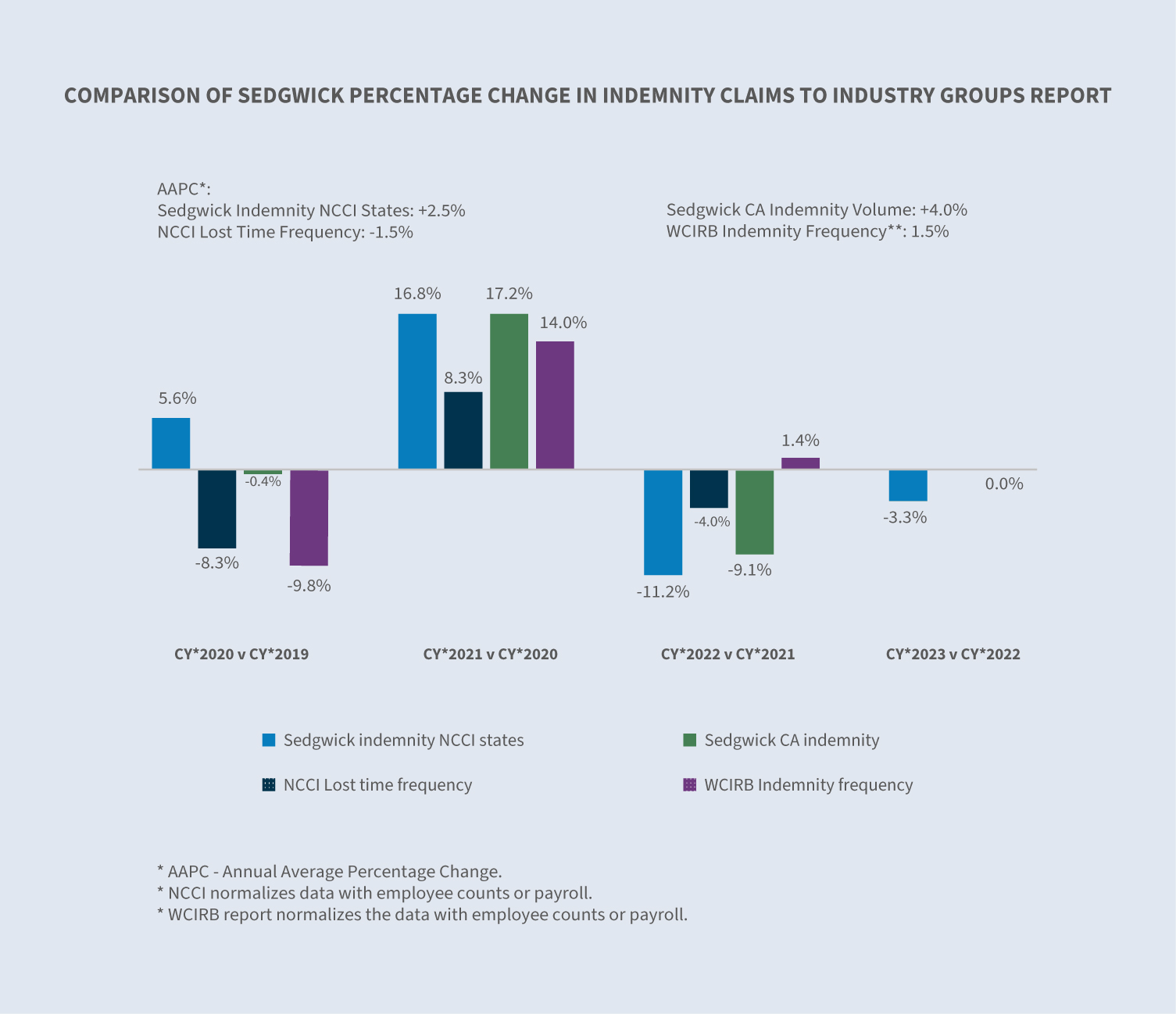

Sedgwick’s 2023 average indemnity paid per indemnity claim cannot yet be compared with the industry; however, in 2022, our year-over-year changes were less than the changes reported for NCCI states.

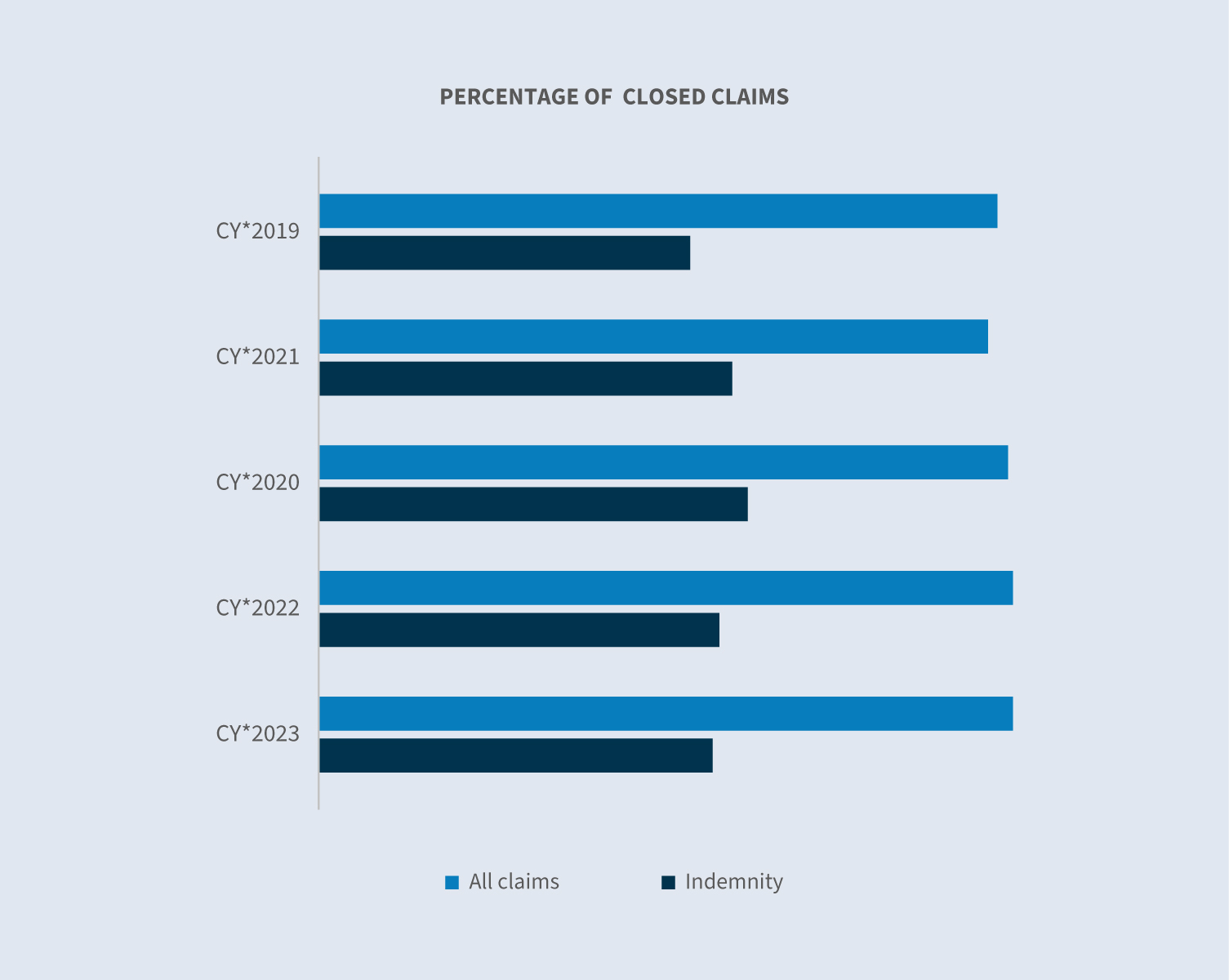

Closures

The percentage of all claims closed in calendar year 2023 stayed relatively consistent. On average, COVID claims closed more quickly than non-COVID claims. Excluding COVID claims, the 2023 percentage of indemnity claims closed remained flat compared to 2022.

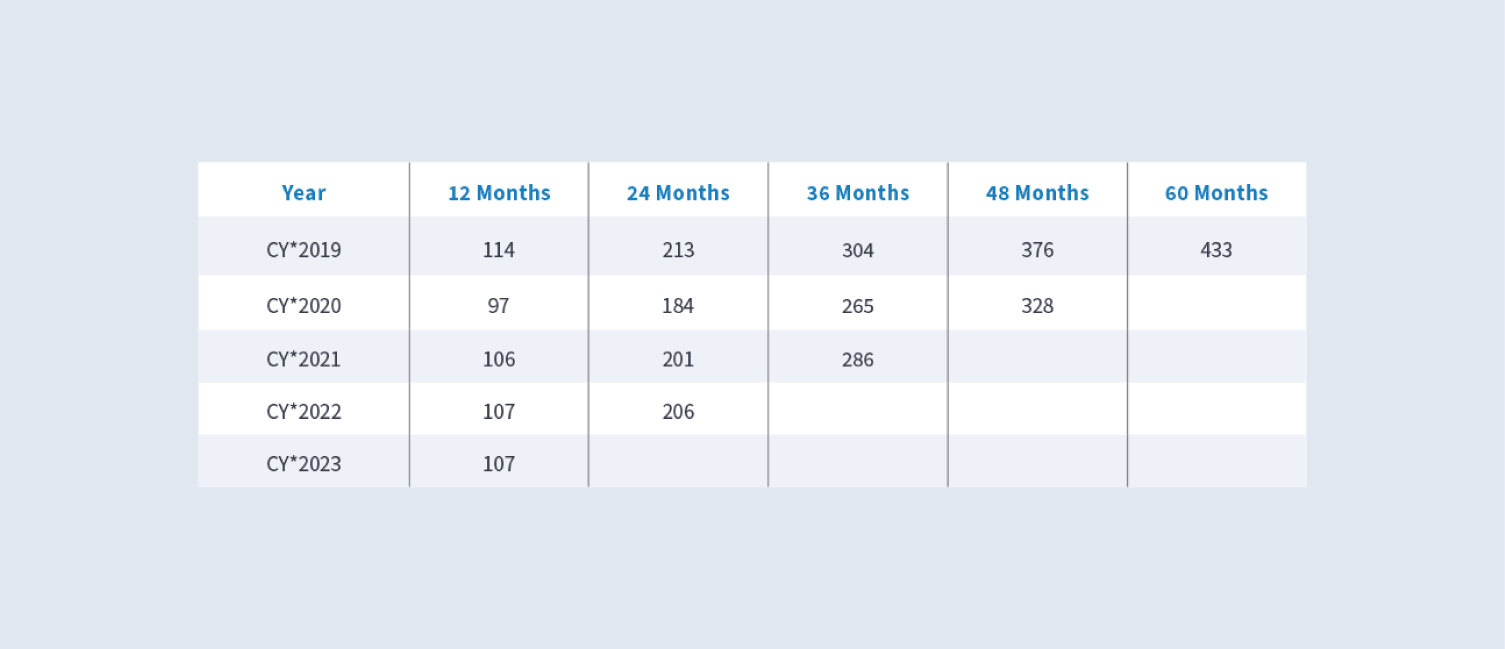

The duration of indemnity benefits at 12 months, another component of indemnity costs, was stable in 2023 when compared to 2022.

Medical costs

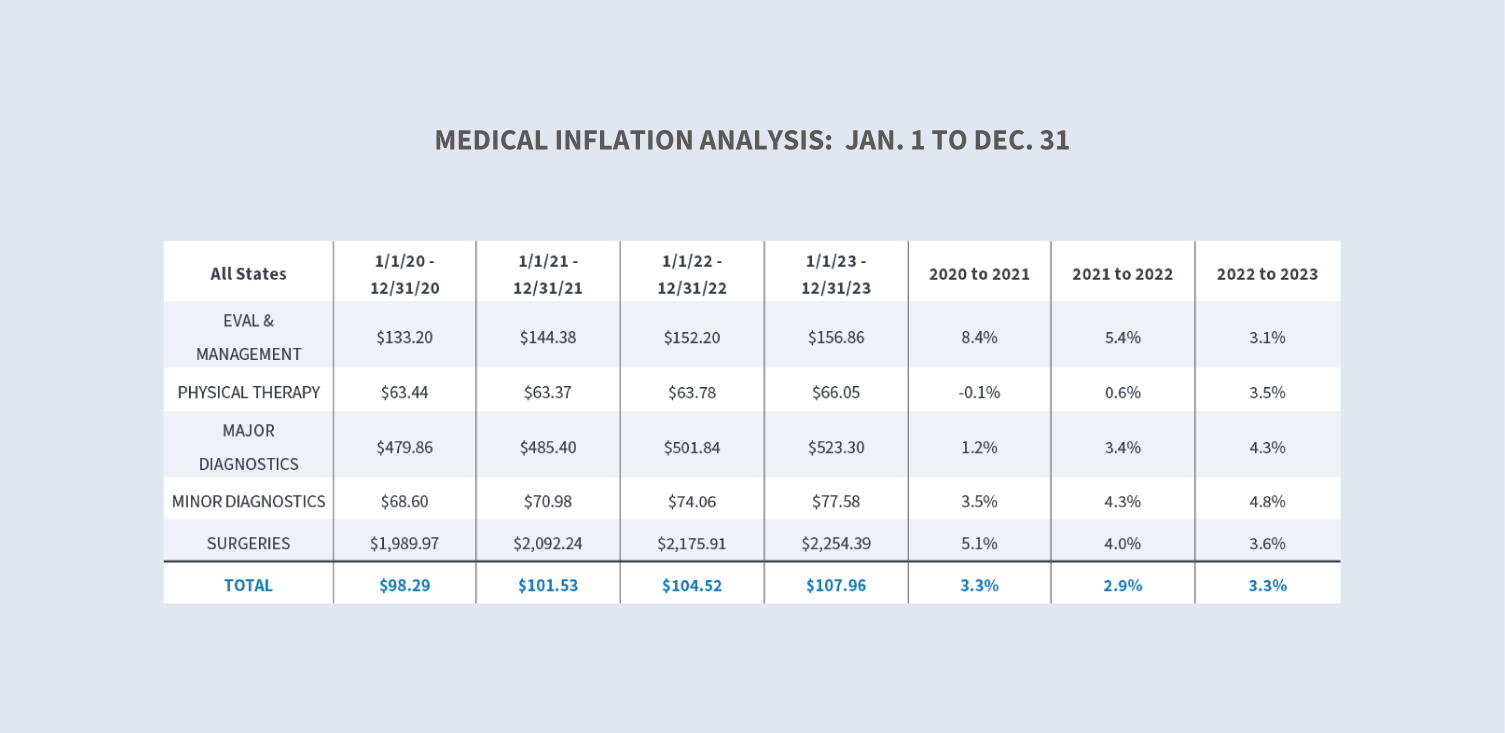

Medical costs are primarily driven by a combination of utilization and price. Medical utilization continued to return to pre-pandemic levels. The price component of medical payments under the workers’ compensation system is highly regulated by each state, which results in substantial differences in prices paid for medical services across states. Our medical inflation analysis tool indicated that overall pricing increased 3.3% for 2023 in comparison to 2022.

The increase in medical costs is also seen for medical-only claims, whether COVID claims were included or not.

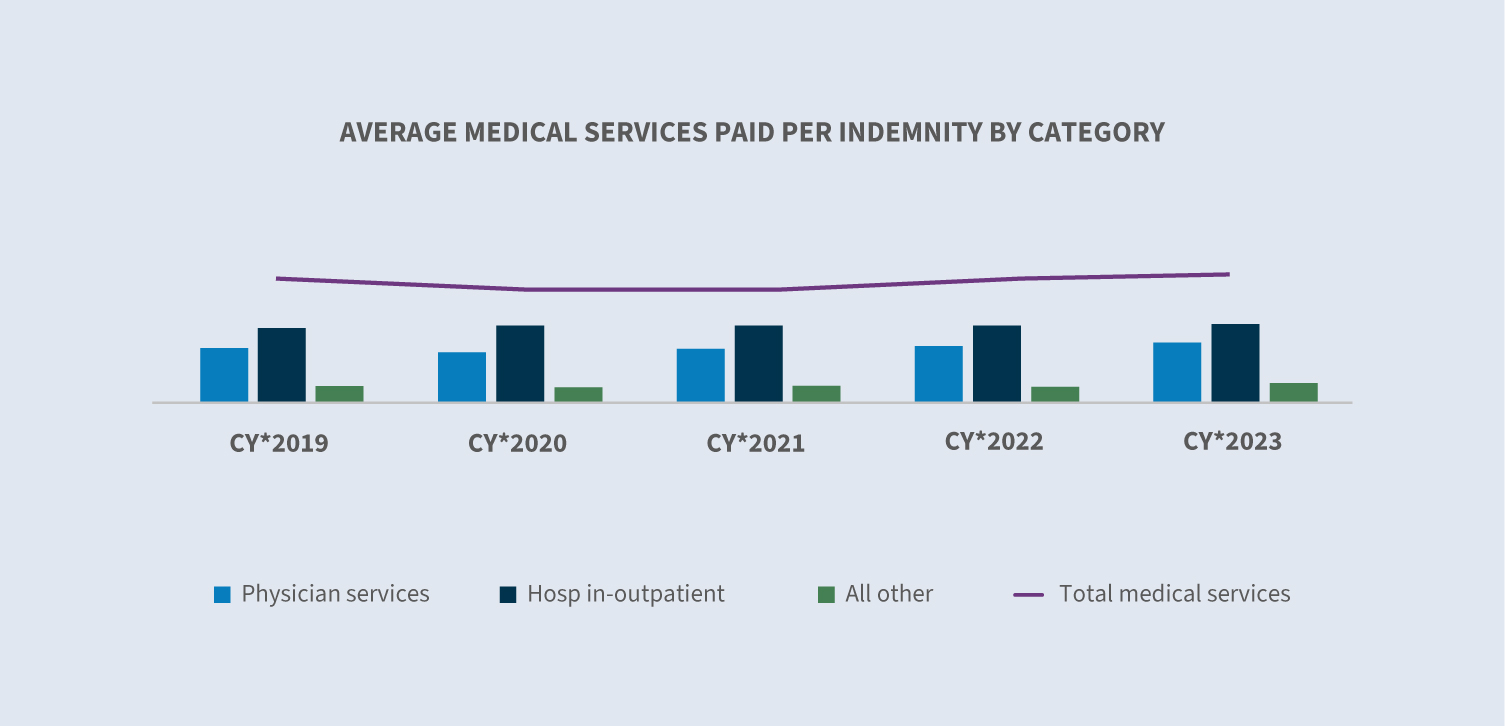

Sedgwick’s average medical services paid per indemnity claim for calendar year 2023 cannot yet be compared with the industry; however, in 2022 Sedgwick’s average medical paid per indemnity claim favorably compared with the industry.

Expense costs

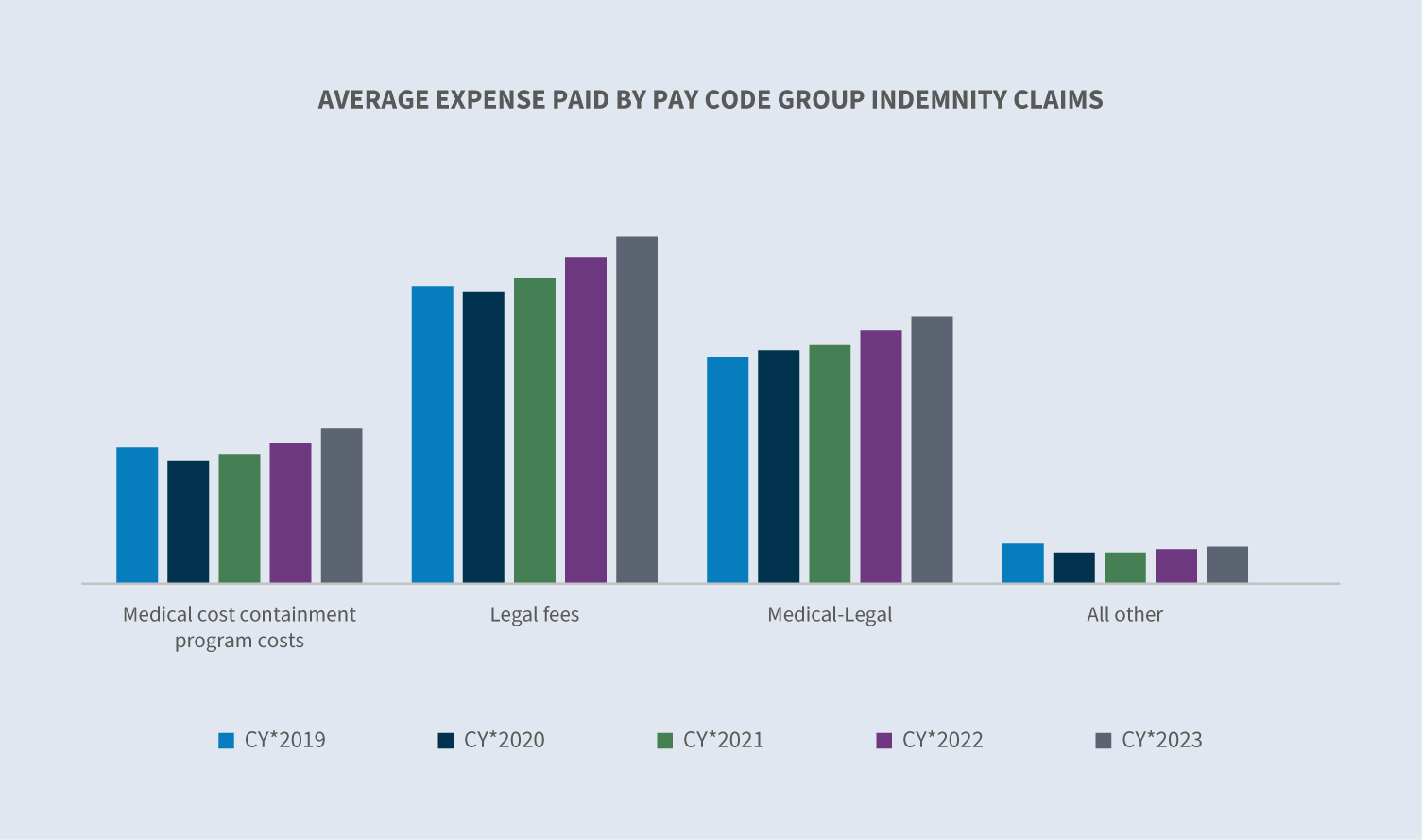

Allocated lost adjustment expense (ALAE) costs per indemnity claim are driven by three major categories:

1. Average medical cost containment program costs

2. Legal fees

3. Medical-legal

While average expenses paid increased in each of these categories, medical cost containment (+10% over 2022) and legal fees (+6% over 2022) reflected the largest increases.

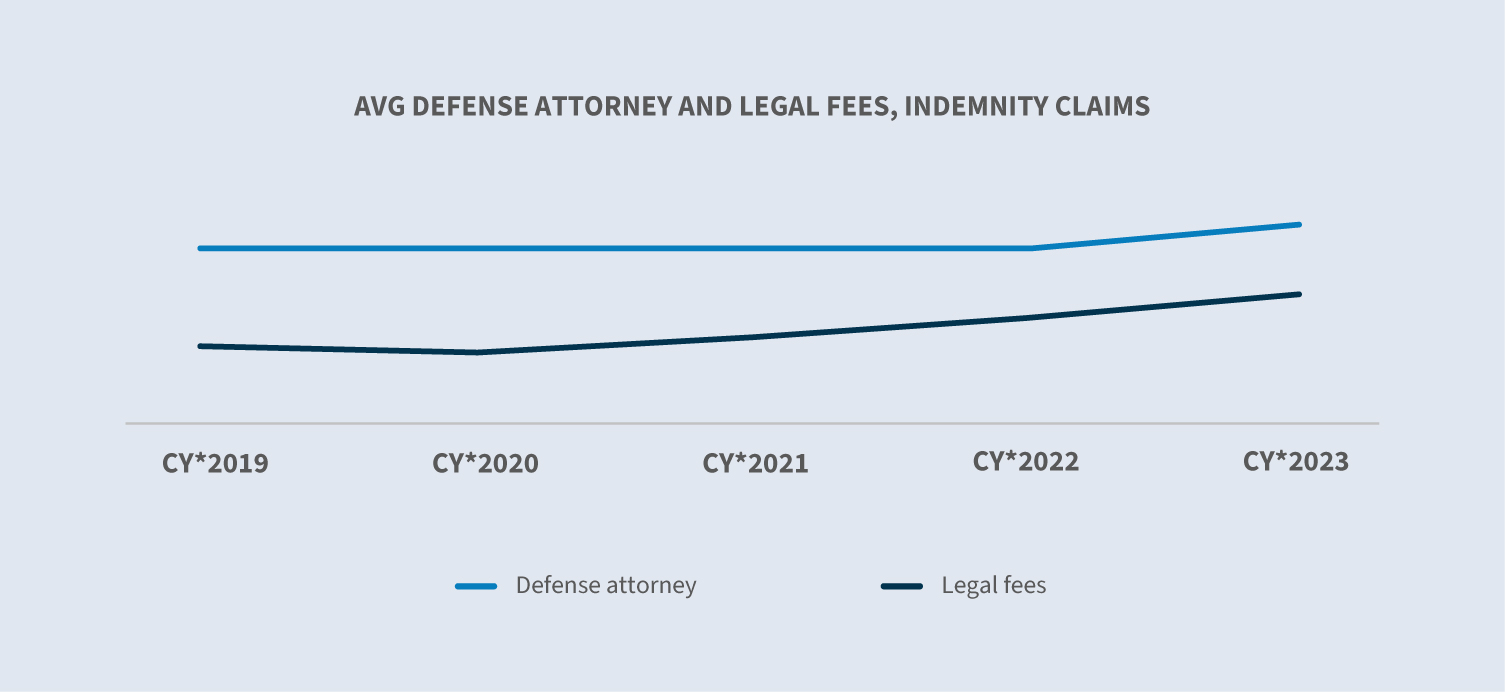

Defense attorney fees make up 82.1% of legal fees and the average paid in calendar year 2023 increased approximately 4% with wide variations between jurisdictions.

In calendar year 2023, closed litigated claims increased 8% over 2022, representing 4.2% of total closures. The increase in closure volume provides another indication of the system normalizing with the courts resumption of proceedings. Yet closed litigated claims cost over three times more than non-litigated claims, which emphasizes the importance of preventing unnecessary litigation.

Future considerations

2023 continued the trend of overall favorable results for the industry as to workers’ compensation representing another year of loss ratios below 100%. Despite this, we must remain vigilant in maintaining positive outcomes in 2024.

Claim costs and inflation

Overall claim costs increased 8% in 2023 when excluding COVID claims. A primary driver of this increase was Inflation – 5.7% for disability daily rates and 3.3% for medical cost. It is anticipated that there will be less of an impact in 2024 with indemnity benefits due to stabilization of wage rates; however, cost pressure will likely continue for medical with the increased cost experienced by the healthcare sector.

Litigation

Litigation increased slightly in 2023. Tactics such as advocacy; timely communication that promotes understanding of the claim process; prompt payments; and a focus on resolution will help ensure that claims do not become litigated.

Employee demographics

Employee demographics are becoming increasingly important in the claims process. Ensuring understanding of different process expectations, different communication styles and different understandings of the focus of the claims process will help ensure that positive outcomes are achieved efficiently.

Labor market shifts

The COVID pandemic resulted in labor market shifts and wage changes that have impacted workers’ compensation.

The current national unemployment rate is 3.7% with the number of unemployed persons essentially unchanged at 6.3 million, which signals a return to pre-pandemic employment levels in the U.S. economy. However, unemployment rates were higher than a year earlier in 18 states and the District of Columbia, lower in 15 states, and stable in 17 states.

Employment turnover is slowing, which reduces low-tenured workers as a percentage of the overall labor force over time. Historically shortened average job tenure due to workers moving into new jobs, occupations and industries tends to increase injury frequency and may also affect injury severity as a difference in injury rates varies across industries.

Demographic shifts, such as a change in the age and gender distribution of workers, may also affect injury frequency and severity. According to a Pew Research study, roughly 1 in 5 Americans aged 65 and older were employed in 2023 — nearly double the share of those who were working 35 years ago. Women make up a larger share of the older workforce, representing 46% of all workers 65 and older.

Over the past two years several states have enacted legislation to loosen restrictions on which occupations minors from 14-17 years old are allowed to work as well as the number of hours they are allowed to work. According to the National Institute for Occupational Safety and Health (NIOSH), these young workers have high rates of job-related injury.

As these labor trends evolve, attention to safety, training and return to work programs becomes more important than ever.

Medical accessibility and costs

Medical costs and severity are expected to increase in the future driven by various factors.

The American Hospital Association estimates a shortage of up to 124,000 physicians by 2033 and a need for approximately 200,000 nurses a year to meet rising healthcare demand. This demand for healthcare workers will inevitably impact healthcare accessibility. Our data shows slight increases in the lag between the date of loss to the first service date for certain medical treatments, with variation by state.

The talent shortage in the healthcare industry is also resulting in increased labor costs for health systems and hospitals that is expected to be passed on to payers and consumers through higher prices and increased utilization.

Another factor impacting medical accessibility and costs is consolidation in the healthcare market. This year has seen continued regulatory and antitrust scrutiny for health system mergers and acquisitions at the federal and state levels.

Medical advances, such as precision medicine, offer potential for improved outcomes by tailoring interventions based on patient-specific demographics and disease-specific data to treat patients with non-unions, fractures associated with polytrauma and burns. However, new advances in medical care are usually costly.

Technology transformation

Technology is playing an increasingly significant role in reshaping the workers’ compensation industry. Some of the areas where strategic adoption will potentially transform processes include:

1. Artificial intelligence (AI): AI is anticipated to improve claims processing efficiency and aid in identification of workers’ compensation trends, leading to reduced claim costs and overall risks.

2. Telemedicine: This technology allows injured workers to receive medical consultations remotely, improving access and convenience.

3. Empowering injured workers: Providing injured workers access to information more efficiently and conveniently enhances their experience and reduces uncertainty during the claim process.

4. Wearable technology: As the use wearable technology advances, the data and information provided could potentially lead to safer workplaces, facilitate return to work and reduce the cost of workers’ compensation claims.

Marijuana legalization

As of Jan. 1, 2024, with 2023 enactment of marijuana legislation in Kentucky, 38 states, the District of Columbia, Puerto Rico, U.S. Virgin Islands, Guam, Northern Mariana Islands, Canada and Mexico that have legalized the medical use of marijuana.

Over the years, many courts and state legislatures have addressed whether marijuana is reimbursable medical treatment under workers’ compensation and currently only six states — Connecticut, New Jersey, New Mexico, New York, Pennsylvania and New Hampshire — require workers’ compensation to reimburse as medical under specified circumstances.

The remaining states are either silent on this issue or include a provision that typically states, “a government medical assistance program, health insurance provider or private health insurer is not required to reimburse a person for costs associated with the medical use of marijuana.” For additional information, refer to this list of state medical marijuana programs as of Jan. 1, 2024.

Regulated marijuana for adult recreational use is legal in 24 states and Canada, with passage just last year in Delaware and Minnesota and a ballot initiative in Ohio. Data does not yet show any direct impact on frequency in states that allow adult recreational use. This is in part due to most jurisdictions having workers’ compensation laws that, in some form, restrict workers’ compensation benefits when the injury is attributed to intoxication or drug use.

Federal action to reschedule marijuana may be a real possibility for 2024, with several bills under consideration by Congress.

Heightened regulatory environment

In 2023, legislatures convened in every state. In 2024, legislatures are convening in all but four states — Montana, Nevada, North Dakota and Texas.

In 2023, many states focused on the mental well-being of workers, and this trend is expected to continue. Ten states enacted laws related to mental injuries, with most laws either expanding or providing a mental health presumption to first responders. Washington and Connecticut expanded eligibility to file claims for post-traumatic stress disorder (PTSD). In Illinois, the definition of compensable mental injury was expanded to include repetitive stress, and in California, the definition was expanded to include any mental injury resulting from a stress-related injury.

Multiple states expanded other presumptions for first responders to either add additional conditions or make additional first responders eligible. These laws historically are applied to local public entities or certain state and federal agencies; however, they sometimes apply to some private sector employees or volunteers.

Penalty exposure substantially increased in Nevada and Washington due to enacted legislation. Several states enacted bills that increased claimant attorney fees and expanded circumstances when the employer may be responsible for payment of those fees. Regulators in Minnesota, Oregon and Texas have taken steps to ensure responsiveness of claims examiners.

On Jan. 10, 2024, the U.S. Department of Labor published a final rule, effective March 11, revising the guidance on how to analyze who is an employee or independent contractor under the Fair Labor Standards Act (FSLA). The new rule examines the “totality of the circumstances” economic reality test with six factors to be considered. It is anticipated that there will be court challenges to the new rule. The impact on businesses from a workers’ compensation standpoint may involve increased exposures and associated costs.

Elections in 2024 will be held for the president, vice president, all 435 seats in the United States House of Representatives, 34 of 100 seats in the United States Senate and 85 state legislative chambers in 44 states, including four insurance commissioners.