- WINTER 2024:

- Property

Loss adjusting

Report objectives

The objective of this report is twofold: to provide an overview of U.S. property metrics and specific metrics focused on property loss adjusting, our core property business, in a comparative analysis to the broader property claims market.

Unlike workers’ compensation, auto liability and general liability, property is not a monolithic product line. U.S. property consists of property loss adjusting and specialty services. Property loss adjusting contains five distinct product lines: catastrophic (CAT), high frequency low severity (HFLS), middle market, large loss and transfer of physical assets (third-party administrator). Each of these has its own distinct market, clients, competitors, pricing and service requirements. Our specialty service encompasses our forensic advisors/accountants; EFI Global forensic engineering, environmental and fire experts; contents evaluators; and building consultants. Sedgwick repair solutions, our direct repair network, and temporary housing are also significant and growing segments of U.S. property.

data parameters

Although our property business is global in nature, to align with other business lines producing state of the line reports, this study focuses solely on Sedgwick’s U.S. property and the trends in that market. We have not included any data for Canada or Latin America, although they are significant pieces of the property, Americas business.

Key observations

Claim volume year-over-year (YOY) decreased slightly primarily driven by benign weather.

- ∙ YOY flat daily claim volume.

- ∙ There were some small but impactful storms in the first half of 2023 that drove an early increase in volume compared to 2022.

- ∙ Property continues to focus on diversification of solutions.

- ∙ Building consultancy and contents experienced YOY increases of 28.1% and 23.6%, respectively.

The traditional products lines most impacted by weather events saw a negative YOY impact on volume resulting from the lack of a significant catastrophic event in 2023.

- ∙HFLS

- ∙Sedgwick delegated authority (London TPA)

- ∙EFI (forensic engineer and cause and origin)

Sedgwick repair business continues to see significant growth YOY.

Pressure to exceed industry standard metrics continues to be an area of emphasis both internally and externally.

Prior year’s increased market interest in desk examination plateaued in 2023, impacting our HFLS line of business.

Sedgwick property’s innovative offering of a self-service, AI-driven solution to small and medium claims continues to prove beneficial as we continue to see increased interest from clients.

Increased complexity in technology solutions in the broader property claims ecosystem has generated focus for increased consistency and standardization.

Challenges around talent, including recruitment and labor shortages persist, especially when seeking experienced commercial or desk adjusters. Sedgwick continues to invest heavily in training and programs to develop talent. One key program is our protégé program which pairs up-and-coming adjusters with our market-leading team of executive general adjusters and senior executive adjusters promoting knowledge transfer.

Claim count by line of business

New assignment volume for 2023 saw a decrease of 4% YOY. This is directly attributable to the lack of a severe weather event in the fourth quarter of 2023.

Our strategy to diversify our property service offerings portfolio continues to pay dividends and helped to offset the impacts of the lack of a single severe weather event in 2023. U.S. field operations, which is our core loss adjusting business, grew 6.8% YOY, driven by growth in our customer base and market share. In addition, building consultancy, contents solutions and property third-party administration saw double-digit growth. These areas were offset by EFI Global, Sedgwick delegated authority and HFLS, which were all severely impacted by the lack of weather events. Sedgwick repair solutions saw YOY growth of 6.1%.

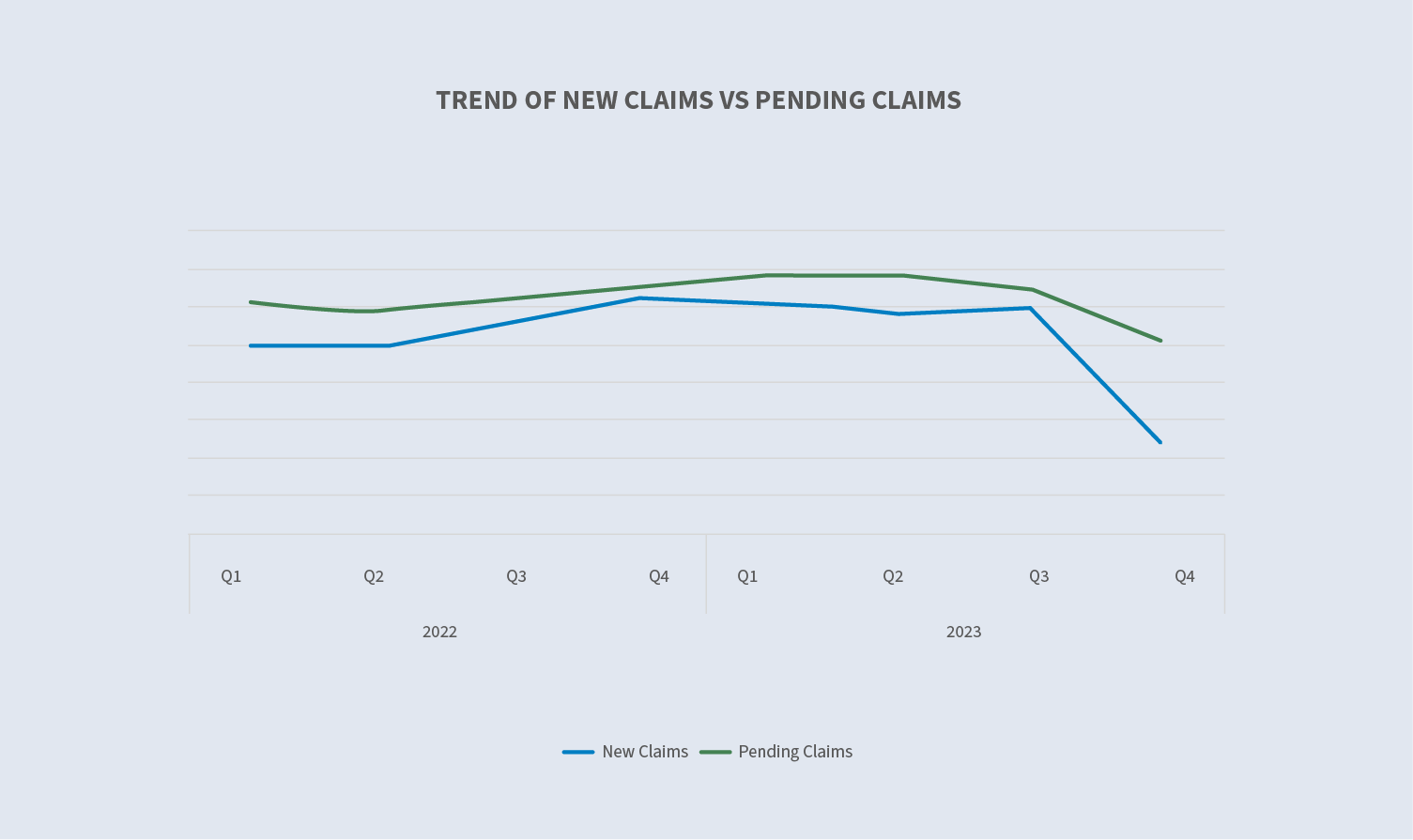

Pending vs. new claims (excl. repair solutions)

In 2023, pending claim count decreased 14% overall. Pending claim count has decreased at a faster rate than new claim counts due to faster claim closure.

A direct line can be drawn between the severe weather event in the third quarter of 2022 that allowed for a significant carryover of pending inventory into the fourth quarter of 2022 and the lack of a severe weather event in the second half of 2023 and the lack of carryover volume into the fourth quarter of 2023. The pending inventory equation of these numbers continue to reflect our continued strong adherence to metrics performance and claim turnover for our clients.

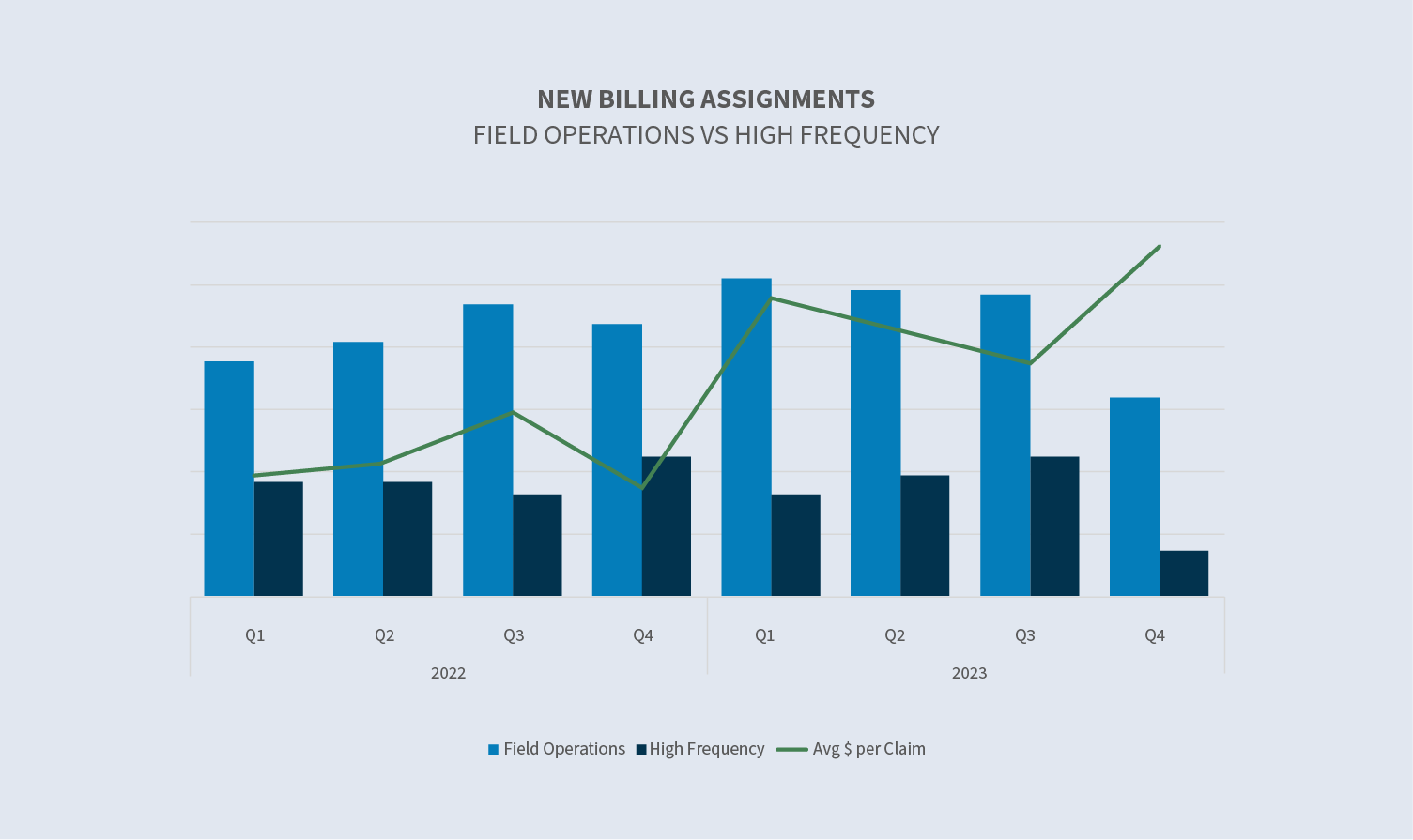

New claims: Field operations vs. HFLS

We remain committed to being a full-service claims provider by diversifying our portfolio of service offerings, while also focusing on all lines including personal lines, mid-market (commercial), and large loss. Within the personal lines space, our HFLS business unit continues to be an area of growth. The industry’s approach and expectations for adjusting and handling these claims are different. The HFLS business unit has developed unique solutions to address these expectations and is specifically monitoring our trends in this space.

The high frequency space is driven by high volume on lower value claims. The increased dollar value per claim in the fourth quarter of 2023 is driven by the reduction of the lower value claim count.

Sedgwick continues to be a market leader developing new technologies for the property space.

In 2022, we released an end-to-end, self-service solution designed to allow insureds to adjudicate routine property losses by interacting with a decision-engine-based tool. With this tool, the insured answers some basic questions about the loss and when completed, provides us with the data necessary to complete an estimate and make initial payment. Through pilot programs with multiple clients over the last 18 months, this tool has been perfected and is currently engaged and live with several clients. We are at various stages of discussions and onboarding with others.

New claims vs. CATs

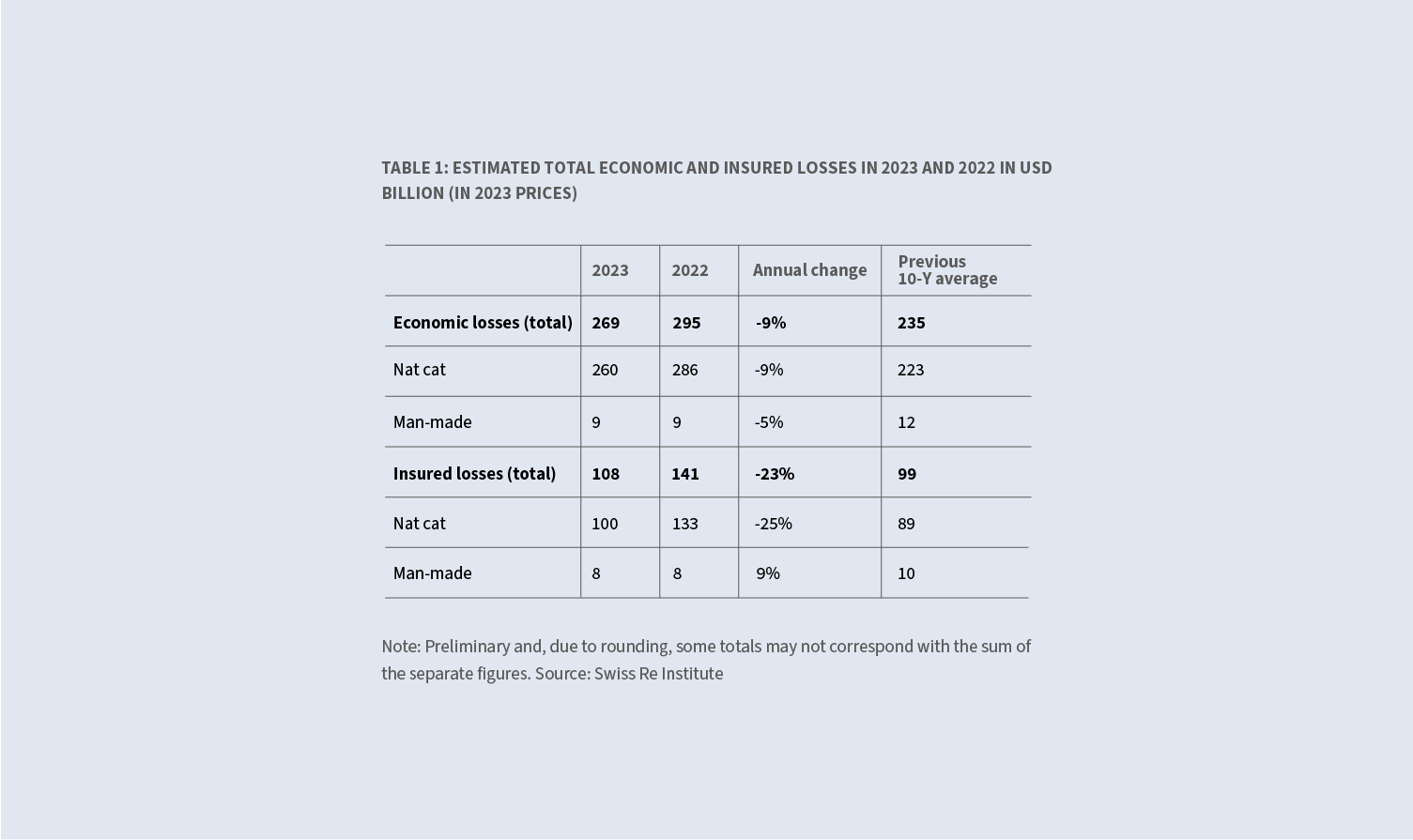

Globally, 2023 continued to see substantial weather-generated activity with only a mild slowdown in the recent trend. Weather events and their severity continue to increase over the last five to 10 years, across the globe.

Per Swiss Re Institute, economic losses from natural CATs were down 9% YOY — from $286 billion to $260 billion — driven primarily by the lack of an impactful hurricane season for the North Atlantic. That $260 billion is still well above the 10-year average of $223 billion. Insured losses due to natural CATs were down 25%, from $133 billion to $100 billion, but still well above the 10-year average of $89 billion.

We have invested significantly in CAT preparedness and are ready to help clients and their policyholders when these events occur.

Key areas of focus include:

- ∙ Continued outreach and growth of our resources housed in our independent contractor resource platform and continued efforts at engagement with these resources.

- ∙ Leveraging our suite of services to enhance service levels to our customers. We’re able to utilize our internal relationships with adjusters, forensic accountants, building consultants, engineers, temporary housing and Sedgwick repair solutions and more to quickly engage them to assist in the adjustment process. Having all experts working seamlessly together under one roof in a team environment during a CAT event is a tremendous advantage.

- ∙ Automation and key integrations.

Although the first half of 2023 reflects several small convective storms that provided increased volume, we did not have the annual hurricane event we have seen over the last few years during the second half of 2023. This data supports multiple small events over the course of the first half of 2023 as well as tailing claims from the CAT event in late 2022, driving the CAT numbers up in the first quarter of 2023.

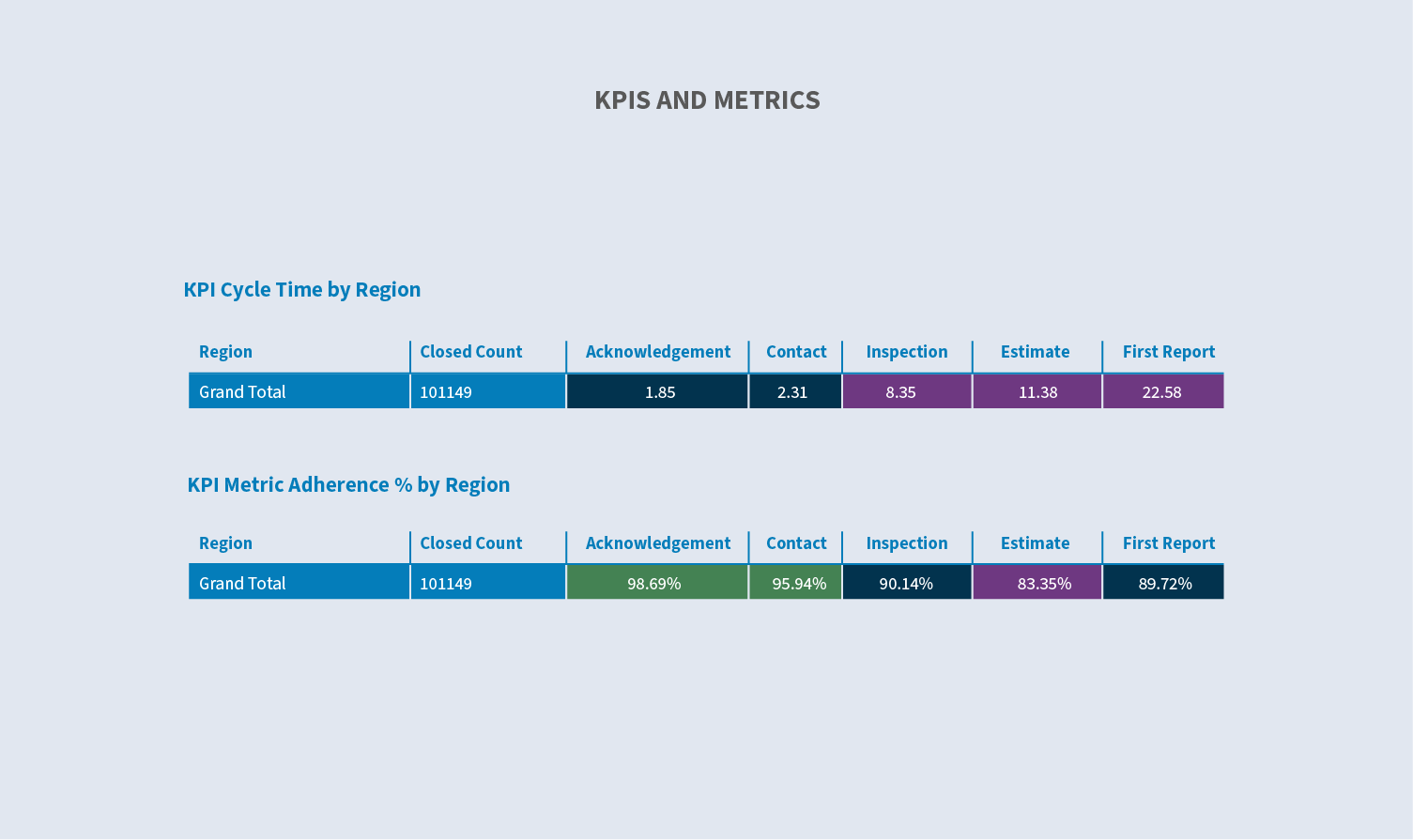

Key metrics

Metric performance continues to be a key determining factor in our clients’ choice of vendor or partner. We continue to increase our resources and tools to improve our ability to calibrate, capture and present metrics. This data allows us to drive increased performance, via management by exception.

With a few clicks, our managers can drill down to this same view at the adjuster level. They can also filter by any number of key data components to assess the unit or individual performance more accurately.

Over the second half of 2023, we formalized our future initiatives and received funding to proceed with our digital transformation strategy. This strategy will leverage existing technologies like RPA as well emerging technologies like AI to improve efficiencies in standard claims processes — such as first notice of loss (FNOL), triage and assignment. Eventually, this strategy will move to encompass the entire claims process. The goal of this strategy is to make our teams more efficient and improve our internal user experience, resulting in faster and improved service to our clients.

Future considerations

Overall, our U.S. property core business volume remained flat year-over-year, with any specific volume reductions driven by lack of weather activity. This performance is directly attributable to two things:

- ∙A continued strong performance and growth of our core, loss adjusting business.

- ∙A continued execution of the diversification strategy into supporting specialty markets like Sedgwick repair solutions, building consultancy and contents.

Our large loss team of adjusters is the largest and most experienced in the U.S. market. There is significant competition in this space, and this expertise-driven market requires a high level of attention and diligence to acquire and maintain our talent. Our talent is a continued target of the competition, so we must remain vigilant in offering the best environment possible for our existing colleagues to flourish and grow. This has not changed since years prior and will likely remain a constant into the near future. Our continued high levels of retention show that the various programs structured specifically at colleague growth and retention within Sedgwick property are successful.

Industry concerns

- ∙Climate change impacts on surge volume and severity

- ∙Graduating expertise and knowledge transfer

- ∙Emerging technologies (automation and AI)

- ∙Metrics performance and accurate measurement in a complicated ecosystem

- ∙Labor competition (expertise market)

- ∙Experienced labor (catastrophe)